The rapid spread of the Omicron variant has been spooking the oil community at large and despite OPEC shrugging off any major demand disruption in its short-term forecasts, it remains the large downside risk factor today. This being said, the sentiment is not evenly spread out across continents, in fact, Asia looks much more robust, both in terms of its refinery runs and its overall buying activity, than most of the Atlantic Basin. The oft-mooted return of China looms large over this mood discrepancy, after all, Beijing has softened its electricity mandates, ramped up coal production, drew down its insane crude inventories, being seemingly ready for potential cold snaps coming up. It is against this background that Middle Eastern national oil companies have set their pricing for cargoes loading in January 2022.

Chart 1. Saudi Aramco Official Selling Prices for Asia vs Oman/Dubai Average (USD per barrel).

Source: Saudi Aramco.

Having decided to maintain the 400,000 b/d monthly increments despite demand concerns, Saudi Aramco set the pricing stage by hiking Asia-bound prices by 30-80 cents per barrel. Technically, the decision was well-grounded in past practice – most often than not the Saudis base their pricing on month-on-month changes in the Dubai backwardation between the front-month and M3, a metric that averaged $1.10 per barrel last month. In a peculiar twist of events, it was the heaviest grades that saw the biggest month-on-month improvement, with the Saudi NOC boosting Arab Heavy to an unprecedented $1.80 per barrel premium over the Oman/Dubai average, despite residue cracks performing quite weakly in November-December. Fearing Omicron, Saudi Aramco could have cut prices and most analysts would not blink an eye, however, the Saudi NOC doubled down on the strength of the Asian market.

Chart 2. Saudi Aramco Official Selling Prices for Asia vs ICE Bwave (USD per barrel).

Source: Saudi Aramco.

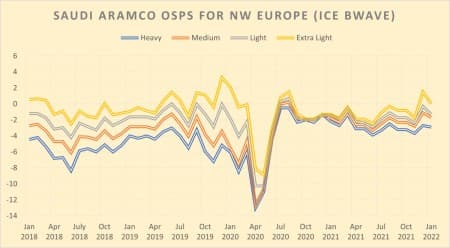

The price increases to Asia were not replicated in the cases of NW Europe and the Mediterranean. Saudi Aramco dropped European prices by $0.2-1.5 per barrel, once again with heavy grades (i.e. Arab Heavy) seeing the lowest month-on-month change, arguably because in case of market shocks sophisticated refiners would prefer to buy the heaviest barrels. Having said this, one ought to note that there were no Arab Heavy departures towards Europe in November and most probably will not be this month, too. When it comes to the United States, Saudi Aramco hiked its January 2022 OSPs by $0.4-0.6 per barrel to hit the highest levels since March 2020. This means that after the weakest month in terms of US-bound crude exports – November averaged a mere 210,000 b/d - Saudi outflows will most probably remained subdued over the upcoming months. Related: U.S. Oil Rig Count Jumps Along With Crude Prices

Chart 3. Iranian Light vs Arab Light in 2018-2022 (USD per barrel, vs Oman/Dubai average).

Source: NIOC, Saudi Aramco.

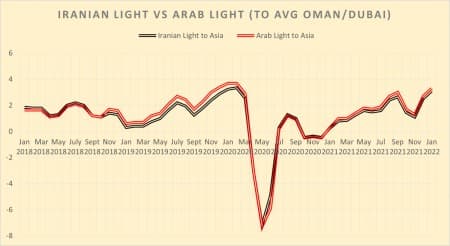

Meanwhile, the seventh round of negotiations on Iran’s nuclear talks have been underway in Vienna, with some early success stories. On the back of what seems to be a Russia-sponsored measure, Iran has restarted its surveillance cameras at its Karaj centrifuge facility, which, coupled with a draft wording of a potential JCPOA restoration agreement, have sparked hopes that a deal might not be that far away overall. Whilst most of international focus goes towards the nuclear talks, Iranian crude exports have been enjoying a period of stability. After the Chinese government allocated private refiners their third and fourth batches of import quotas in early October, teapots have ramped up buying of Iranian barrels, driving the total volume of crude imported in November to 650,000 b/d.

Chart 4. Middle Eastern Medium Sour Grades in 2021-2022 (USD per barrel).

Source: SOMO, NIOC, Saudi Aramco.

