Houthi missile attacks on tankers transiting the Red Sea and the Bab-el-Mandeb strait have lifted oil prices, allowing OPEC+ heavyweights such as Saudi Arabia or the United Arab Emirates to save face after the most recent meeting of the oil group actually prompted another sell-off rather than persuading the oil markets that Riyadh, Moscow and the others could manage the pitfalls of declining demand. However, even with Dubai moving back to the $80 per barrel mark, sentiment has been weak across the Asian market, aggravated by China’s unsettling silence on new import quotas. The Dubai futures contract moved into contango this month, for the first time in three years, with spot-traded medium sour grades across the Middle East continuing their decline amidst increasing availability and slackening demand.

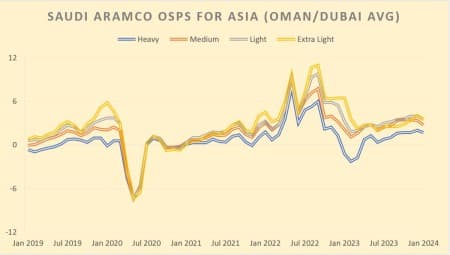

Chart 1. Saudi Aramco’s Official Selling Prices for Asian Cargoes (vs Oman/Dubai average). Source: Saudi Aramco.

The flattening backwardation curve in the Dubai futures contract, with November dropping a hefty $1.11 per barrel compared to the October average, has set the Asian stage for a sizable formula price cut from the likes of Saudi Aramco. Despite some marginal improvements in Asian refinery margins, coming from a slight uptick in gasoline and HSFO cracks, Asia’s refinery majors widely expected Saudi Arabia to cut its OSPs into January 2024. The Saudi national oil company Saudi Aramco did so, albeit somewhat reluctantly, lowering Asia-bound prices by $0.30-0.60 per barrel, with Arab Medium seeing the largest m/m drop and Arab Heavy the lowest. This is much less than what the market expected, subsequently reflected in Chinese refiners nominating less into the upcoming month than they usually do. We will see if weaker Chinese demand is a reflection of seasonal maintenance or generally weaker margins when refining relatively expensive Saudi barrels, however, crude differentials of other medium sours in Asia have been falling much more steeply than Aramco’s formula pricing. Related: Petrobras Returns to Africa with Shell Asset Acquisition

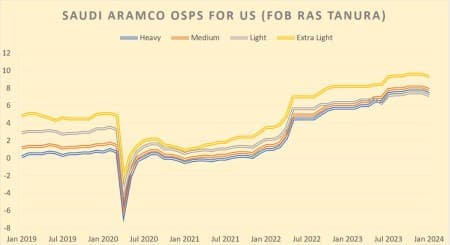

Chart 2. Formula prices of Saudi cargoes bound for the United States by selected grades (vs ASCI). Source: Saudi Aramco.

Asia remains the key export market for Saudi Aramco, especially on the heels of Red Sea shipping disruptions potentially weakening the viability of exports into Europe. For European customers, Saudi Aramco dropped its January OSPs by a whopping $2.00 per barrel across the board, bringing the heavy sour Arab Heavy to a discount to ICE Brent for the first time since June 2023. The Saudi benchmark grade Arab Light is now priced at a $2.40 and $2.90 per barrel premium to ICE Bwave into the Mediterranean and Northwest Europe, respectively, so for the first time in many months it actually feels as if it’s competitively priced. Saudi Aramco has also changed policy on US-bound cargoes, cutting all grades by a uniform $0.30 per barrel, marking the first time that the likes of Arab Medium or Arab Heavy were cut since October 2021. In the 26 months that followed Aramco always hiked or rolled over, whatever the circumstance. A more constructive pricing approach from Saudi Arabia might reflect improving export economics into the US as Motiva started taking in more Saudi barrels recently.

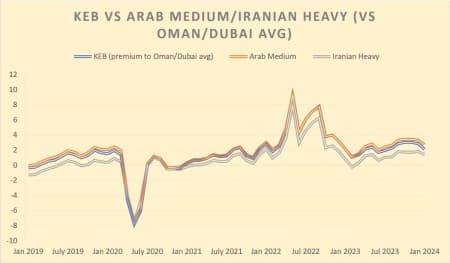

Chart 3. Kuwait Export Crude official selling prices into Asia, compared with Arab Medium and Iran Heavy (vs Oman/Dubai average). Source: KPC.

The emirate of Kuwait moved into a new phase after Sheikh Nawaf al-Sabah passed away on 16 December, replaced by the 83-year-old Crown Prince Mishal and triggering another full government resignation. Against the backdrop of this, Kuwait’s national oil company KPC cut the formula price of its flagship Kuwait Export Blend crude by $0.75 per barrel, more than Saudi Aramco did with Arab Medium’s 60-cent-per-barrel drop, bringing the OSP to a $2.10 per barrel premium against the Oman/Dubai average. This marks the widest spread between Kuwait Export grade and Arab Medium, ticking in at -$0.65 per barrel this January, in seven years, reflecting a gradually diverging path between KPC and Saudi Aramco in terms of their pricing strategies.

Meanwhile, the troubled 615,000 b/d Al Zour refinery that has experienced a string of disruptions and dysfunctions throughout this year has now officially reached completion, with the third and final unit of the refinery running full steam and seemingly nothing standing in Kuwait’s way to fully exploit its expanding downstream capacity. The 454,000 b/d Mina Abdullah refinery caught fire in December, however, so the Asian market should expect more product exports from Kuwait only in 2024.

