Saudi Arabia pledged to cut production right after the OPEC+ summit in early June, however, it took the market several weeks to see and properly assess the impact of such output curtailments. When Middle Eastern national oil companies set out to issue their formula prices for August 2023, Saudi Arabia’s extension of the production cuts into August and Russia’s pledge to cut exports by 500,000 b/d in the same month were making headlines across the OPEC+ universe. The market needed the Saudi extension as worrying signs of an impending decline in Chinese manufacturing as well as recessionary fears spreading across North America and Europe prompted many investors to quit their positions in the oil market and wait for all the woes to pass.

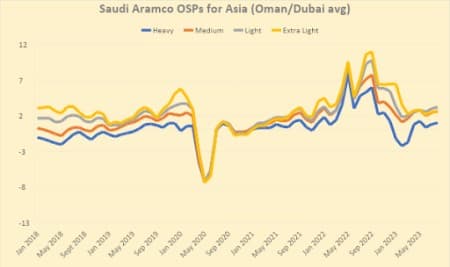

Chart 1. Saudi Aramco’s Official Selling Prices for Asian Cargoes (vs Oman/Dubai average).

Source: Saudi Aramco. Timing is everything for Saudi Arabia, especially when it comes to setting prices. With the Dubai cash-to-futures spread coming in flat compared to May, with the June average at $0.99 per barrel, the futures curve indicated that Asian prices should be rolled over into August. There was some upside in refining margins across the globe, mostly coming from stronger diesel cracks, however, major increases seemed very unlikely. Then came the announcement that Saudi Arabia would extend its production cuts into August, followed up within a couple of minutes by Russia’s pledge to curb exports in the same month by 500,000 b/d and hikes were back on the agenda. The heavier grades, Arab Light, Medium and Heavy were all lifted by a uniform $0.20 per barrel compared to July, whilst Arab Extra Light was rolled over and Arab Super Light (a grade that didn’t witness any exports in May and June) was cut by $0.40 per barrel, reflective of naphtha cracks going into a tailspin. Consequently, Asia has the narrowest spread between Arab Heavy and Arab Extra Light, a mere $1.55 per barrel, which goes on to show just how tight medium sour supply is across the Asian continent. For reference, the same spread in Northwest Europe is $3.50 per barrel, more than double the Asian.

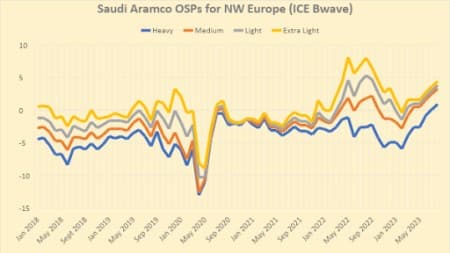

Chart 2. Formula prices of cargoes bound for Northwest Europe by selected grades (vs ICE Bwave).

Source: Saudi Aramco.

Right after the August OSPs were published, Saudi Aramco stated that it would provide Asian buyers with full requested volumes for the month, suggesting that the production cuts were in a sense also a reaction to much lower Asian buying. The same pledge of delivering full term volumes was also repeated for European customers, however the situation in Europe is in many ways different. The closest regional competitor to Middle Eastern sour grades, Norway’s very own Johan Sverdrup, has strengthened to a whopping $2 per barrel premium to Dated Brent by early July, almost $2 per barrel higher than a month before, so hiking OSPs into Europe was by no means controversial. In the end, all NW European formula prices were lifted by $0.80 per barrel, whilst prices into the Mediterranean went up by $1.00-1.10 per barrel. Considering Saudi exports to Europe have fallen back to 600,000 b/d recently, down more than a quarter compared to April-May, such prices are unlikely to incentivize higher purchases.

Related: China Accelerates Crude Stockpiling To Highest Rate In Three Years

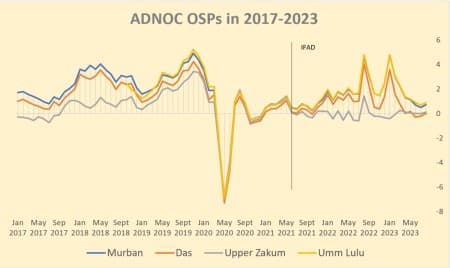

Chart 3. ADNOC Official Selling Prices for 2017-2023 (set outright, here vs Oman/Dubai average).

Source: ADNOC.

For ADNOC, the national oil company of the UAE, things are starting to look better than they did a month ago. Back then, the premium of light sweet Murban to Dubai was less than 50 cents per barrel, in June the same spread rose marginally to $0.72 per barrel. Considering 35% of UAE exports are coming from Murban (and the share will increase once the Ruwais refinery finishing its upgrades that would allow ADNOC to refine more of their heavier grades), this is certainly good news for them. At the same time, the shrinking of heavy-light spreads is also becoming ever more visible with UAE oil, in that light sweet Das and medium sour Upper Zakum are now trading only 10 cent per barrel apart, despite the quality difference. ADNOC has been in the news quite frequently – upping the Covestro takeover bid to $12.4 billion, reaching a crude production capacity of 4.5 million b/d (several years before the assumed deadline), merging petrochemical facilities into a giant polyolefin giant with Austria’s OMV. In brief, things have been really busy at ADNOC as it seeks to catch up with Saudi Aramco, making up for lost time.

