Earlier in the year, Bloomberg New Energy Finance (BNEF) reported that an impressive $1.1 trillion flowed into the global clean energy sector in 2022. According to the clean energy watchdog, almost all sectors received record levels of investment, including renewable energy, energy storage, hydrogen, carbon capture and storage (CCS), electrified transport, electrified heat and sustainable materials spurred by a rush to attain energy security amid Russia’s war in Ukraine.

BNEF also revealed that China spent $546 billion on renewables in 2022, nearly half the total global spend; more than triple the European Union’s total spend at $180 billion, and the United States’ $141 billion. It’s, therefore, hardly surprising that BNEF has revealed that companies listed on the S&P 500 currently derive only about 3.4% of their revenue from clean energy, roughly half the figure by their peers on the Shanghai Composite Index. Indeed, the Asia-Pacific region is home to nearly 700 companies that draw more than half their revenue from clean energy, which includes renewable and nuclear power, electrified transport, biofuels, hydrogen and carbon capture. That compares with just over 400 companies in the U.S. and slightly more in Europe, the Middle East and Africa combined.

Leading Chinese solar firms are enjoying roaring profits driven by strong demand and an uptick in panel sales: Jinko Solar Co. Ltd. (NYSE:JKS) reported a staggering 325% jump in net income to 3.8 billion yuan for the first half of the current year; Longi Green Energy Technology Co. Ltd, the world’s largest panel-maker, reported a 42% year-on-year jump in net profit to 9.2 billion yuan ($1.3 billion), Trina Solar Co. Ltd. saw its H1 202 profit soar 179% to 3.5 billion yuan while JA Solar Technology Co. Ltd. saw its net income rise 183% to 4.8 billion yuan.

China Dominating Global Solar Industry

With China now leading the world in clean energy investments, it’s almost par for the course that it’s the undisputed global leader in solar manufacturing, with four out of five solar panels sold worldwide originating from the country.

China has poured over $50 billion in wafer-to-solar panel production lines, 10 times more than Europe, and also controls a staggering ~95% of the world’s polysilicon and wafer supply. Last year, the International Energy Agency warned of the dangers the world is exposing itself to by relying so heavily on the Middle Kingdom for its solar needs:

"The world will almost completely rely on China for the supply of key building blocks for solar panel production through 2025. This level of concentration in any global supply chain would represent a considerable vulnerability,” the agency wrote in a special report.

Now, Beijing is looking to protect its vast solar investments in a move that’s very likely to be inimical to the U.S. solar sector.

China plans to ban the export of several key technologies used in the manufacture of solar panels. Amongst the proposed rules, advanced technologies used in the manufacture of wafers and ingots will be placed in a list of export controls, according to a public consultation process. If the plan is adopted, Chinese solar manufacturers would be required to obtain a license from their provincial commerce authorities to export such technologies. Related: G20 To Pursue More Renewables And Carbon Capture

Polysilicon is used in ingot-casting molds to construct solar wafers. The wafers are then pieced together to create the photovoltaic (PV) cells. Although the proposed ban will not restrict the supply of complete wafers for solar panels, it’s likely to negatively affect American solar companies because U.S. photovoltaic power generation components are highly dependent on Chinese tech.

The Wall Street Journal has warned that restricting exports of key solar manufacturing technology will disrupt U.S. solar ambitions. According to Taipei-based market research firm TrendForce, only Chinese companies are capable of making larger 182 and 210 millimeter wafers. That’s an alarming revelation because larger wafers--which allow for cheaper and more efficient solar panels to be made--are expected to make up 96% of the world’s market share in 2023.

Expanding American Solar Manufacturing

“China’s proposed export restraints are Exhibit A on the need to rapidly scale American solar manufacturing,” Abigail Ross Hopper, president and CEO of the U.S. business lobby Solar Energy Industries Association, told WSJ after the Biden administration launched the IRA, which has been hailed as a game-changer for the solar sector.

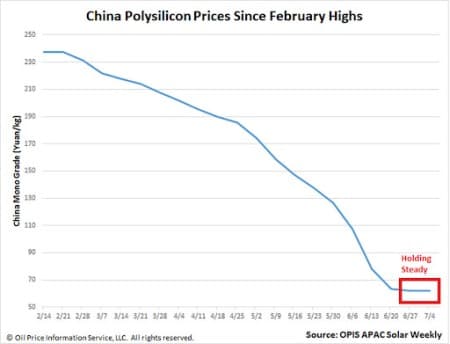

Over the past two years, solar manufacturers have been hampered by supply chain disruptions including increasing material costs for polysilicon. Indeed, last year, Rystad Energy estimated that rising equipment and shipping costs led to the postponement or cancellation of 56% of worldwide utility-scale solar projects that had been planned for 2022.

Luckily, these challenges have been rapidly fading with energy prices falling back close to pre-war levels. The same scenario has been unraveling in the solar sector, with polysilicon prices on a steady decline.

Source: PV Magazine

A new report published by the Rocky Mountain Institute has forecast that wind and solar energy will produce more than 33% of total energy in the world by 2030 compared to just 12% currently

"Exponential growth of clean energy is an unstoppable force. The benefit of rapid renewable deployment is greater energy security and independence, plus long-term energy price deflation because this is a manufactured technology - the more you install the cheaper it gets," RMI said.

The report concludes the COP28 goal for renewable power, which seeks to triple renewable energy capacity by 2030, is achievable as long as adequate grid investment, streamlined permitting and investments into greater storage are made.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Soars Above $90 As Saudi Arabia Extends Deep Output Cuts

- Commodity Trader Trafigura Sees Upside Risk For Oil Prices

- China’s Influence In Oil Markets Grows With BRICS Expansion