BloombergNEF (BNEF) published its New Energy Outlook 2020 (NEO) last week. The NEO projects the evolution of the global energy system over the next 30 years. It is widely utilized by planners, strategic thinkers, and investors in developing long-term forecasts and plans.

The report has three components:

- The Economic Transition Scenario (ETS) employs a combination of near term market analysis, least-cost modelling, consumer uptake and trend-based analysis to describe the deployment and diffusion of commercially available technologies.

- The NEO Climate Scenario (NCS) investigates pathways to reduce greenhouse gas emissions to meet a well-below-two-degree emissions budget.

- The Implications for Policy section offers BNEF perspective on some of the most important policy areas that emerge from our two core scenario analyses.

One of the NEO’s most notable projections is that the sharp drop in energy demand from the Covid-19 pandemic will remove about 2.5 years’ worth of energy sector emissions between now and 2050. The report predicts that energy emissions that fell 8% in 2020 as a result of the pandemic will begin to rise again as the economy recovers, but will never again reach 2019 levels. Thus, the report predicts that 2019 will be the peak of global carbon dioxide emissions. From 2027 to 2050 they predict carbon emissions will decline at an average annual rate of 0.7%.

However, the report states that this still puts the world on track for 3.3 degrees of warming by 2100. If the global temperature increase is to be kept below two degrees, emissions would need to fall at 6% per year to 2050.

What is expected to cause the decline in carbon emission? One factor is a projected massive decline of fossil fuel use in the production of electricity.

The declining contribution of coal is projected to have the biggest impact on carbon emissions, while wind and solar power are predicted to grow to a 56% share of electricity generation by 2050.

The declining contribution of coal is projected to have the biggest impact on carbon emissions, while wind and solar power are predicted to grow to a 56% share of electricity generation by 2050.

Transportation is also expected to rapidly decarbonize through 2050, with the report projecting that electricity will drive more than 60% of passenger car miles in 2050.

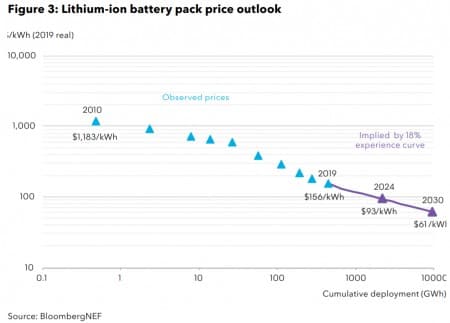

That projection is partially enabled by lithium-ion battery pack prices that are forecast to further decline by more than half over the next decade.

Other notable projections from the report:

Other notable projections from the report:

ADVERTISEMENT

- Renewables and batteries will capture 80% of the total $15.1 trillion invested in new power capacity. Around $2 trillion or 13% is invested by households and businesses. Asia Pacific attracts 45% of all new capital.

- Oil demand peaks in 2035 and then falls 0.7% year-on-year to return to 2018 levels in 2050. Electric vehicles (EVs) reach upfront price parity with Internal Combustion Engine (ICE) vehicles before 2025.

- Gas is the only fossil fuel to grow continuously through the outlook, gaining 0.5% year-on-year to 2050. Cheap gas ultimately slows the energy transition in the United States.

- Coal demand peaked in 2018 and collapses to 18% of primary energy by mid-century, from 26% today. Coal-fired power peaks in China in 2027 and in India in 2030.

- In the NEO Climate Scenario, the clean electricity and hydrogen pathway requires 100,000 terawatt-hours (TWh) of power generation by 2050. This power system is 6-8 times bigger than today’s and generates five times the electricity.

- Green hydrogen provides just under a quarter of total final energy in 2050 under the Climate Scenario.

- Reducing emissions well below two degrees under the clean electricity and green hydrogen pathway requires between $78 trillion and $130 trillion of new investment between now and 2050.

By Robert Rapier

More Top Reads From Oilprice.com:

- Saudi Arabia Is Suffering The Consequences Of Its Failed Oil Price War

- Tech Breakthrough Promises Hydrogen Gas From Plastic Waste

- China's Crude Imports Become Backbone Of Oil Price Recovery

The report assumes erroneously that the sharp drop in energy demand from the Covid-19 pandemic will continue leading to a removal of 2.5 years’ worth of energy sector emissions between now and 2050 and that energy demand will never again reach 2019 levels. Nothing is further from the truth.

Stop the pandemic and the global economy and oil demand will surge pushing global energy demand far beyond 2019 levels. The proof is that China’s crude oil and gas demand has surged far beyond 2019 levels the minute it exited the lockdown. Moreover, China’s economic growth is expected to hit 6.8% in 2021 according to the IMF compared with 6.1% in 2019.

The news that a vaccine developed jointly by the American pharmaceutical company Pfizer and the German company BioNTech can prevent 90% of people from getting COVID-19 is a hugely welcome development. It will give a huge glimmer of hope to a market bereft of good news.

While a large percentage of electricity will be generated by solar and wind power with considerable support from natural gas and nuclear energy, coal will be headed towards its demise.

Furthermore, there will neither be a post-oil era nor a peak oil demand throughout the 21st century and probably far beyond. Moreover, the notions of an imminent global energy transition from oil and gas to renewables and zero emissions by 2050 are sheer illusions.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London