The active buying of Iranian crude is somewhat at odds with official Chinese customs statistics which indicate that there have been no imports from the Middle Eastern country over the past year. Even though many of these deals were concluded on a spot basis and did not follow the official OSPs, NIOC nevertheless kept in line with the Saudi-dictated pricing strategy and lifted Asia-bound prices by 60-80 cents per barrel. Corresponding to the Saudi moves, the lightest grade – Iranian Light – saw the lowest month-on-month increase to a $3.10 per barrel premium to the Oman/Dubai average. Europe-bound OSPs were decreased in line with Saudi Aramco, with NW Europe (a rare buyer of Iranian cargoes even in non-sanctionable times) witnessing cuts going beyond $1 per barrel.

Chart 5. Iraqi Official Selling Prices for United States in 2018-2022 (USD per barrel, vs ASCI).

Source: SOMO.

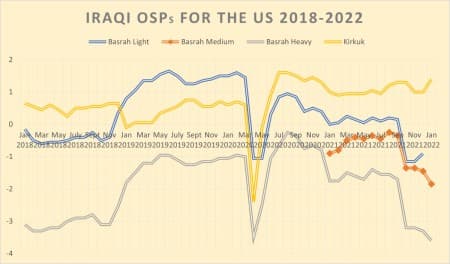

The January 2022 OSPs of Iraqi state oil marketer SOMO felt incomplete as next month will be the first not to have Basrah Light quotes, as we have signaled here previously Baghdad discontinued the practice, seeking to use the grade primarily as source for domestic refining. Having hiked Basrah Medium and Basrah Heavy by $0.5 and $0.6 per barrel, respectively, SOMO was fairly in line with Saudi Aramco’s pricing, though there are some nuances to point out. Basrah Heavy is even heavier than Arab Heavy, i.e. whoever might be seeking a residue-heavy yield to run through secondary units would be fairly satisfied, yet its month-on-month change was 20 cents per barrel lower compared to the Saudi grade and is far from reaching any all-time high (as in the case of the latter). Its relative cheapness might put Basrah Heavy, a long-time favourite of complex Indian refiners, at a competitive advantage to heavy Saudi barrels.

Chart 6. Iraqi Official Selling Prices for Europe in 2018-2022 (USD per barrel, vs Dated BFO).

Source: SOMO.

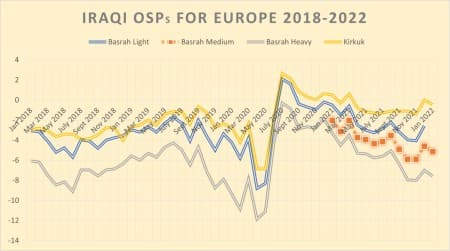

Iraqi crude exports overall have reached their highest level in the post-pandemic times, reaching 3.25 million b/d in November. Whilst outflows to the United States have largely stagnated over the past months and exports to Europe slid down to just a little more than 300,000 b/d, it was in Asia that most of demand for Iraqi barrels came from, moving to a total of 2.5 million b/d. With this in mind, Iraqi official selling prices for Europe are once again better-positioned in their face-off with Saudi pricing. The thing is that by dropping Basrah Medium by 55 cents per barrel and Basrah Heavy by 60 cents per barrel from December 2021 OSPs, Iraq has more or less mirrored Aramco yet the reference price to which its official selling prices are pegged did change – SOMO prices are based on Dated Brent, whilst Saudi Aramco is linked to ICE Bwave, meaning that Brent increasingly flirting with contango might become a new positive reality for SOMO.

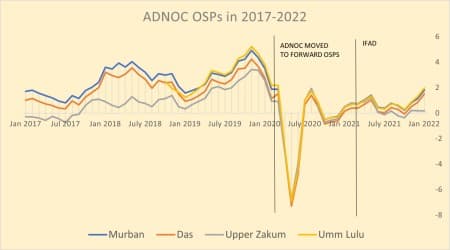

Chart 7. ADNOC Official Selling Prices in 2017-2022 (USD per barrel, set vs IFAD Murban).

Source: ADNOC.

Traditionally, the Emirati state oil company ADNOC set its January 2022 OSPs based on the monthly average of daily Singapore marker prices for its IFAD Murban futures contract, at $82.03 per barrel. One of the somewhat unexpected consequences of the Black Friday price tumble was that Murban quotes turned out to be the most resilient vis-à-vis market turbulence, rising to a premium over ICE Brent, a state they remain at the time of writing, too. This is most probably the reason behind Upper Zakum dropping once again vs Murban, with its differential to the Emirati benchmark cut by 70 cents per barrel to a -$1.65 per barrel discount, the widest it has been in years.

By Gerald Jansen for Oilprice.com

More Top Reads From Oilprice.com:

- Cities Around The World Are Trying To Cut Out Natural Gas

- Tight U.S. Oil Inventories Prop Up Oil Prices

- Are Oil Markets Already Oversupplied?