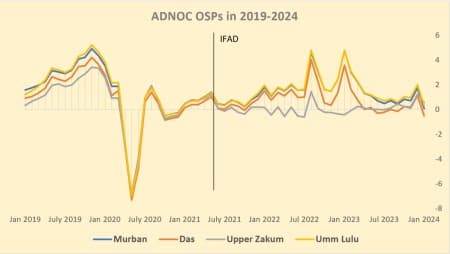

Chart 4. ADNOC Official Selling Prices for 2017-2024 (set outright, here vs Dubai). Source: ADNOC.

For the United Arab Emirates, the upcoming refinery maintenance programme at the 817,000 b/d Ruwais refinery will mark a new beginning. The country’s arguably main export grade Murban, the only ADNOC-marketed crude grade that has its own exchange-traded futures contract, will be gradually moved away from domestic refining and exported externally, whilst Ruwais would run more on medium sour grades such as Upper Zakum. Abu Dhabi’s state-owned oil company ADNOC has already modified its export plans; from now on Murban exports should be coming in above the 1.6 million b/d mark, however perhaps regrettably to the UAE, the markets have noticed these changes as well.

Murban has been trading at a premium to Dubai for a long time, however the November spread between the two futures contracts was only marginally above zero, the narrowest spread since the IFAD contract was launched. Setting the January price of Murban at $83.32 per barrel, down from $91.00 per barrel in December, ADNOC has simultaneously lifted the medium sour Upper Zakum by an entire dollar, so that in the first month of 2024 Upper Zakum will be sold at a $0.50 per barrel premium to Murban, for the first time since February 2021.

Chart 5. Iraqi Official Selling Prices for Asia-bound cargoes (vs Oman/Dubai). Source: SOMO.

Nine long months have passed since the Ceyhan-Kirkuk pipeline was halted and crude production from Iraq’s semi-autonomous Kurdistan region was cut off from export markets, however, even as we move into 2024 there is still only vague hope things will turn for the better anytime soon. The Iraqi Prime Minister Mohammed Shia al-Sudani has shown some willingness to accommodate the concerns of upstream firms operating in Kurdistan, saying that Baghdad would need to tweak its federal budget law as fields in Iraq proper have a breakeven cost of $8 per barrel whilst ones in Kurdistan are almost triple that level, however there is still no guarantee this would actually happen. Moreover, the Kurdish authorities claim that the well-cost of producing is higher than that, around $30-35 per barrel, so Erbil and Baghdad most probably still need to iron out differences before a comprehensive deal can be reached.

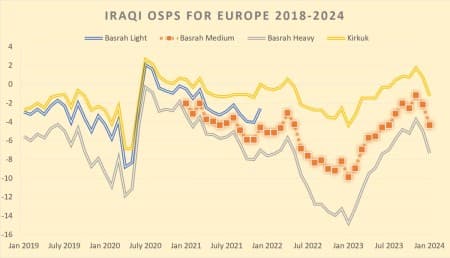

Chart 6. Iraqi official selling prices in Europe (vs Dated Brent). Source: SOMO.

When it comes to pricing, Iraq’s state oil marketing company SOMO cut the Asian formula price of its medium sour grade Basrah Medium by $0.80 per barrel compared to December, lowering the overall premium against the Oman/Dubai average to $1.00 per barrel. This is more than any Saudi grade for the same months, widening the gap between Iraqi and Saudi pricing again, just as things have started to feel weaker on the physical side. Also, at that level Basrah Medium is a whopping $0.70 per barrel cheaper than Arab Heavy and $1.75 per barrel cheaper than Arab Medium, which should incentivize Indian refiners to maximize their Iraqi purchases into Q1. Similarly to all Middle Eastern exporters, SOMO’s European pricing has witnessed another hefty cut with Basrah Medium and Basrah Heavy down by $2.20 and $2.40 per barrel, respectively. Given the roughly $3 per barrel freight cost of sending a tanker from Basrah to the Mediterranean, the -$4.35 per barrel discount of Basrah Medium vs Dated Brent seems like a big arbitrage opportunity opening up for European refiners, just as Johan Sverdrup’s been fully sold out and strengthened to Brent parity in recent weeks.

Chart 7. Iranian Official Selling Prices for Asia-bound cargoes (vs Oman/Dubai average). Source: NIOC.

Notoriously late to publish its official selling prices, Iran’s national oil company NIOC overdid itself this time around and only issued the January 2024 OSPs after Christmas. The formula prices are largely irrelevant as Chinese customers generally buy their cargoes much cheaper (currently it is rumoured that Iranian differentials have strengthened to -$6/-$7 per barrel to Dubai), however NIOC wished to externalize an image of strength by only cutting $0.40 per barrel from its Asian prices, putting Iran Light at a $3.60 per barrel premium over Oman/Dubai. Even though the spectre of more sanctions is haunting the longer-term export outlook of Iran, the country’s exports to China have seen a notable rebound in November (Kpler seems to suggest exports went up to 1.5 million b/d, the second highest pace of exports in the post-sanctions period).

Crude exports could get even higher as Tehran is apparently nearing in on an oil supply deal to Syria’s 110,000 b/d Homs refinery that Iran’s state-owned refining company NIORDC is seeking to rebuild. As Iran already supplies oil to the coastal 130,000 b/d Baniyas refinery, a full-scale ramp-up in Syrian refining could lift Iranian exports to the Levant country to some 200,000 b/d, creating a new export outlet to ease Tehran’s dependence on China.

By Gerald Jansen for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Shale Growth Could Exceed Forecasts in 2024

- New U.S. Oil Field Developments Are A Sign Of Things To Come For Saudi Arabia

- Two Elections that Will Impact Energy and Geopolitics in 2024

then the wti spread will be 12 bucks.

do you think American traders will accept that and the oil producers