The latest surge in gasoline prices at the pump, something we detailed last week (read: here), could begin to impact the Biden administration's reelection outlook unless the White House unleashes market interventions to arrest surging prices and prevent the national average cost of gas from breaching the critical level of $4/gallon.

Let's begin with hedge fund positioning: These traders have pushed their bullish bets on gasoline futures in New York to the highest level in four years. New data from the Commodities Futures Trading Commission shows money managers raised net-long gasoline positions by 2,508 to 9,734, the highest level since March 2020.

Gasoline futures in New York have soared 36% since early December, reaching a seven-month high in recent sessions.

And given the 1-2 wek lag, that is a problem for pump-prices...

In a recent note to clients, Rapidan Energy Advisors explained how surging gas prices could complicate the outlook for the Biden administration:

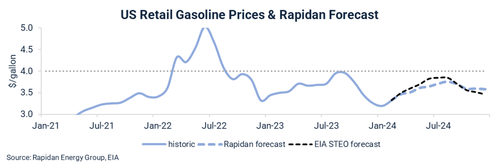

"Low US gasoline inventories underpin our forecast for $3.70/gal average US pump prices this summer – below the politically sensitive $4.00/gal threshold, but not by much.

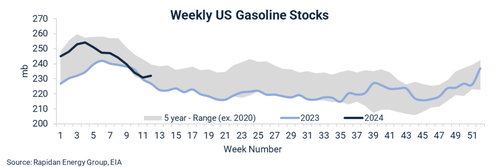

The US is approaching April with gasoline inventories at 232 mb – the low end of the recent five-year range and roughly in line with 2023 levels (see chart).

This and other factors in our new Refined Products Module (RPM) underpin our forecast for $3.70/gal US average gasoline prices in 3Q24 – a critical period for US politicians looking to get reelected in November."

Rapidan pointed out:

"Washington and state capitals will consider market interventions (i.e., SPR draws, export limitations, gas tax holidays) if voter anger over high pump prices begins to boil."

They added:

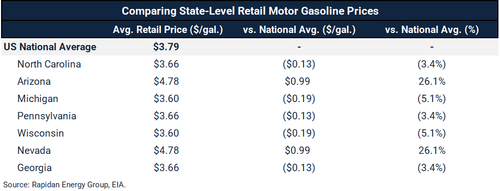

"Two swing states, Arizona and Nevada, typically have pump prices ~20% higher than the national average. Our forecast for $3.70/gal national average gasoline in 3Q24 would put retail prices above $4.50/gal in those states. Other swing states should have pump prices below $4.00/gal – good news for incumbents – but the margin for comfort is small, and any supply disruption this summer could send gasoline prices higher."

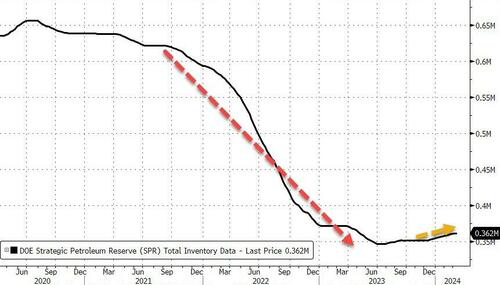

The anticipation of additional market interventions by the White House to arrest fuel prices this summer and before the November elections comes as the administration is trying to refill the nation's Strategic Petroleum Reserves after releasing a record amount to control last year's summertime gas price spike.

Meanwhile, Ukrainian drone attacks are taking out critical Russian refineries, boosting the prospect of tighter global supplies of refined crude products. Traders are also spooked that Iran-backed Houthis could be several steps away from targeting Saudi refineries. We penned this in a note titled "Dominoes Falling As Biden Admin Deals With Twin Energy Crisis In Russia, Middle East."

By Zerohedge.com

More Top Reads From Oilprice.com:

- Exxon and CNOOC Team Up To Challenge Chevron’s Guyana Oil Deal

- Baltimore Port Closure Threatens U.S. Coal Exports

- Brent Closes in on $90 as Geopolitical Risk Climbs