Russia’s invasion of Ukraine has simultaneously both eased and complicated the task of Middle Eastern national oil companies. On the one hand, it had pushed the backwardation in the Brent even steeper, making any flows from Europe to Asia uneconomic, hence safeguarding the usual outlets for Saudi Arabia or Iraq. Simultaneously, the risk of seeing Russian supply sanctioned led to oil prices shooting up above $120 per barrel, making the outright basis of March cargoes remarkably profitable. On the other hand, the likes of Saudi Aramco and SOMO had to increase prices, in fact, they could do it even more substantially as arbitrage flows would be most probably weak in April 2022, however, this could antagonize even further all the Asian buyers that keep on fretting about unprecedentedly high prices. So there was a very fine line to walk, especially considering that the specter of an impending Iranian nuclear deal never really left the decision room. Chart 1. Saudi Aramco’s Official Selling Prices for Asian Cargoes (vs Oman/Dubai average).

Source: Saudi Aramco.

For the second time in a row, Saudi Aramco hiked all its official selling prices, regardless of the respective continent. Asia-bound April OSPs were increased by $2.15-2.70 per barrel, coming on the back of record-high Dubai backwardation as the M1-M3 Dubai spread rose above $4 per barrel, i.e. almost $2 per barrel higher than last month. The main Saudi export streams – Light, Medium, and Heavy – all saw the same $2.15 per barrel jump, breaking previous all-time highs. Whilst Saudi Arabia, in general, is still some way off bringing aggregate crude production back to pre-pandemic levels, its exports to Asia have already moved in there, hovering around 5.7 million b/d this month.

Looking forward, with the Dubai forward structure steepening further, the May 2022 OSPs will inevitably see another month-on-month hike. For Asian countries that, unlike India and to a lesser extent China, are not willing to pick up heavily discounted Russian barrels, spring will bring quite the refining margins as they are compelled by the market to continue buying Middle Eastern crude.

Chart 2. Saudi Aramco’s Official Selling Prices for US Cargoes (vs ASCI).

Source: Saudi Aramco.

Looking back, those who decided to maximize their ADNOC term nominations for April 2022 will be rewarded with an official selling price that seems more than palatable under the current circumstances. Based on the monthly average of Murban futures contracts traded on a Singapore basis, the UAE national oil company ADNOC set the April price of the Emirati flagship-grade at $93.99 per barrel, up almost $9 per barrel but still a way to go to the current pricing levels. Inevitably, the bargain deals of today will at some point turn out to be outright bad from a pricing perspective – IFAD Murban has been at almost complete parity to ICE Brent in the first two decades of March – when the unchanging expectations of oil prices decreasing finally materializes. ADNOC has also dropped the differential of Upper Zakum to the widest discount to Murban since it started trading on the IFAD, standing at $2.05 per barrel in April, up 50 cents from March. This might be a reaction to Urals, an immediate peer of Zakum, making tangible inroads into India and China, or also a reflection of increasing availability thereof – March exports so far have averaged 950,000 b/d, the highest since the April 2020 export insanity.

Chart 3. ADNOC Official Selling Prices for April 2022 (set outright, here vs Oman/Dubai average).

Source: ADNOC.

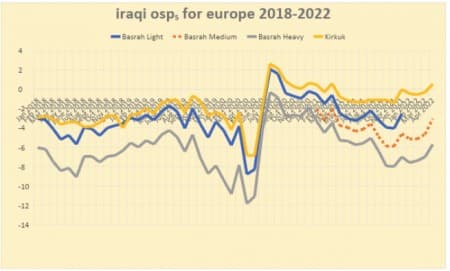

Following in the footsteps of Saudi Aramco, the Iraqi state oil marketer SOMO has also increased all its April-loading formula prices. SOMO’s Asian pricing strategy is particularly interesting as the Iraqis hiked Basrah Medium and Basrah Heavy by $2.20 per barrel and $2.00 per barrel, respectively. In the case of Basrah Medium this means that the month-on-month change was marginally higher than that in Saudi peers. Yet that is only part of the equation as SOMO prices its cargoes based on Dated Brent which in the current period of unprecedented backwardation stands at several dollars of a premium over the futures contract of ICE Brent, the pricing basis of Saudi Aramco. If Iraq wanted to create a tailor-made solution that reflects this trend, it should have cut prices rather than hike them the same way Saudi Aramco did, insinuating that Baghdad expects the current market tightness to remain in place for quite some time, similarly to the profitability of Atlantic Basin inflows.

