Breaking News:

How to Prepare Your Portfolio for a Harris Victory

From an historical perspective, it’s…

Turkey Willing To Boost EU Gas Exports If Bloc Guarantees Demand

Turkey has said it is…

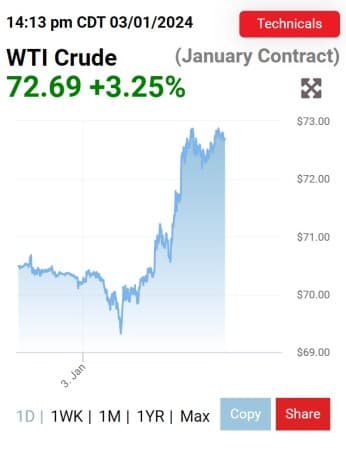

Oil Gains Over 3% On Libya, OPEC and Middle East Escalation

Crude oil prices rose more than 3% Wednesday driven by escalating tensions in the Middle East, an OPEC pledge of unity and the shut-in of Libya’s biggest oilfield over protests.

At 14:13 p.m. ET on Wednesday, Brent crude was trading up 3.07% at $78.22, while West Texas Intermediate (WTI) was trading up 3.25% at $72.69.

Up until now, weak fundamentals had been counterbalancing any impact on oil prices from escalating tensions in the MIddle East.

“We haven’t seen prices react much in part because fundamentals are softer for crude right now,” Amrita Sen, founder and director of research at Energy Aspects, told CNBC on Wednesday. “We’ve seen some inventory builds toward year end and that’s why the market just isn’t sensitive to this.”

On Wednesday, Yemen’s Houthis claimed another attack on a merchant vessel in the Red Sea, though the French shipping giant that had chartered the container ship in question said it had not suffered any incident, CNBC reported. On Tuesday, Danish shipping giant Maersk said it was once again refraining from any Red Sea shipping despite a U.S.-led international coalition for protection.

Also on Wednesday, OPEC+ announced it would hold a Joint Ministerial Monitoring Committee (JMMC) meeting on February 1, stressing in a statement that the expanded cartel was unified and cooperation would continue in the wake of Angola’s exit from the group.

More protests in Libya that have led to the shutdown of the Sharara oilfield, the country’s largest, are also putting upward pressure on oil prices. Protesters are demanding better public service and development in southern Libya.

The Sharara field has a 300,000 barrel-per-day capacity and has been the target of protests in the past, most recently in July this year. Libya is currently producing around 1.2 million bpd and is targeting a ramp-up to 2 million bpd by 2030.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Argentina’s New President Is Looking To Shake Up Its Oil Industry

- The 11 States Leading America’s Oil Production Boom

- What Will Influence Oil Prices in 2024?

Tom Kool

Tom majored in International Business at Amsterdam’s Higher School of Economics, he is Oilprice.com's Head of Operations

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B