Breaking News:

Tehran's Nuclear Threats Raise Global Concerns

Iranian officials are increasingly suggesting…

The IEA Has Cut Its Oil Demand Growth Forecast for 2024

The IEA has cut its…

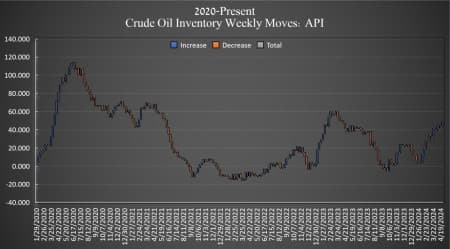

Unexpected Crude Inventory Build Weighs on Oil

Crude oil inventories in the United States rose this week by 4.906 million barrels for the week ending April 26, according to The American Petroleum Institute (API).

For the week prior, the API reported a 3.23 million barrel draw in crude inventories.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 0.6 million barrels as of April 26. Inventories are now at 366.3 million barrels—the highest point since last April.

Oil prices were trading down ahead of the API data release on Tuesday on disappointing economic data as traders lose hope that the Fed will lower interest rates anytime soon. This sticky inflation means that hopes of lower interest rates triggering economic growth—and a subsequent rise in oil demand—are waning.

At 3:52 pm ET, Brent crude continued Monday’s slide, trading down another 0.61 on the day at $87.86, $0.55 per barrel lower than this time last week. The U.S. benchmark WTI was also trading down on the day by 1.22% at $81.62—down roughly $1.70 per barrel from this time last week.

Gasoline inventories fell this week by 1.48 million barrels, on top of last week’s 595,000 barrel drop in the week prior. As of last week, gasoline inventories were about 4% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories also fell this week, by 2.187 million barrels, on top of last week’s 724,000-barrel dropoff. Distillates were 7% below the five-year average for the week ending April 19, the latest EIA data shows.

ADVERTISEMENT

Cushing inventories saw a build this week, according to API data, gaining 1.479 million barrels after falling by 898,000 barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- New Indian Refinery to Be Delayed by Two Years

- The U.S. Supermajors Double Down on World's Top Oil Basins

- ExxonMobil Underwhelms With Q1 Earnings

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

Again grave danger of a collapse of a massive US Trucking Company, US Airline or both which obviously would be crazy bearish for oil prices and commodities in general.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B