Chart 4. Iraqi Official Selling Prices for Asian cargoes (vs Oman/Dubai average).

Production issues might help in explaining (partially) SOMO’s pricing vigor, with the West Qurna-2 play going into several weeks of field maintenance. The initial plan was to have the field halted for 21 days so that upgrading works could be carried out to boost the production capacity of West Qurna-2 to 450,000 b/d, however, apparently inventory levels at the field dropped to critical levels and the Iraqi authorities restarted the field by 10 March. Whether West Qurna-2 is now upgraded or not, there seems to be no official confirmation, what we do know for certain is that Iraq’s crude oil production this month will reflect this flurry of chaos. Meanwhile, outflows to Europe seem to have taken the primary hit from weaker Iraqi availability – so far in March, there have been only seven cargoes loading to Europe, approximately a third of the number in February.

Chart 5. Iraqi Official Selling Prices for European cargoes (vs Brent Dated).

Source: NIOC.

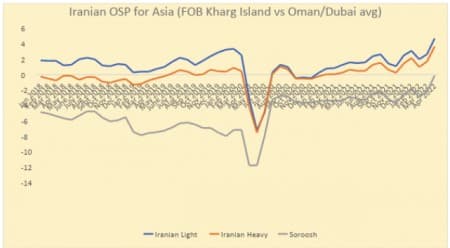

Iran’s national oil company NIOC took some time to issue its April 2022 official selling prices, publishing them almost two weeks after Saudi Aramco did so, arguably driven by the anticipation of a prospective deal that nevertheless witnessed yet another hiccup. NIOC priced its Iranian Light and Iranian Heavy cargoes going to Asian buyers more advantageously than its Saudi peer, increasing the April OSP by $2.05 per barrel and $1.95 per barrel, respectively. Having said this, Iran seems to have narrowed down its crude exports lately, coming on the back of intensifying rumors of a potential JCPOA deal.

Related: UAE Energy Minister: Stop Vilifying And Then Venerating Oil Producers

Peaking in December 2021 at around 850,000 b/d, Iranian outflows have lost steam so far this year, dropping some 100,000 b/d from those levels. Exports are still dominated by Asian buying (i.e. the usual path of sending initial cargoes to Malaysia, to be trans-shipped from there to China), with a steady flow of crude going towards Syria.

Chart 6. Iranian Official Selling Prices for Asia-bound cargoes (vs ICE Bwave).

Source: NIOC.

As for the Iranian nuclear deal itself, the past month’s developments have been an emotional rollercoaster. First Russia tried to scupper a nascent deal by demanding guarantees, primarily from the United States, that it would be free to trade and deal with Iran, should a new nuclear deal take place. Long deliberations ensued and just when it seemed that the overall momentum has ground to a halt, Moscow apparently received those guarantees. By that point, Iran has already released the political detainees it held in Tehran, so a revived covenant seemed a genuine possibility. From then onwards, however, sides have resorted to mutual recriminations, indicating that it is primarily political will that is lacking right now to pull a deal through.

Chart 7. Kuwaiti Official Selling Prices for Asian cargoes (vs Oman/Dubai average).

Source: KPC.

Kuwait, whose production and total exports have been relatively stagnant since November 2021, traditionally mirrored Saudi Aramco’s moves, though it did hike the April 2022 Asia-bound OSP of its mainstream, KEB, by $2.25 per barrel (i.e. 10 cents per barrel more). With KEB priced against a $4.80 per barrel premium vs the Oman/Dubai monthly average, Kuwait too will see record-high differentials next month – the same is true of Kuwait’s marginal 75,000 b/d KSLC stream as the super-light crude was set at a $5.95 per barrel premium to Oman/Dubai, the highest since the grade started trading. Simultaneously, the top echelons of Kuwait’s petroleum company KPC have seen some changes recently, with Sheikh Nawaf al-Sabah named as the new CEO – though after having spent more than 20 years in the company, such corporate reshuffling is unlikely to trigger any changes in the overall policy of KPC.

By Gerald Jansen for Oilprice.com

More Top Reads From Oilprice.com:

- Sanctions Are Forcing Russian Companies To Consider Moving To Kazakhstan

- Russia Threatens G7 Nations As Ministers Reject Gas-For-Rubles Scheme

- Are You Really Being ‘Gouged’ At The Gas Pump?