Breaking News:

Oil Moves Higher on Crude, Fuel Inventory Draw

Crude oil prices ticked higher…

How the U.S. Presidential Election Could Influence Precious Metals Prices

Precious metals prices are expected…

Oil Markets Shocked By Across the Board Inventory Builds

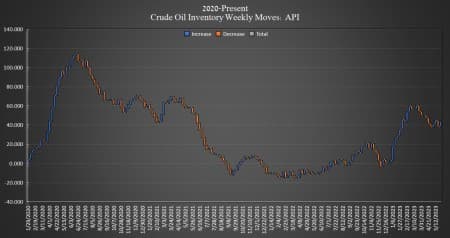

Crude oil inventories in the United rose this week by 5.202 million barrels, the American Petroleum Institute (API) data showed on Wednesday, with analysts expecting a 1.22 million barrel dip. The rise in crude oil inventories doesn’t fully offset the 6+ million barrel drop last week.

The total number of barrels of crude oil gained so far this year is just over 40 million barrels.

This week, SPR inventory dropped for the ninth week in a row as another 2.6 million barrels of congressionally mandated crude oil was sold during the week ending May 26. There are now 355.4 million barrels—the lowest amount of crude oil in the SPR since September 1983.

U.S. crude oil production rose during the week ending May 19, to 12.3 million bpd. U.S. production is now 800,000 bpd lower than the peak production seen in March 2020, but 400,000 bpd higher than this time last year.

The price of WTI and Brent were both trading up on Tuesday in the run-up to the data release.

By 4:14 p.m. EST, WTI was trading down $1.62 (-2.33%) on the day at $67.84 per barrel, and down roughly $5 per barrel week over week. Brent crude was trading down $0.88 (-1.20%) on the day at $72.66 —down roughly $4 per barrel from this time last week.

WTI was trading at $68.06 shortly after the data release.

Gasoline inventories rose 1.891 million barrels after falling in the week prior by 6.398 million barrels. Distillate inventories rose 1.849 million barrels after decreasing by 1.771 barrels in the week prior.

Inventories at Cushing, Oklahoma, rose by 1.777 million barrels—after rising by 1.711 million barrels last week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Slip As Fears Of A U.S. Default Return

- European Natural Gas Prices Fall On Weak Global Demand

- Three New China-Russia-Iran and Iraq Agreements Confirm The New Oil Market Order

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B