Oil Prices Move Higher After a Volatile Week

After a volatile week, oil…

Japanese Yen Surges in Apparent Currency Intervention

The Japanese Yen experienced a…

The 13 U.S. States That Raised Gasoline Taxes For 2023

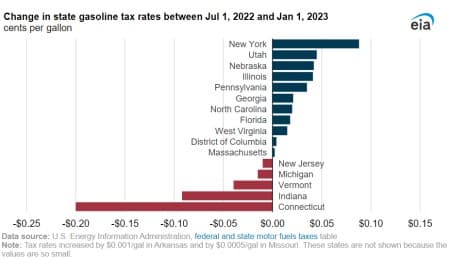

More than a dozen U.S. states raised gasoline taxes in the second half of 2022 and in 2023, and many states ended their fuel-tax holidays that were introduced in 2022 as a way of reducing the retail prices of gasoline.

Gasoline and diesel taxes, which are applied at the wholesale level, were increased in 13 states between July 2022 and January 1st, 2023, the U.S. Energy Information Administration (EIA) said on Thursday.

Since July 2022, these taxes increased the most in New York State, rising by $0.088 per gallon for both gasoline and diesel, according to the EIA’s federal and state motor fuels taxes data.

Illinois surpassed California as the state with the highest taxes—with $0.674/gal—while Connecticut temporarily surpassed Alaska as the state with the lowest gasoline taxes ($0.05/gal), although that low tax rate will gradually increase through May 2023.

Several states also increased their fuel tax rates in January this year, while many states ended the fuel-tax holidays from 2022 when gasoline and diesel prices hit record highs in the early summer.

For example, taxes in New York State for both diesel and gasoline rose $0.088/gal in January 2023 compared with July 2022. Other states, including Florida, Georgia, and Maryland, will also end their suspensions of at least some part of their taxes on motor fuels this year, the EIA said.

As of Wednesday, the national average price of gasoline was holding relatively steady at $3.38/gal, flat from a week ago, Patrick De Haan, head of petroleum analysis at GasBuddy, said. Diesel prices are dropping and were at $4.45/gal on Wednesday, the lowest level since March 4, 2022, De Haan added.

ADVERTISEMENT

In a Monday note, GasBuddy said that the national average price for a gallon of gasoline in the United States appeared to be holding steady, but consumers in the West saw hikes, and prices across the country may rise next month.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Is This Shale Giant A Buy After Earnings Miss?

- Top 5 Best Oil Stock Performers And 5 Worst Performers

- Attacks On The U.S. Power Grid Are Surging

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B