Why the IEA is Wrong About Peak Oil Demand

The International Energy Agency (IEA)…

Oil Demand Likely To Surprise To The Upside

Commodity analysts at Standard Chartered…

API Surprises With Crude Build, Gasoline Draw

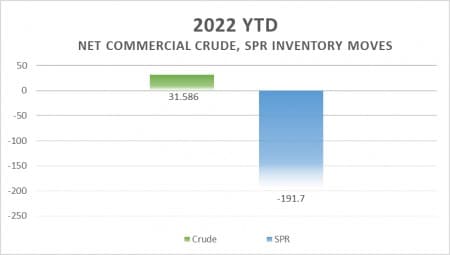

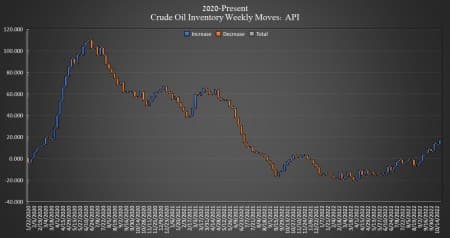

The American Petroleum Institute (API) reported a build this week for crude oil of 4.520 million barrels. U.S. crude inventories have grown by roughly 32 million barrels so far this year, according to API data, while the U.S. Strategic Petroleum Reserves fell by six times that figure, at 192 million barrels.

The build in crude oil inventories includes the Department of Energy’s release of 3.4 million barrels from the Strategic Petroleum Reserves in the week ending October 21, leaving the SPR with 401.7 million barrels.

In the week prior, the API reported a draw in crude oil inventories of 1.27 million barrels.

WTI rose on Tuesday on the weaker dollar. At 12:12 p.m. ET, WTI was trading up $054 (+0.64%) on the day at $85.12 per barrel. This is an increase of roughly $2 per barrel from the prior week as OPEC+ and the United States ready for an oil battle of production cuts and SPR releases. Brent crude was trading up $0.16 (+0.17%) on the day at $93.42—an increase of more than $3 on the week.

U.S. crude oil production has remained flat for months. For the week ending October 14, U.S. crude oil production rose slightly to 12 million bpd, according to the latest weekly EIA data, within the same 11.9-12.1 million bpd range it has been in since the beginning of summer. At 12 million bpd, U.S. crude production is just a 300,000 bpd rise from the levels seen at the start of the year, and still a 1.1 million bpd shortfall from the levels seen at the start of the pandemic.

The API reported a draw in gasoline inventories this week of 2.278 million barrels for the week ending October 21, compared to the previous week’s 2.17 million-barrel draw.

Distillate stocks also saw a build this week of 635,000 barrels, compared to last week’s 1.09-million-barrel decrease.

Cushing inventories rose 740,000 barrels in the week to October 21. In the week prior, the API saw a small Cushing increase of 89,000 barrels.

ADVERTISEMENT

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Tanker Market In Disarray As EU Ban On Russian Crude Nears

- Colombia Is On The Brink Of An Energy Crisis

- Saudi Minister Says Sour Relations With The U.S. Will Improve

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B