Chart 4. Iraqi Official Selling Prices for Asia-bound cargoes (vs Oman/Dubai).

Source: SOMO.

Iraqi state oil marketing company SOMO had two key things to keep in mind when setting the official selling prices for August-loading cargoes to Asia. First, Saudi Arabia has been blazing the trail for other producers and the lack of medium sour barrels is set to lift not only Saudi OSPs but also those of peer countries. Briefly put, Iraq needed to capitalize on the Saudi price hikes. Second, the Asian market is looking increasingly difficult for Iraq, too, as Indian buyers keep on buying up whatever Russian crude they can lay their hands on and China’s imports of Iranian oil has been shooting through the roof. Despite the above consideration, SOMO hiked Asian formula prices more than Saudi Aramco, lifting Basrah Medium by $0.50 per barrel and Basrah Heavy by $0.60 per barrel compared to July. At last, Basrah Medium will be trading above the Oman/Dubai average, though it remains more than $2 per barrel lower than Arab Medium, it’s closest Saudi competitor in terms of quality.

Chart 5. Iraqi selling prices for Europe-bound cargoes (vs Dated Brent).

Source: SOMO.

Seeing Saudi Arabia’s $0.80-$1.10 per barrel increases to Europe, Iraq was tempted to hike formula prices for August even more. Its pricing benchmark is not the ICE Brent weighted average used by the Saudis, but the Platts-assessed Dated Brent which ever since the inclusion of WTI Midland into its calculation methodology has been dragging down the European physical benchmark. So, if the Iraqis wanted to adjust their pricing upwards to reflect this, they now had the ideal opportunity and it seems that they did account for it. Basrah Medium prices to Europe were hiked by $1.20 per barrel to a -$3.15 per barrel discount to Dated Brent and even though the heavier Saudi peer Arab Heavy is some $4 per barrel more expensive, that gap has been shrinking. SOMO also lifted the formula prices of Kirkuk, a grade that has been missing from the market since the export blockade started in March this year, hiking them by $0.75 per barrel to a $0.45 per barrel premium vs Dated, all this despite there not being any deliveries. It seems that Europe’s rising appetite for Iraqi barrels, exports last month were the highest in more than four years at almost 800,000 b/d, boils down to a lack of Kurdish options in the market.

Chart 6. Iranian Official Selling Prices for Asia-bound cargoes (vs Oman/Dubai average).

Source: NIOC.

Whilst Iran has not been getting that much of attention as it should, the Middle Eastern country has been step by step building up its crude production capacity and exports, to the point when Iran’s oil minister feels confident to announce that it produces 3.1 million b/d crude and some 700,000 b/d condensate. With total liquids output passing the 3.8 million b/d mark, Iran’s national oil company NIOC has made great strides in bringing production closer to pre-sanctions levels. Iran followed Saudi Arabia’s suit and lifted Asia-bound formula prices by $0.05 per barrel and $0.15 per barrel for Iran Heavy and Iran Light, respectively. This would mean that Iran Light is to be traded at a $3.15 per barrel premium to Oman/Dubai, i.e. only 5 cents cheaper than Arab Light, however in reality NIOC needs to heavily discount its deliveries to China to be able to sell them. As Iranian exports have doubled year-on-year to 1.5 million b/d, Tehran doesn’t mind the discounting as long as the volumes remain plentiful.

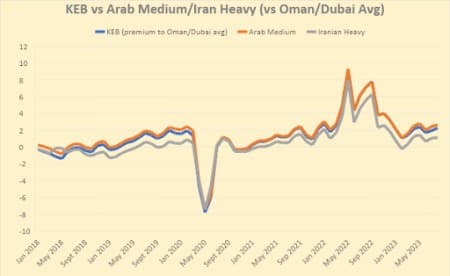

Chart 7. Kuwait Export Blend official selling prices into Asia, compared with Arab Medium and Iran Heavy (vs Oman/Dubai average).

Source: KPC.

KPC, the Kuwaiti national oil company, hiked its Asian prices by $0.30 per barrel to a $2.25 per barrel premium vs Oman/Dubai, slightly more than Saudi Aramco increased its Arab Light and Arab Medium cargoes. It might be argued that Kuwait could have increased prices even more given the rapid decrease in exported volumes – flows have dropped below 1.4 million b/d already, the lowest in more than 11 years, as an increasing amount of crude is refined domestically at the Al Zour refinery. KPC recently announced that it had launched the final (third) distillation unit of Al Zour, taking its operational capacity to 615,000 b/d and ramping up production of oil products along the way. Kuwait is the key factor in the Middle East’s rapidly increasing product flows to Europe, sending both diesel and jet fuel, as the country’s overall product exports went up by more than 50% year-on-year and are gradually approaching the long-coveted 1 million b/d threshold. As there’s less Kuwaiti crude available, KPC might become even more assertive with its pricing than Saudi Aramco.

By Gerald Jansen for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. and Qatar At The Forefront Of Global LNG Supply Growth

- Saudi Arabia’s Oil Revenues Slump To The Lowest Level Since 2021

- Oil Prices Drop As Market Awaits Fed’s Interest Rate Decision