Despite the dramatic reaction of oil markets to news that the OPEC+ meeting would be postponed, oil prices are set to end the week with little real change as traders now await the outcome of the November 30th meeting.

Friday, November 24th, 2023

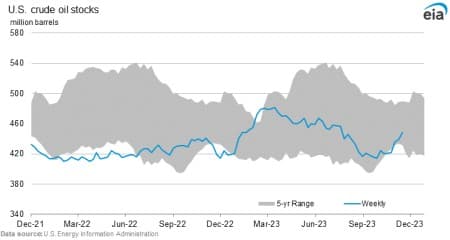

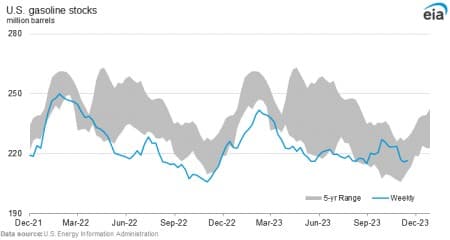

The seesawing in oil prices seen over the past weeks has wound down as the market awaits the OPEC meeting, postponed from this week to November 30 and changed from an in-person summit to an online event. ICE Brent front-month futures have settled within a narrow frame of $81-83 per barrel the entire week, with the Thanksgiving holidays in the US keeping the main developments firmly focused on the Eurasian landscape. A better outlook for China’s property sector was offset by higher US inventories, so OPEC+ will be the trendsetter for the next weeks’ pricing direction.

OPEC Meets Online After Quota Spat. The upcoming meeting of OPEC+ has been postponed to November 30 amidst speculation that the renegotiation of African producers’ production quotas has been met with notable resistance whilst other members of the group defy calls to chip in with cuts.

ADNOC Eyes Major Upstream Expansion. ADNOC, the national oil company of the UAE, is reportedly weighing the acquisition of BASF-backed European energy firm Wintershall Dea for some $11 billion. Increasing its portfolio with Norwegian fields that could be adding some 324,000 b/d of oil equivalent.

Oil Spill Forces Gulf Producers to Shut. More than 60,000 b/d of crude production has been shut in the US Gulf of Mexico, equivalent to 3% of the region’s output, following Third Coast Infrastructure’s underwater pipeline leak, impacting Occidental Petroleum (NYSE:OXY), Talos Energy (NYSE:TALO) and others.

One of Europe’s Oldest Refineries to Halt Operations. Scotland’s only refinery, the 150,000 b/d Grangemouth plant operated by PetroIneos, is expected to shut down by spring 2025 with the operator seeking to revamp it into a diesel import facility.

Colombia Eyes Imports of Cheap Venezuelan Gas. Colombia’s national oil company Ecopetrol (NYSE:EC) is considering starting imports of natural gas from Venezuela, saying the $5 per MMCf cost is significantly cheaper than its current import options.

US Wind Might Not be Dead in the Water. The US Department of Interior green-lighted the Empire Wind offshore project developed jointly by BP (NYSE:BP) and Equinor (NYSE:EQNR) in offshore New York, with a new bidding round next week allowing the stakeholders to reorder their projects at higher prices.

Freeport LNG to Roar Back to Full Capacity. The US Federal Energy Regulatory Commission approved Freeport LNG’s request to ramp up production to full capacity, bringing Phase II infrastructure back and taking the total liquefaction rate back to 2.1 billion cubic feet per day.

Greek Shippers Wary of Breaking Price Caps. According to market reports, three major Greek shipping companies – TMS, Minerva, and Thenamaris - have stopped transporting Russian oil recently as the Biden administration has ratcheted up pressure on price cap sanction busters.

Indonesia Launches First Ever CCUS Project. Indonesia’s President Joko Widodo launched the construction of the $2.6 billion Tangguh carbon capture, utilization, and storage (CCUS) project, the first to be built in the country, eyeing increased utilization of depleted oil and gas reservoirs in saline aquifers.

US Court Defies EPA Waiver Ban. The US Court of Appeals for the Fifth Circuit ruled in favor of smaller refiners that challenged the EPA’s decision to deny smaller downstream companies “hardship waivers” temporarily exempting them from the country’s biofuel mandates, handing a win to the refining industry.

Russia Sells All Its Crude Above Price Cap. Russian government authorities have declared that the country’s oil exporters are selling almost all of their exported crude above the Western-imposed price cap of $60 per barrel, replacing a sizeable chunk of European shippers and insurance.

QatarEnergy Wins Arbitration Ruling. Spanish utility major Endesa (BME:ELE) will have to pay $570 million to QatarEnergy following a ruling by the International Court of Arbitration over a retroactive price adjustment, roughly half of what the Qatari NOC was initially demanding.

Fossil Subsidies Rise Despite COP28 Looming. Despite the global community’s pledges to cut “inefficient” fossil fuel subsidies at previous COP summits, the IMF estimates that the global tally of such subsidies soared from $2 trillion to $7 trillion over the past two years, on the back of rising energy prices.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- EU to Propose Multi-Billion Euro Plan for Grid Investments

- Europe Has To Live With Unpredictable Natural Gas Prices

- European Natural Gas Prices Seesaw as Cold Snap Arrives