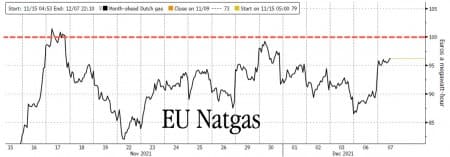

On Tuesday, European natural gas futures jumped after U.S. and European allies weighed new sanctions against Russia if it should invade Ukraine. Cold weather is not the only driver of natgas prices but also geopolitical instability in the region has helped push prices near 100 euros per megawatt-hour.

According to Bloomberg, citing people familiar with the matter, the U.S. and European allies could hit Moscow with sanctions that would paralyze its ability to convert rubles for dollars and other foreign currencies if an invasion of Ukraine was seen early next year.

President Joe Biden and President Vladimir Putin are expected to speak Tuesday. People familiar with the upcoming meeting said Biden will outline various types of sanctions the US could use if Putin were to invade Ukraine.

Rising tensions between the US/EU and Russia come as U.S. intelligence has warned as many as 175,000 Russian troops are assembling on the Ukraine border. Moscow denied invasion plans but warned Western countries to scale back support for Ukraine.

Any action or proposed action against Russia or its energy industry has pushed natgas prices across Europe higher. Weeks ago, German regulators suspended the application process for Russia's Nord Stream 2 pipeline. Then the US sanctioned companies related to the pipeline's construction.

After the fresh talks of sanctions, Dutch month-ahead gas, the European benchmark, rose 7% to 96.295 euros, nearing the 100 euro breakout level.

Prices have slumped since early October records (116 euros), but some expect with a La Nina cold season that has brought unseasonably frigid weather to continental Europe and the Nordic region, along with low natgas storages levels (currently at 66%, compared with the five-year average of 82% for this time of year), prices could continue rising as geopolitics becomes another upside driver.

By Zerohedge.com

ADVERTISEMENT

More Top Reads From Oilprice.com:

- The Multi-Billion Dollar Start Of A Nuclear Fusion Boom

- Natural Gas Bulls Hit Hard By Warm Weather Reports

- The Oil Price Crash Has Taught U.S. Shale A Valuable Lesson