Iraq Hopes to Expand Economic Relationship With the U.S.

Sudani wants to strengthen Baghdad’s…

China Dominates Global Hydropower Generation

China is the undisputed global…

Surprise Crude Build Weighs On Oil Prices

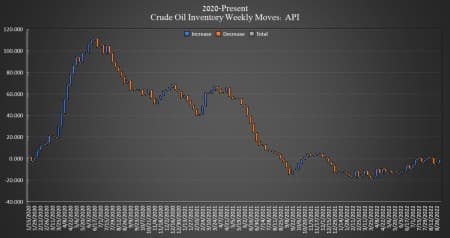

The American Petroleum Institute (API) reported a build this week for crude oil of 3.645 million barrels, while analysts predicted a draw of 733,000 barrels.

The build comes as the Department of Energy released 7.5 million barrels from the Strategic Petroleum Reserves in the week ending September 2, leaving the SPR with just 442.5 million barrels.

In the week prior, the API reported a build in crude oil inventories of 593,000 barrels after analysts had predicted a draw of 633,000 barrels.

WTI fell on Wednesday prior to the data release as the threat of a global recession weighed on the market, adding to fears that additional and expanded Covid-inspired lockdowns in China could dent demand for oil. At 2:30 p.m. ET, WTI was trading down 5.44% on the day at $82.18 per barrel—a roughly $10 per barrel dip on the week. Brent crude was trading down 4.96% on the day at $88.23—an $11 dip on the week.

U.S. crude oil production data for the week ending August 26 rose by 100,000 bpd to 12.1 million bpd, according to the latest weekly EIA data.

The API reported a draw in gasoline inventories this week of 836,000 barrels for the week ending September 2, compared to the previous week's 3.414-barrel draw.

Distillate stocks saw a build of 1.833 million barrels for the week, compared to last week's 1.726-million-barrel decrease.

Cushing inventories were down by 772,000 barrels this week. Last week, the API saw a Cushing decrease of 599,000 barrels. Official EIA Cushing inventory for the week ending August 26 was 25.284 million barrels, down from 25.807 million barrels in the prior week.

Oil prices were falling after the release, with WTI trading at $81.66 (-6.01%) and Brent trading at $87.54 (-5.70%).

ADVERTISEMENT

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- OPEC+ Cuts Production Despite Resistance From Russia

- Can OPEC+ Keep Oil Prices Above $90?

- China Steps Up LNG Sales To Europe As Prices Soar

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

Even $bp British Petroleum might be worth a look here.

I think Equinor is the huge name in Norway. Amazing YouTube review of the new Bluetti portable Battery offering. That's great news for the US economy and US utilities in particular.