U.S. and European natural gas prices are sliding as warmer weather reduces demand for the heating fuel, and storage levels remain high. Risks of a global energy crisis are diminishing for now -- well -- that's until the next cold blast strikes.

The polar vortex that sent much of the Lower 48 into a deep freeze at the end of 2022 ended last week. Now, much of the US will see warmer-than-normal temperatures through mid-Jan.

The National Oceanic and Atmospheric Administration's latest 6-10 Day Temperature Outlook shows that nearly all Lower 48 will experience above-average weather.

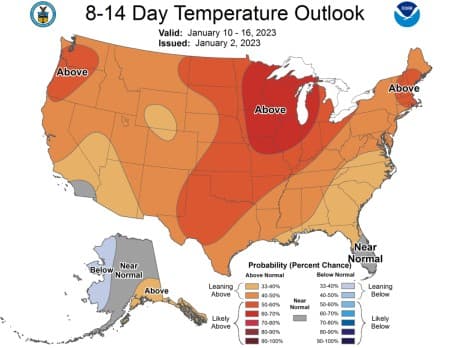

NOAA's 8-14 Day Temperature Outlook suggests the same.

Weather data via Bloomberg shows Lower 48 temperatures are expected to remain above a 30-year average through mid-month.

And this will reduce heating demand.

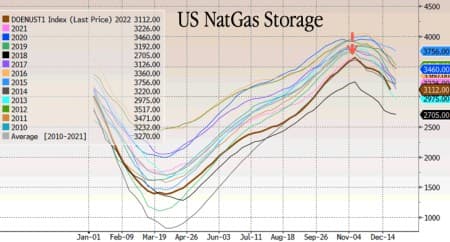

US NatGas storage entered into a drawing period in mid-Nov. and has been sliding since.

A weaker heating demand outlook has sent US NatGas prices down nearly 9% to $4.062 per million British thermal units on the New York Mercantile Exchange in early Tuesday trading. Prices are back to levels not seen since early February 2022.

Across the Atlantic, EU NatGas touched the lowest levels since the start of the Ukraine war.

"The risk of extreme market tightness that people were worried about before the winter started seems low now," BloombergNEF's Abhishek Rohatgi wrote.

Warmer weather in Europe has eased concerns about blackouts and rationing as stockpiles increase:

In fact, Europe has been able to add more gas into storage in the last few days amid a mix of curbed heating needs and typically lower consumption during the holiday season. -Bloomberg

EU NatGas storage increased last week.

ADVERTISEMENT

Temperatures across Central EU are expected to hold above seasonal levels through at least the mid-month.

Sign of relief worldwide: NatGas prices slide in the US, EU, and Asia.

We noted days ago the risks of a collapsing polar vortex in the Arctic could send parts of the EU into a chill later this month. And it's only a matter of time before cold weather returns to the US.

By Zerohedge.com

More Top Reads from Oilprice.com:

- The 10 Most Influential Figures In The History Of Oil

- China Sets The Tone In Oil Markets At Year's End

- Crash In U.S. Natural Gas Prices Incentivizes Power Plants To Ditch Coal

With all the trillions now hither and yon who knows what to believe.