Breaking News:

How to Prepare Your Portfolio for a Harris Victory

From an historical perspective, it’s…

Solar Surplus: California's Renewable Energy Dilemma

California's excess solar power production,…

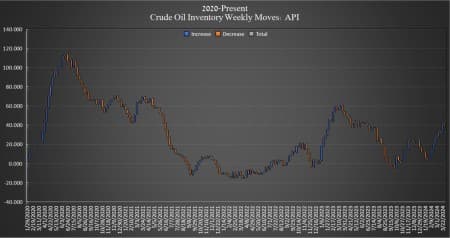

Oil Rally Extends As API Reports Draws Across the Board

Crude oil inventories in the United States fell this week by 2.286 million barrels for the week ending March 29, according to The American Petroleum Institute (API). Analysts had expected an inventory draw of 2 million barrels.

This comes after the API reported a staggering 9.337-million-barrel jump in crude inventories in the week prior.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by another 0.6 million barrels as of March 29. Inventories are now at 363.6 million barrels—the highest point since last April.

Oil prices were trading up ahead of the API data release on Tuesday as the market tries to anticipate this week’s OPEC+ decision on output cuts as well as geopolitical tensions in the Middle East and Ukrainian refinery strikes in Russia.

At 2:21 pm ET, Brent crude was trading up 1.64% on the day at $88.85, up roughly $2.80 per barrel compared to this time last week. The U.S. benchmark WTI was also trading up on the day by 1.62% at $85.07, up roughly $3.50 per barrel compared to last Tuesday.

Meanwhile, gasoline inventories also fell this week, by 1.416 million barrels, on top of the 4.437 million barrel draw in the week prior. As of last week, gasoline inventories were about 1% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories also fell this week, by 2.548 million barrels, compared to last week’s 531,000 barrel gain. Distillates were 6% below the five-year average for the week ending March 22, the latest EIA data shows.

Cushing inventories rounded out the losses this week, falling 781,000 barrels after climbing by 2.392 million barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Drilling Activity Slips Again

- Who Is Behind Iran-Backed Houthi Threats To Attack Saudi Arabia?

- Reuters Survey Shows OPEC Output Reduced in March

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B