Nearly two years ago, OPEC+ made a high-stakes wager that it could curb oil production and drive crude prices higher without unleashing an onslaught of supply from U.S. shale producers. Indeed, Saudi Arabia was adamant that the golden age of U.S. shale was over as plunging oil prices put hundreds of companies out of business. Well, the alliance's gambit has definitely paid off, with oil prices staging a strong rebound and WTI crossing the $80/barrel mark for the first time in seven years. Meanwhile, whereas gloomy predictions about the death of U.S. shale appear to have been overdone, shale drillers have dramatically cut production and mostly stuck to their pledge to cut costs, return money to shareholders in dividends and share buybacks, and also pay down debt.

But with the vast majority of U.S. shale companies solidly profitable at current prices, and the once-large reserve of oil wells waiting to be turned on recording a sharp decline, it appears almost inevitable that drilling activity will spike in the coming months - to the chagrin of shareholders.

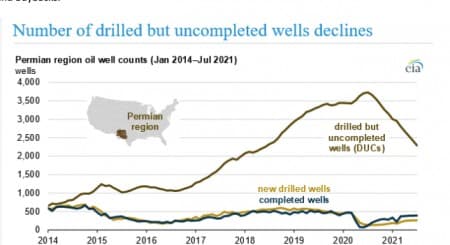

According to the U.S. Energy Information Administration's latest Drilling Productivity Report, the United States had 5,957 drilled but uncompleted wells (DUCs) in July 2021, the lowest for any month since November 2017 from nearly 8,900 at its 2019 peak. At this rate, shale producers will have to sharply ramp up the drilling of new wells just to maintain the current production clip.

Increased drilling activity will not only lead to an increase in global crude supplies but also mean an increase in spending, which could unsettle investors who have been enjoying fatter dividends and buybacks.

Source: U.S. Energy Information Administration

Back to drilling

The EIA says the sharp decline in DUCs in most major U.S. onshore oil-producing regions reflects more well completions and, at the same time, less new well drilling activity - proof that shale producers have been sticking to their pledge to drill less. Whereas the higher completion rate of more wells has been increasing oil production, especially in the Permian region, the completions have sharply lowered DUC inventories, which could limit oil production growth in the United States in the coming months.

The two main stages in bringing a horizontally drilled, hydraulically fractured well online are drilling and completion. The drilling phase involves dispatching a drilling rig and crew, who then drill one or more wells on a pad site. The next phase, well completion, is typically performed by a separate crew and involves casing, cementing, perforating, and hydraulically fracturing the well for production. In general, the time between the drilling and completion stages is several months, leading to a significant inventory of DUCs that producers can maintain as working inventory to manage oil production.

And shale producers certainly have the incentive to drill.

Last year, BTU Analytics LLC President Kathryn Miller told a Colorado Oil and Gas Association's Energy summit that a large number of unconventional wells remained profitable at an oil price of $40 per barrel. BTU Analytics reported that ~50% of U.S. production came from wells that have half-cycle break-even costs of $40/bbl or less, meaning the current WTI price north of $80/barrel dramatically improves cash flows in the shale patch.

Related: Is America Doomed To Replicate Europe’s Energy Crisis?

Back in August, the Biden administration urged the OPEC producers to raise production to ease rising gasoline prices which it views as a threat to full economic recovery.

But Biden won't have to look beyond his own backyard for more oil production. Velandera Energy's Manish Raj has told MarketWatch that U.S. oil production has been slowly "creeping up and is now 300K bbl/day higher from the beginning of the year."

In its latest report, the International Energy Agency (IEA) has predicted that we could start to see a strong comeback by U.S. shale, with supply from non-OPEC producers expected to rise by 1.7 mb/d in 2022, with the U.S. accounting for 60% of the growth. Baker Hughes' latest weekly survey found that the number of active, oil-targeted rigs in the U.S. jumped by 10 to a 16-month high of 397 rigs.

And now they have the money to do it without resorting to excessive borrowing.

Rystad Energy says the U.S. shale industry is on course to set a significant milestone in 2021: Record pre-hedge revenues.

According to the Norwegian energy navel-gazer, U.S. shale producers can expect a record-high hydrocarbon revenue of $195 billion before factoring in hedges in 2021 if WTI futures continue their strong run and average at $60 per barrel this year and natural gas and NGL prices remain steady. The previous record for pre-hedge revenues was $191 billion set in 2019.

The estimate includes hydrocarbon sales from all tight oil horizontal wells in the Permian, Bakken, Anadarko, Eagle Ford, and Niobrara.

ADVERTISEMENT

Rystad predicted that whereas hydrocarbon sales, cash from operations, and EBITDA for tight oil producers are all likely to test new record highs if WTI averages at least $60 per barrel this year, capital expenditure will only see muted growth as many producers remain committed to maintaining operational discipline.

Unfortunately, shale companies are now caught between a rock and hard place given the sharp fall in the DUC inventory. DUCs allow shale companies to rapidly ramp up production without spending heavily. But now, some oil executives are warning that more shale will be needed to offset normal production declines, and investors will have to accept it.

"Spending in 2022 will have to be higher just to sustain volumes enjoyed in 2021 and I think in general Wall Street is aware of that," Nick O'Grady, chief executive at Northern Oil and Gas Inc (NOG.A), has told Reuters.

New wells cost ~$7 million apiece, with drilling representing about 30% of the total. Luckily, with oil at $80 a barrel, most producers can afford to put more money into drilling and still manage to increase shareholder payouts.

By Alex Kimani for Oilprice.com

More Top Reads from Oilprice.com:

- WTI Oil Price Breaks $80 For The First Time Since 2014

- India And UAE Strengthen Energy Ties With New Strategic Oil Deal

- Is Decarbonization Threatening Europe’s Energy Security?

Obviously the steel business is booming in the USA at the moment in its own right as with so many other Industries...but that would need to include real estate now too as not only oil but coal and natural gas prices have soared from their historic "Putin goes Full Retard" lows of 2014.

Someone is buying Chesapeake Energy like crazy anyways.

Anyhow it is plain for all to see the US Federal Reserve needs to start creating a "normal" interest rate policy not that there is a crisis in US monetary policy per se (positive yield, strong carry) at the moment.

China, Russia, Turkey, the Euro zone, Great Britain...all of them seem to be getting annihilated by hyperinflations at the moment.

Even Canada.

Even Mexico.

Only South Korea seems relatively stable at the moment outside of the USA.

Maybe Brazil.

Maybe Australia.

Maybe Qatar

How this is even so is really hard to imagine quite honestly but anyone who has bet against the USA has been wholly and totally annihilated on or about the Fall, 2021. The left and ahem *New York City finance* ahem has made a *LEGION* of enemies of the USA American people at the moment as well.

Certainly this isn't true of Warren Buffett or Vanguard Mutual Funds and John Bogle.

Good luck with that GameStop short Bill Gross!

Long $crwd Crowd Strike

Strong buy