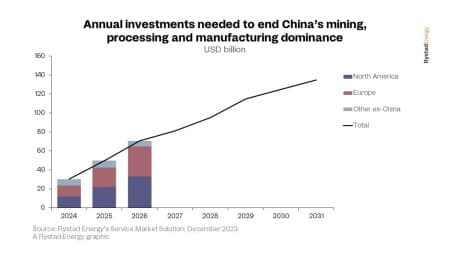

To combat China’s dominance of global clean energy supply chains, Western countries are trying to build up their manufacturing capacity to ensure reliable and affordable supply. These efforts might be too little too late, however, as Rystad Energy research shows that this expansion will cost up to $700 billion and will not make a meaningful impact until the next decade at the earliest.

Our research covers the spending needed to build domestic supply chains for material mining, processing, refining and manufacturing for solar, wind and batteries – the cornerstones of the future energy system. The total bill for these sectors among Western countries will be close to $700 billion.

The West’s increased focus on energy security since Russia invaded Ukraine in early 2022 has forced governments to take greater responsibility for renewable and clean-tech supply chains. China dominates the manufacturing of solar and battery cells, for instance, and with growing concerns around reliability, the EU and the US have initiated big plans to reverse this dependence.

“Relying on a single trade partner for important manufacturing or raw materials is inherently risky. As the energy transition accelerates and demand for affordable clean energy capacity grows, the West is frantically trying to break China’s stronghold on supply chains to boost adoption rates and cut costs. However, these countries are fighting an uphill battle, and it will take many years and significant investments to make an impact,” says Audun Martinsen, head of supply chain research at Rystad Energy.

Related:

In addition to its domestic sourcing, China is looking beyond its borders to mine raw materials. For instance, China has invested in African rare earth mineral mining projects, including lithium extraction in countries such as Namibia. This will boost global supply, but there is still only a handful of nations that sit on most of the mineral deposits needed for the renewable energy supply chain. For many rare-earth elements, volumes could be extracted at new and existing deposits, though the mining cost would be higher. If other nations are to reduce their dependence on Chinese-controlled materials, the issue is not so much about expanding mining capacity as it is about breaking the trade routes of these materials so they end up at processing and manufacturing sites outside of China.

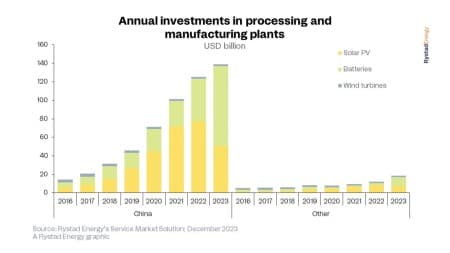

The ability to process, refine and manufacture the materials for clean energy developments will require significant investment before a reliable supply chain is in place. Mainland China’s annual investment in building its manufacturing and processing capacity has climbed from $10 billion in 2016 to $140 billion in 2023. As a result, its solar PV capacity grew from 14 gigawatts alternating current (GWac) to 850 GWac, and its battery cell capacity jumped from 126 gigawatt-hours (GWh) to 1,550 GWh. In comparison, the combined annual investment in all other nations has only grown from $7 billion in 2016 to $20 billion in 2023.

Various programs and policies in the EU and the US are trying to level the playing field. The US Inflation Reduction Act has triggered several new initiatives, including lucrative grants, to encourage the building of battery cells, solar modules and wind component manufacturing across the country. However, the pipeline of projects outside China is less than a quarter of the investments required to decouple from China fully. Overall, $700 billion of mining and manufacturing investments are needed to break Chinese domination in these markets.

As well as a manufacturing and mining head start, China has a know-how and intellectual property advantage as Chinese companies own myriad patents and lead the development of new technologies. This will also delay the speed at which the EU and US can catch up, pushing their self-sufficiency timeline into the 2030s. Large-scale mineral recycling will also be required, including decommissioned equipment, with the EU aiming to source 25% of its mineral demand from recycling.

By Rystad Energy

More Top Reads From Oilprice.com:

- India’s Oil Demand Growth Is Set for a Slowdown in 2024

- Electric Vehicle Market Sees 20% Surge in Global Sales for November

- China’s EV Sector Will Become Self-Sufficient By 2060