Breaking News:

The West Aims to Rebuild Influence in Middle East Energy Hub with LNG Deals

The last few days have…

China's Rare Earths Strategy, Explained

China's recent discovery of new…

ECB Rate-Cut Expectations Soar After EU Inflation Cools More Than Expected

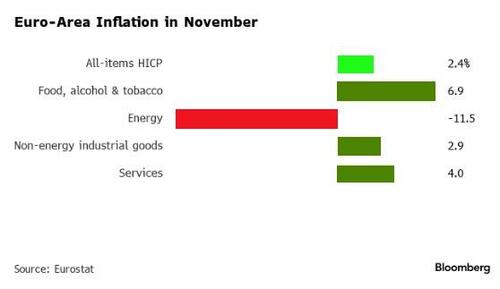

Following cooler than expected CPI from Germany and Spain yesterday, the aggregate euro-zone inflation cooled more than expected this morning with headline CPI tumbling from +2.9% in October to +2.4% in November. Core CPI - that excludes volatile components including fuel and food - also moderated for a fourth month, to 3.6%.

Source: Bloomberg

The decline in inflation was dominated by Energy deflation...

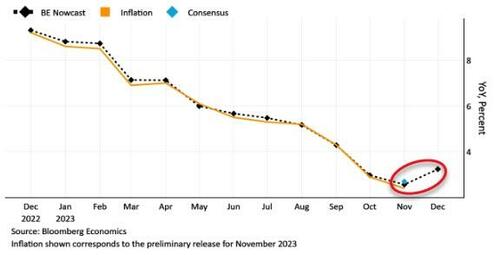

And inflation is slowing across all of Europe...

However, inflation is likely to tick higher before returning to target due to statistical effects and the wind-down of measures deployed last year by governments to offset soaring energy prices.

President Christine Lagarde has warned price gains may quicken “slightly” in the coming months and Bloomberg Economics’ Nowcast for December points to a reading of 3.2%.

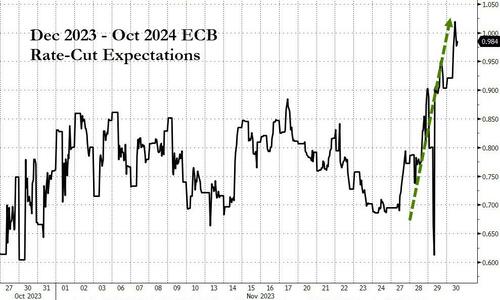

And this has raised expectations for ECB rate-cuts next year, bringing forward expectations for the first cut from May to April...

Source: Bloomberg

Additionally, markets are betting on four quarter-point reductions in 2024 - up from three last week - and are assigning a 70% chance of a fifth, which would bring the deposit rate back to 2.75% from a record 4% currently.

ECB officials are adamant, however, that monetary policy must remain tight to ensure inflation makes it all the way back to 2%.

By Zerohedge.com

More Top Reads From Oilprice.com:

- OPEC to Host “Special Pavilion” at COP28

- Consumer Reports: EVs Are Less Reliable Than Gasoline Cars

- Rumors of Venezuela Invasion Plans Put Oil-Rich Guyana on Edge

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

-

Sure looks like "beggar thy neighbor" to me now *WELL* underway between China moving to the zero bound, Japan never having left that and Russia *LOSING* big time with the USA *STILL* set upon nuking the US Dollar to ahem "tax inflation" ahem.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B