Breaking News:

U.S. Commands Higher Prices for Crude Amid Growing Global Oil Market Influence

Increased domestic offtake capacity and…

U.S. Hits Record High Electricity Generation From Natural Gas

Record-breaking natural gas demand for…

UK Debt Rates Surge As Pound Plunges Against The Dollar

Rates on UK debt surged higher today and the pound trailed the US dollar again driven by investors sweating over the government’s tax and borrowing splurge.

The yield on the 30-year UK gilt jumped six basis points to 5.048 percent, the highest since 1998.

Investors were demanding a greater return ahead of the government today selling a tranche of long-dated debt.

The pound slid 0.4 percent against the US dollar to hover around the lowest level in 37 years, but is above the record low of nearly $1.03 it hit at the beginning of the week.

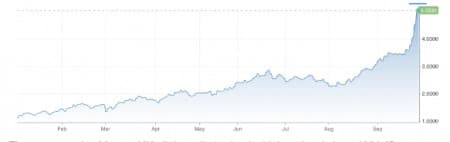

Yield on 30-year UK gilt

The return on the 30-year UK gilt has climbed to its highest level since 1998 (Source: CNBC)

The pound is down over 20 percent against the greenback this year and around six percent against the euro.

Traders expect the Bank of England to steeply hike interest rates in response to surging inflation, which is running at a 40-year high of 9.9 percent, and the government’s tax cut and borrowing splurge.

“One of the reasons for the explosion in gilts is the sovereign premium – markets holding their noses at unfunded, untargeted tax cuts – the other is just simply that the market thinks the budget is going to force the Bank into much more tightening than it had planned,” Neil Wilson, chief markets analyst at Markets.com, said.

Last Friday, Chancellor Kwasi Kwarteng signed off £45bn worth of tax cuts, including scrapping the top 45 percent income tax rate and reversing the corporation tax and national insurance rises.

No public spending cuts were announced, meaning the government will have to borrow more money.

Kwarteng tried to calm City executives and Tory MPs’ concerns over the market jitters yesterday. According to Sky News, he will ask bankers today not to short the pound, however, the Treasury has denied the meeting will take place, according to Reuters.

Related: Will Oil Prices Bounce Back Above $100 This Year?

Last night, the International Monetary Fund, the world’s lender of last resort, urged the chancellor to rethink his fiscal plans to prevent inflation trending higher.

Governor Andrew Bailey and co have lifted rates from a record low 0.1 percent to 2.25 percent since December, including two successive 50 basis point hikes.

The chief economist of Threadneedle Street, Huw Pill, said yesterday recent UK market turmoil which has seen sterling hit a record low against the greenback and debt costs surge, will require a “significant” response from the Bank.

That likely means a super-sized rate hike of as much as 100 basis points at the monetary policy committee’s next meeting on 3 November.

Markets are ditching bonds, which is sending yields higher, in response to the government stepping up borrowing. Yields and prices move inversely.

By CityAM

More Top Reads From Oilprice.com

- Nikola Is Recalling Every Electric Truck It Has Ever Built

- Hurricane Ian Shuts In 11% Of Gulf Of Mexico Oil Production

- Supply Chain Shortage Stalls Delivery Of 45,000 Ford Vehicles

City A.M

CityAM.com is the online presence of City A.M., London's first free daily business newspaper. Both platforms cover financial and business news as well as sport and…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B