Tons of questions on the weakness in Crude – Thoughts from our trading desk: believe the move is more of a "catch-up" to weaker physical markets as we moved past WTI options expiration yesterday & as Middle East risk premium has now come out of the market in our view.

Bigger picture:

- Margins have remained weak for a while

- OPEC continues to export

- Spreads & DFLs have been signaling weaker fundamentals for several days now

Brent breaking through the 200dma…approaching oversold levels (RSI 32.7)…

- On the vol front, it's interesting to note that front-end gamma is well bid on this selloff which is a re-engagement of the negative spot/vol correlation we saw from late September until the early October Israeli attacks flipped that abruptly. We're also seeing put skew rally sharply here with front-end 25d RR's rapidly approaching the September wides of ~5v for puts.) Options desk think there is some gamma around $75 from sov hedging/other prod strikes and worth noting PMI moved their OSP lower yesterday which brings strikes closer to the money.

- We haven't seen too much fresh on the fundamental side. There are some thoughts that an Iraq flows resolution is imminent, but nothing confirmed and that doesn't warrant a sell off of this magnitude.

- Our models have CTA selling continuing and timing of the move was around the time that their flow normally ramps up.

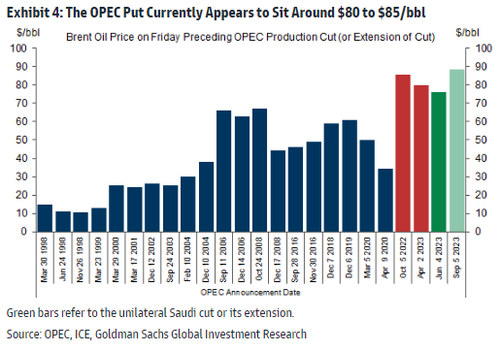

- Fitting that GIR Published their 2024 Outlook today: “We believe that OPEC will ensure Brent in a $80-$100 range by leveraging its pricing power, with a $80 floor from the OPEC put, and a $100 ceiling from spare capacity.” (link)

From Goldman floor trader Michael Nocerino via Zerohedge.com

More Top Reads From Oilprice.com:

- British Steel's Bold Plan to Combat Emissions with Electric Furnaces

- Government Pressure Mounts for Industrial Decarbonization

- China's Shift to Renewable Energy Could Curb Emissions Sooner Than Expected