It all started as an ordinary geopolitical spat. When Australian authorities called for an official inquiry into the origins of the COVID-19 pandemic, few could foresee that such a seemingly conventional diplomatic step might bring about far-reaching ramifications for China’s steel industry, its domestic coal prices and one of Australia’s largest commodity streams, namely its coal exports to China. China wanted to strike hard – it drastically reduced its Australian coal imports just when iron ore quotes bounced back from all the coronavirus-entailed lethargy to a 6-year high – hoping that suppliers from adjacent countries like Mongolia, Russia or Indonesia can fill the void rather seamlessly. However, something went wrong in Beijing’s assumptions and now China is faced with unprecedently high domestic prices and a protracted political feud that might eventually be adjudicated by the WTO. For quite some time, China refrained from going all-out on Australian coal imports and argued instead that the drop in volumes being supplied was due to them “failing to meet (Chinese) environmental standards”. It was never properly elaborated what sort of environmental standards were breached; however, one could certainly take notice of the many coal cargoes being delayed in China’s maritime ports. Beijing officially acknowledged its feud with Australia only in mid-December 2020 when the National Development and Reform Commission (NDRC), China’s economic planning body, announced that it would allow power plants to import coal from abroad without clearance restrictions from any country except Australia. Such a bold move was premised on China’s own coal-producing capabilities, however unforeseen developments have hindered the domestic output drive.

The Diaoshuidong coal mine accident in early December when a seemingly routine dismantling of underground equipment went horribly awry, trapping two dozen miners with excessive levels of carbon monoxide around. The tragic death of 23 people (follows a recent incident in the same municipality of Chongqing in late September that killed 16 miners) has prompted the Chinese authorities to take a closer look at how coal mines are operated, regardless whether they are privately owned as the Diaoshuidong mine or with state participation, and such hands-on government surveillance was definitely not conducive to a quick ramp-up in production. China simply cannot afford such coal mine collapses if it wants to maintain its hard-liner trading policy. Related: Will Biden Seal The Fate Of The U.S. Shale Patch?

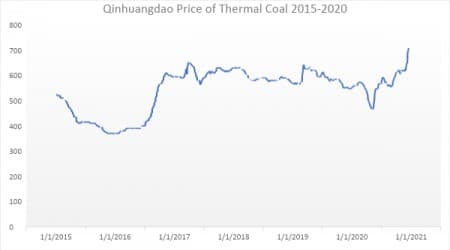

Graph 1. Qinhuangdao Thermal Coal Prices in 2015-2020 (yuan per tonne).

Source: Thomson Reuters.

It is believed that Chinese authorities prefer to keep domestic coal prices within the so-called green zone, an interval between 500-570 yuan per tonne of thermal coal, which purportedly allows to guarantee the profitability of domestic coal producers. Above that corridor prices would be too high for the purposes of electricity generation, below that coal producers would suffer economically. Now, amidst the Sino-Australian conflict and all the travails of maintaining safety at coal mines, domestic prices in China have been on the rise during the past weeks. The Qinhuangdao benchmark coal price surged to its 5-year high in mid-December, flirting with the 700 yuan per tonne barrier on December 16 (see Graph 1).

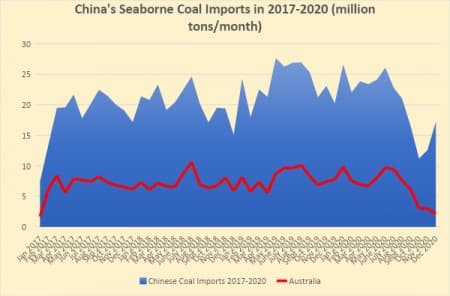

Graph 2. China’s Seaborne Coal Imports in 2017-2020 (million tons per month).

Source: Thomson Reuters.

Related: Goldman Turns Bullish On Oil: Sees $65 Brent In 2021

With the aim of setting coal imports free to pressurize the high thermal coal prices, China has tacitly buttressed end consumers to import more than previously. Hence, coal imports have been on the rise in November-December 2020, though neither in the case of Indonesia (where the 9.8 million tons arriving in December 2020 corresponds to the historical average) nor Russia (whose 3.2 million tons of seaborne exports only marked a return to the June-September period) can one talk of a significant surge. Inevitably, land-based movements are harder to track – and Mongolia’s coal exports to China are all land-based - and therefore require more time to account for than maritime supplies yet overall it seems that China could not fully cater for its needs from adjacent countries amidst inadequate spot availability.

We have been focusing heavily on China, however, at the same time, there is a reason why Australia’s prime minister Scott Morrison described the ongoing feud as a lose-lose situation – in the long term Australian coal producers might suffer, too. The short term consequences can be mitigated by means of market outlets in Asia Pacific – South Korea, Japan and Vietnam can supplant the Chinese market, at least during this winter season. Yet the drop in the freshly IPOed Dalrymple Bay Coal Terminal share price indicates that the perpetuation of China’s trading ban cannot be maintained forever. In fact, the longer the spat’s duration the more resolute steps can be expected from the Australian government in terms of boosting its renewables portfolio.

Thus, China has ended up with the exact opposite of what it wanted to achieve – it intended to curtail the marketing outlets of Australian coal for its perceived coronavirus skepticism but had in fact partially contributed to the pricing surge thereof, without actually seeing their aggregate exports decline. At the same time it needs to be said that whilst today’s situation might tilt slightly to Australia’s favor, the adverse long-term implications are still there and the sides would be much better off if they had amiably settled the political row. For instance, the insecure atmosphere has started to take its toll on some projects’ timeline – the uncertainty has compelled Anglo American to postpone its anticipated 4mtpa capacity expansion at its Moranbah-Grosvenor coal mine.

ADVERTISEMENT

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

- Mexico Is Quietly Pushing Out Foreign Oil Investors

- Oil Jumps On Crude Inventory Draw

- Goldman Turns Bullish On Oil: Sees $65 Brent In 2021

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London