After a sharp decline in the final quarter of 2023, U.S. gasoline prices are surging again in a pivotal election year, offering Republicans a fresh chance to pin the blame on President Biden’s green agenda much to the chagrin of the White House. According to Bloomberg, citing new data from AAA Automobile Club, U.S. gas prices are now on course to hit the dreaded $4-a-gallon mark in the coming months, thanks to rising crude prices amid tightening supplies.

But here’s the kicker: under most key metrics, the U.S. oil and gas industry has flourished under the Biden administration despite its push towards a carbon-free future, proving that not even Washington has sufficient power to single-handedly sway large, globally interconnected markets like oil and gas. GOP White House hopefuls were quick to lambast Biden and his energy policies in the post-Covid oil price rally that hit its zenith shortly after Russia invaded Ukraine.

Source: Y-Charts

Yet, Big Oil investors were hardly complaining. According to data compiled by Reuters, profits of the top five publicly traded oil companies, namely Exxon Mobil Corp. (NYSE:XOM), Chevron Corp.(NYSE:CVX), BP Inc.(NYSE:BP), Shell Plc (NYSE:SHEL) and TotalEnergies SE (NYSE:TTE) rocketed to $410 billion during the first three years of the Biden administration, a 100% increase compared to the corresponding period of Donald Trump’s presidency. Related: Oil Closes the Month on a Strong Note

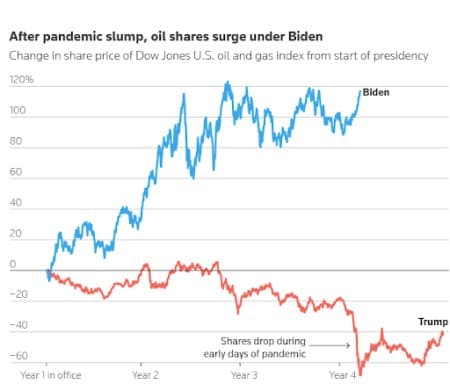

Not surprisingly, oil and gas investors have been handsomely rewarded under the Biden administration, with energy shares jumping 124% so far since Biden took over at the Oval Office vs.-65% decline for the comparable period under Trump.

Source: Reuters

Republicans have repeatedly railed against Biden’s climate policies, blaming them for compromising U.S. “energy independence” by limiting U.S. oil and gas production and raising fuel prices. Shortly after becoming president, Biden [in]famously canceled the Keystone XL Pipeline project designed to bring in more Canadian crude to U.S. refineries and paused new LNG export permits pending an environmental review in 2023 ostensibly in a bid to woo climate voters.

Meanwhile, Trump has promised to “drill baby, drill” and restore America's energy independence when he returns to the White House--even as the U.S. cements its position as a fossil fuel superpower.

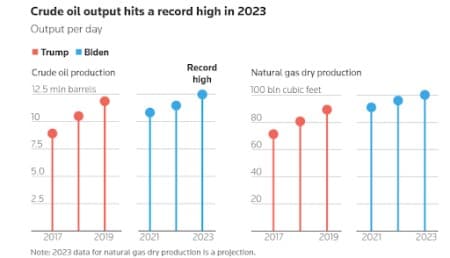

However, Trump will have his work cut out because U.S. crude and natural gas production have both hit all-time highs under the Biden administration. According to the U.S. Energy Information Administration (EIA), crude oil production in the United States, including condensate, averaged 12.9 million barrels per day (b/d) in 2023, breaking the previous U.S. and global record of 12.3 million b/d, set in 2019. Average monthly crude oil production set a new monthly record high in December 2023 at more than 13.3 million b/d.

Source: Reuters

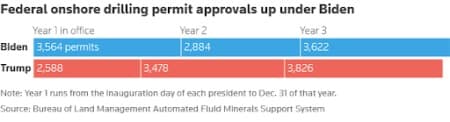

And, the notion that Biden is tight-fisted when it comes to awarding oil permits is nothing but a myth, with the current administration having issued a total of 10,070 onshore drilling permits during its first three years in office compared to 9,892 under Trump over a similar period.

Reuters

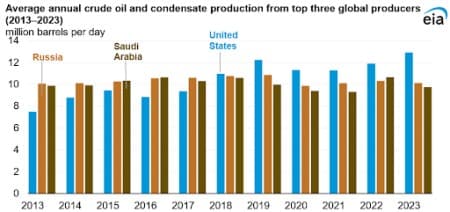

U.S. crude production now significantly outpaces production by key rivals Saudi Arabia and Russia. Even better for the oil bulls, U.S. leadership is unlikely to be breached any time soon because no other country has even hit the pivotal level of 13.0 million b/d. Saudi Arabia had the best shot to give the U.S. a run for its money; however, state-owned Saudi Aramco recently scrapped plans to increase production capacity to 13.0 million b/d by 2027.

Together, the U.S., Saudi Arabia and Russia now account for 40% (32.8 million b/d) of global oil. By comparison, the next three largest producers--Canada, Iraq, and China--produced a combined 13.1 million b/d in 2023, only slightly higher than what the United States produced by itself.

Source: EIA

Dustin Meyer, senior vice president of policy, economics and regulatory affairs at the American Petroleum Institute, the top U.S. oil and gas trade group, has acknowledged that Biden’s climate policies are having little negative impact now, although he still fears they might do the damage in the years ahead,

"There's only so much that an administration of either party can do in the near term to impact supply or demand. We are concerned about the administration's policies when it comes to leasing, when it comes to LNG, when it comes to infrastructure development, and they are going to make it very difficult for us to meet the energy needs of the future,” he has told Reuters.

Several analysts have predicted that Brent prices will eventually cross $90 per barrel in the months ahead thanks to strict production discipline by OPEC+, production disruption in Russia due to Ukrainian drone attacks and limited production growth by non-OPEC producers including the U.S. There’s a possibility we might see $4 oil before the end of the year, although the Biden administration will be almost powerless to intervene this time around, having nearly drained the U.S. Strategic Petroleum Reserve.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Drilling Activity Slips Again

- Exxon and CNOOC Team Up To Challenge Chevron’s Guyana Oil Deal

- Baltimore Port Closure Threatens U.S. Coal Exports

But with condensates accounting for 5.2 mbd, this means that US crude production was only 7.7 mbd. That is because natural gas condensates are neither classified as crude nor are they sold as crude. They are normally sold as diluents for blending with other heavier crudes.

So the EIA's claim that US is the world's largest crude oil producer ahead of Russia and Saudi Arabia isn't correct. And while the United States has self-sufficiency in gas and is also an exporter of LNG for the time being and also has enough coal reserves to satisfy its needs, it doesn't have self-sufficiency in oil. Since it became a net oil importer in 1970, it continues to import 8.0-9.0 mbd currently and this is projected to remain the case well into the future.

That is why the US will never achieve energy independence.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert