Despite months of rumors regarding a rebound in global oil demand, oil prices are decidedly range-bound at the moment as they await a major development to break through resistance.

Chart of the Week

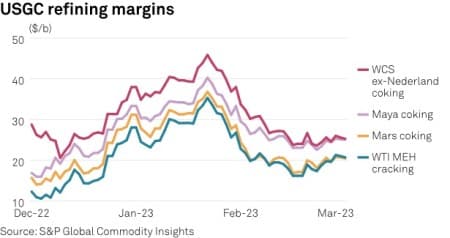

- The US downstream landscape remains hamstrung by widespread refinery maintenance that peaked in February at 1.5 million b/d of offline capacity, just as gasoline demand is set to pick up amidst the summer quality change.

- US gasoline prices have already shown a slight uptick and are expected to grow further as refiners need to replace cheap butane with more expensive reformates to meet hot-weather vapor pressure requirements.

- Most US refining majors aim to operate at 85-89% capacity this quarter, down from 94-97% in Q4 2022, as years of healthy margins forced them to postpone maintenance for as long as possible.

- US gasoline production has rebounded from its January lows and is now (9.7 million b/d) within touching distance of late 2022 levels, but this comes at the expense of diesel which remains 0.5 million b/d below December readings.

Market Movers

- US LNG firm New Fortress Energy (NYSE:NFE) will be moving its first Fast LNG unit to Mexico’s Altamira in June, so the commissioning of the 1.4mtpa liquefaction plant will happen in July.

- Carbonvert, the joint ventures of US oil companies Chevron (NYSE:CVX) and Talos Energy (NYSE:TALO), has tripled the size of the Bayou Bend carbon capture project to 1 billion metric tons.

- US natural gas producer Chesapeake Energy (NASDAQ:CHK) signed a 15-year LNG supply deal with Swiss commodity trader Gunvor for up to 2 million tons LNG per year, starting in 2027.

Tuesday, March 07, 2023

A string of oil events around the world has been providing a steady flow of sound bites about the prospects of 2023 demand, but there is still no indication that the current $80-$86 per barrel bandwidth for Brent oil is to undergo any changes. Chinese crude demand is still not where it was expected to be, the US might be in for a first stock build in 10 weeks, and Powell is set to testify before congress, all of which should amount to another week of choppy trading.

Oil and Gas Industry to Lead on Climate Change. The CEO of ADNOC and the new President of the COP 28 meeting Sultan al Jaber said the oil and gas industry ought to promote decarbonization of the global economy and lead on climate change issues, seeking to boost investments into the Global South.

Iran Hints at IAEA Nuclear Access. The visit of the UN nuclear watchdog to Tehran seems to have eased tensions as Iran appears to have agreed to rekindle some form of information sharing and coordination after the Middle Eastern country was found to have enriched uranium to 84%.

Chevron Eyes FLNG for Offshore Israel. Buoyed by a string of gas deliveries in the Eastern Mediterranean that followed its 2020 purchase of Noble Energy, US oil major Chevron (NYSE:CVX) is considering building an FSRU in offshore Israel to supply LNG into the European market.

UAE Disavows Reports of OPEC Departure. The United Arab Emirates indicated they have no plans to leave the OPEC+ alliance after a WSJ report that said Emirati officials are having an internal debate on the issue, following a series of clashes with Saudi Arabia.

Colombian Court Stops Presidential Takeover. Colombia’s highest administrative court halted an attempt by the country’s President Gustavo Petro to take control of the energy and gas commission (CREG), arguing it is Congress’ prerogative to regulate energy and water prices, not the President’s.

Philippines to Launch LNG Terminal Next Month. Philippines will commission their first ever LNG terminal by April, according to the country’s energy minister, with the 3mtpa capacity Vires FSRU operated in Batangas Bay expected to meet energy needs as domestic gas output declines.

Nigeria Pipeline Blast Hits Shell. An explosion on the Rumuekpe-Nkpoku Trunk Line in Nigeria’s Rivers State operated by Shell (LON:SHEL) killed at least 12 people and postponed indeterminately the restart of the Bonny Light export terminal that has been in force majeure since November 2022.

European Gas Storage Sites Are Well-Stocked. Gas inventories across the EU and the United Kingdom are 61% full as we are nearing the end of the 2022/23 winter season, and are expected to bottom out in late March at 617 TWh (or 55% of capacity) thanks to energy curbs and mild weather.

Oil Majors Line Up for Guyana Licensing. As the Guyanese government is set to offer 14 offshore blocks in its upcoming licensing round next month, international oil majors such as Shell (LON:SHEL), Chevron (NYSE:CVX), and Petrobras (NYSE:PBR) are rumored to be bidding into it.

Belgian Regulator Against Reactor Extensions. Belgium’s nuclear energy regulatory advised Brussels not to extend the lifespan of the country’s three oldest reactors in Doel and Tihange, with the 2025 nuclear exit goal triggering a risk of lacking electricity supply over the next two winters.

China Highlights the Importance of Coal. Still reliant on coal for more than 56% of its electricity generation, China’s economic planning agency NDRC stated it would promote further production growth in coal as more than 50 GW of new coal-fired capacity is being constructed.

Hedge Funds Sue LME Over Nickel Trades. Buoyed by Elliott Associates' $456 million litigation, the London Metal Exchange is facing another slew of lawsuits from at least 10 hedge funds and asset managers for its March 2022 suspension of nickel trading, allegedly violating the Human Rights Act.

Oil Bonanza Looming Amidst Another Namibian Oil Find. Project partners Shell (LON:SHEL) and QatarEnergy discovered another commercial oil play in Namibia’s offshore zone some 270 km from the coast, with the Jonker-1X well hitting a light oil deposit in water depths of 2,200m.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Shell Is Reviewing Its Plan To Reduce Oil Production This Decade

- Equipment Failure Disrupts UK Natural Gas Exports To Europe

- Rare Earth Elements: What They Are And Why They Matter