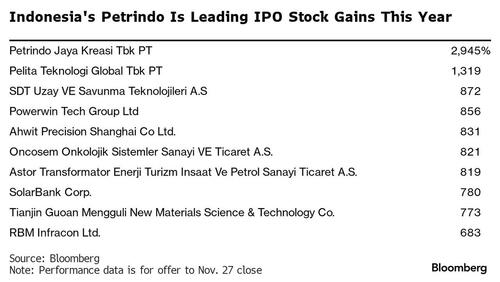

The world’s best-performing IPO stock this year is a little known Indonesian coal mining company that’s backed by one of Southeast Asia’s richest men.

PT Petrindo Jaya Kreasi has soared more than 2,900% since it listed in March following a $25 million offering. Yet it still has no analyst coverage, is richly valued and has relatively low trading volumes. Counting Indonesian billionaire Prajogo Pangestu as its main shareholder, the company’s market value has grown by more than 25 times to $5.4 billion in just nine months.

Indonesia has been one of the most vibrant markets for initial public offerings globally this year, partially helped by a boom in demand for renewable energy stocks. Petrindo, in particular, is among a cohort of Indonesian stocks that have posted unexplained gains and wild swings this year, reaping fortunes for their backers and leading to regulatory scrutiny.

Including Petrindo, companies that debuted on Asian exchanges this year after raising up to $100 million have gained an average 43% since listing.

The company has “shown aggressive diversification initiatives through gold mining and nickel mining, which the market might perceive as a growth impetus story,” said Alif Ihsanario, a mining sector analyst at MNC Sekuritas. Investors have “hopped on the bandwagon of Prajogo Pangestu’s rally momentum this year,” he added.

Petrindo’s gains led to multiple trading suspensions and have sent valuations skyrocketing. The stock is trading at 114 times its annualized earnings for the June-ending quarter versus the 16 times price-to-earnings multiple of Indonesia’s benchmark Jakarta Composite Index. Daily trading volumes have averaged about 32 million shares since listing.

The stock gains have delivered a windfall for Pangestu, who is Indonesia’s third-richest man, according to the Bloomberg Billionaires Index. He derived his fortune from a controlling stake in PT Barito Pacific, a Jakarta-based power generation and petrochemical company. A unit of the group, Barito Renewables Energy Tbk, has also surged since listing last month.

There’s optimism that Petrindo’s rally will continue. Agreements announced by the company in recent months include buying a 34% stake in engineering firm PT Petrosea and acquiring coal company Multi Tambangjaya Utama, as well as diversifying into gold mining. Petrindo, which operates across Kalimantan and West Nusa Tenggara, reported sales of 1.04 trillion rupiah ($67 million) in the June quarter.

“Only time will tell whether the stock is currently overvalued or attractively priced,” said Mohit Mirpuri, a fund manager at SGMC Capital Pte., who doesn’t own the shares.

By Ishika Mookerjee and Fathiya Dahrul, Bloomberg markets live reporters and strategists

More Top Reads From Oilprice.com:

- Traders Cut Bullish Bets on Oil Ahead of OPEC+ Meeting

- Connecticut Plan to Ban Gasoline Cars Faces Opposition

- Alberta Strikes Back at the Federal Government’s Energy Transition Plan