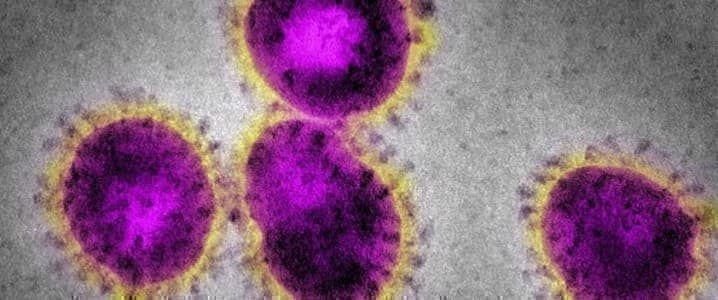

They say once bitten, twice shy. Last year, global oil traders were left shell-shocked after oil prices sunk into negative territory for the first time in history, a scenario few could have imagined, let alone foretold. And their knee-jerk reaction to any breakout of new Covid-19 variants now appears to be: sell first, ask questions later. They did with Delta, and now they are doing it with Omicron.

After six months of impressive gains, oil prices have suddenly shifted into reverse as a fresh wave of Covid-19 threatens to end the bull party prematurely. On Thursday, both WTI and Brent crude continued their slide, collapsing below $70 for the first time since September as the weeks-old Omicron coronavirus strain sparks fears over the potential effects on travel and oil demand as well as the global economic recovery. On 26 November, Brent prices fell by over 10% in a single day for only the 15th time since Brent futures trading began in 1988, marking the fifth-largest single-day fall in USD terms, and the seventh-largest in percentage terms.

But it's not the oil markets alone that have been hard-hit; global stocks markets, as well as the majority of commodities, are selling off, too.

Base metals prices have posted a broad-based sell-off spurred by news of the Omicron COVID variant that spooked risky assets, raising concerns over potential lockdowns, mobility restrictions, and the impact on the economic recovery. Price declines have been led by aluminum and nickel, followed by copper, tin, and zinc; lead has posted the smallest decline. LME inventories continue to trend lower across all base metals and the cash-to-three-month spread for the entire complex remains in backwardation, reflecting nearby tightness.

Meanwhile, Platinum Group Metals remain even more vulnerable after Omicron hit PGM markets during an oversupplied quarter, making them prone to downside risk.

But all this doom and gloom might not be fully justified.

Irrational Fears

Indeed, in its latest commodities report, Standard Chartered analysts have warned that whereas the underlying trends for most commodities, including oil, remain supportive, Omicron has triggered irrational fears that are likely to temper hopes for a commodity supercycle.

On Monday, the World Health Organization (WHO) declared the Omicron coronavirus variant carried a very high risk of infection surges, with border closures by more countries now casting a shadow over an economic recovery from the two-year pandemic.

But the markets appear to be more spooked by comments by Moderna chief executive Stéphane Bancel who has warned that existing vaccines will be much less effective at tackling Omicron than earlier strains of coronavirus, adding that it would take months before pharmaceutical companies could manufacture Omicron-specific vaccines at scale.

"There is no world, I think, where [the effectiveness] is the same level . . . we had with [the] Delta [variant]. I think it's going to be a material drop. I just don't know how much because we need to wait for the data. But all the scientists I've talked to . . . are like, 'This is not going to be good'," Bancel has told the Financial Times.

Bancel says scientists are particularly worried because 32 of the 50 mutations in the Omicron variant are on the spike protein, which current vaccines focus on to boost the human body's immune system to combat Covid. Most experts did not expect such a highly mutated variant to emerge in less than a year or two.

Not everybody agrees with Bancel, though.

The Moderna chief's comments have come at a time when many public health experts and politicians have been trying to strike a more upbeat tone about existing vaccines' capacity to protect against Omicron.

On Monday, Scott Gottlieb, a director of Pfizer and a former US Food and Drug Administration (FDA), told CNBC: "There's a reasonable degree of confidence in vaccine circles that [with] at least three doses . . . the patient is going to have fairly good protection against this variant."

Moderna and Pfizer have become the leading vaccine suppliers for most of the developed world.

More encouragingly, it's early days into the Omicron era, but so far, most cases have been relatively mild. In fact, the WHO has pointed out this observation and urged countries to apply "an evidence-informed and risk-based approach" to travel measures instead of resorting to blanket bans.

To be fair, the oil sell-off kicked off in October before Omicron became a major concern and accelerated in November shortly after OPEC downgraded its 2021 global oil demand forecast by 160,000 b/d, citing weaker economic factors in China and India.

But on the same report, OPEC struck an upbeat note, saying all indications were that the market would remain tight through the rest of the year.

Talks about the U.S. selling oil from its strategic reserves have not been helping matters, either. Last week, the Biden administration announced that it would release 50 million barrels of crude oil from the Strategic Petroleum Reserves in a bid to bring down gasoline prices.

ADVERTISEMENT

Still, the market is overpricing this one-off event. According to Goldman Sachs:

"Our pricing model shows that the $8/bl price decline since late October is equivalent to the market pricing in a 4mn b/d combined hit to demand or increase in supply over the next three months. This would be ... equivalent to a 100mn bl government stock release as well as a 1.75mn b/d hit to demand due to the current Covid resurgence," Goldman Sachs's analysts wrote in a note cited by Argus.

Goldman has maintained its $85 forecast for average Brent prices the current quarter, pointing out that the oil market remains in a deficit.

Stanchart is being more pragmatic and says that the failure of an oil price rebound thus far perhaps implies that a hope-for-the-best trading view about Omicron is not likely to be tenable, at least until firmer information on transmissibility, vaccine effectiveness, and likely government responses is available. Further, the analysts say that Omicron fears are likely to be a decisive factor in turning sentiment against ultra-bullish USD 100/bbl views.

The latest Energy Information Administration (EIA) weekly data was mildly bullish according to our US oil data bull-bear index, which fell 33.1 w/w to +19.8. The strength in the data was on the oil products side, with the crude oil element neutral or slightly bearish, and seems to support Stanchart's conservative stance at this point.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Guyana To Become The 11th Country To Produce Over 1 Million Bpd

- The Electric Vehicle Charging Market Could Be Worth As Much As $1.6 Trillion

- OPEC+ To Add 400,000 Bpd In January Despite Oil Price Plunge