Breaking News:

Canada Looks to Challenge China’s Rare Earth Dominance

Canada secures rare earth minerals…

Kyrgyz Parliament Lifts Ban on Uranium Mining

Kyrgyzstan's parliament has approved the…

Rongsheng Becomes Next Chinese Refiner to Buy Trans Mountain Oil

Rongsheng Petrochemical has become the latest refiner in China to have purchased crude oil delivered to Canada’s Pacific coast via the expanded Trans Mountain oil pipeline.

Rongsheng Petrochemical has bought its first-ever crude cargo via the Trans Mountain Expansion Project, which entered into service in early May, through a tender from TotalEnergies, Reuters reported on Monday, citing trade sources.

Traders and market analysts are closely watching Asia’s appetite for Canadian crude, as the Trans Mountain Expansion Project (TMX) gives Canadian producers an outlet on the Asian markets and on the U.S. West Coast.

The expanded Trans Mountain pipeline is tripling the capacity of the original pipeline to 890,000 barrels per day (bpd) from 300,000 bpd to carry crude from Alberta’s oil sands to British Columbia on the Pacific Coast.

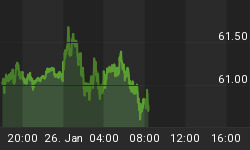

The rise in pipeline egress is set to boost the price of Western Canada Select (WCS), the benchmark for Canadian heavy crude sold at Hardisty in Alberta, as it will narrow the discount at which WCS has traded in recent years relative to the U.S. crude oil benchmark, West Texas Intermediate (WTI).

The expanded pipeline is set to boost the price of Canada’s heavy crude oil for years to come, top executives at the major energy firms say.

Last month, Scott Stauth, president of Canadian Natural Resources, the top oil and gas producer in Canada, told analysts that the company had secured some marine sales from TMX. Some of the sales “may end up going marine side still onto the West Coast, or it could move to Asian markets,” Stauth added.

In Asia, Sinochem bought a cargo of crude via TMX as early as in March. Sinopec and PetroChina have also acquired cargoes for shipment to China, while India’s Reliance Industries is also reportedly awaiting a cargo for delivery in July.

ADVERTISEMENT

While TMX provides more Canadian crude to Asia, not all of that crude can be processed at all Chinese refineries due to its high density and sulfur and acid content, traders told Reuters.

By Charles Kennedy for Oilprice.com

More Top Reads From Oilprice.com:

- OPEC Resolves Compensation Plans for Overproducing Members

- The Pipeline Project Preparing for Canada’s Largest Ever Corporate Bond Deal

- 76% of Small Offshore Oil Companies at Risk

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B