I’m in favor of the global output cut orchestrated by President Trump but let’s recognize it for what it is: largely irrelevant. Mohammed bin Salman and Vladimir Putin were glad to burn down the world a month ago when they walked away from production cuts. They had dueling temper tantrums in the junior high locker room while the world descended into economic Armageddon. To Trump’s credit, he may have found a way for them to reverse their terrible blunder, save face and emerge looking like much better guys than they really are.

An agreement means conceding to the lack of demand for their oil. Price takers can’t be choosers. It will be lipstick on an ugly pig made larger than life by the closure of the world economy. If an agreement happens, we will see how much of it is sleight-of-hand arithmetic based on imaginary starting levels of output much mentioned but never seen.

Energy is the economy and oil is the largest and most productive part of world energy. The global economy has been dying of accumulated debt for 50 years. Coronavirus has sent it to the intensive care unit.

The closing of the world economy has caused the greatest demand decrease at least since the 1980s and probably ever. Many credible sources have estimated demand levels for 2020 but there is little data so far.

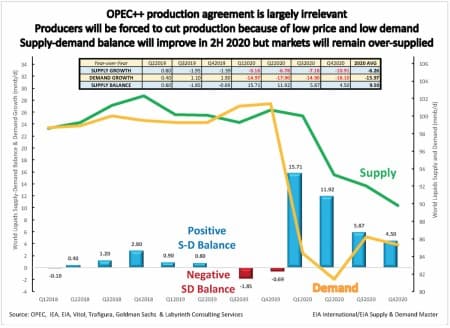

Figure 1 is a thought experiment. I have integrated many estimates into a possible scenario. It is based on expectations of how long the economy may be closed and how this will affect oil supply, demand and price. It anticipates an 18 million barrel per day maximum annual demand decrease in the second quarter of 2020. Unlike other models, it does not include a rapid economic recovery in the third quarter.

Figure 1. The OPEC++ production agreement is largely irrelevant.

Source: OPEC, IEA, EIA, Vitol, Trafigura, Goldman Sachs, Rystad Energy and Labyrinth Consulting Services, Inc.

That’s because I don’t believe that the world will go back to work in May. I doubt that the world will go back to work in June.

That means that people–not just corporations–will have to be supported by thin-air money created by central banks or the economy will collapse. The $2 trillion allocated by the U.S. will be grossly insufficient. Use whatever imaginary multiple you like to estimate what the world must spend. This may become the greatest global currency devaluation in history.

Related: Political Battle Could Jeopardize World’s Most Spectacular Oil Boom

If the economic patient survives the ICU, it will need a long period of recovery and therapy before returning to its previous life.

Which brings me back to oil. Demand is so weak and price is so low that all producers in the world will be forced to shut in production. The only reason Russia and Saudi Arabia may agree to a cut is because they now see that they have no choice but to decrease output. They might as well look good doing what is inevitable anyway.

An output agreement will result in higher oil prices–for awhile anyway. At $30 WTI and $35 Brent, prices are at least $20 under-valued so there’s room for higher prices. The problem is that supply cannot possibly fall as fast as demand in the present situation. Once markets realize or even suspect that this is the case, prices will collapse maybe to even lower levels than in late March.

Figure 1 also shows a second demand decrease in the fourth quarter. That is because it is possible that the second wave of Coronavirus will close the economy again, at least partially. I hope that I’m wrong.

I have not seen any analysis about why the United States is engaged for the first time ever in discussions with the two leading oil exporting countries in the world. It’s because the U.S. has become a major exporter since the crude oil export ban was lifted in late 2015. Exports averaged 3.5 million barrels per day in the first quarter of 2020. This trade depends on a $4.00 per barrel Brent spot premium to WTI to cover transport costs from Cushing, Oklahoma to overseas markets. Since the failure of OPEC+ talks in early March, that arbitrage has turned negative.

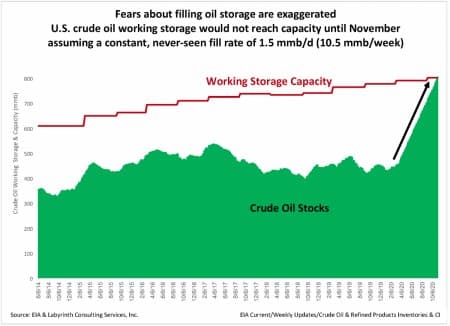

Most analysts believe that world oil storage will soon be filled to capacity because of falling demand. Even those who agree that a coordinated output cut would make little difference on the demand side believe that it would take help the impending storage crisis.

Fears of filling oil storage are exaggerated. It was widely believed that storage would be overwhelmed in 2016. The gap between crude oil stocks and working capacity never fell below 192 million barrels. If U.S. storage began filling at a constant and never-before seen rate of 1.5 million barrels per day, working capacity would not be filled until November (Figure 2). That doesn’t include the 77 million barrels available in the Strategic Petroleum Reserve. Markets are ruthlessly efficient and production will almost certainly slow before there is a storage crisis. Related: Big Oil Raises Debt To Ride Out Price Crash

Figure 2. Fears about filling oil storage are exaggerated.

ADVERTISEMENT

Source: EIA and Labyrinth Consulting Services, Inc.

It is curious that in this age of customer focus, oil exporters seem blind to the buy-side of the oil market. China is mentioned in almost every analysis of global economics yet has hardly appeared in any reporting on the potential coordinated production cut.

Almost everyone says that we will get through this. I wonder what things will be like when we do. It seems likely that oil markets and, therefore, the world economy will be quite different. Shale plays will continue to supply more than half of U.S. oil but total output may be lower. Many companies will disappear. I doubt that oil production or prices will return to 2018 levels for many years.

It seems unlikely that what is happening today will cause society to experience some transformative epiphany that will end the age of oil. If anything, we will need inexpensive liquid fuel more than ever in a poorer world. Rather than seeing 2020 as a year of unspeakable loss, it is my sincere wish that we somehow find ways to live better with somewhat less.

By Art Berman

More Top Reads From Oilprice.com:

- What Happens If You Can’t Pay Your Electricity Bill?

- The Only Logical End To The Oil War

- Oil Majors Rally On Rising Crude Prices

Even then, no agreement on cuts will be reached without a commitment by the United States to join the cuts and therein lies the rub. Moreover, a tax or tariff on foreign crude oil exports to the United States to finance a bailout of the the bankrupt US shale oil industry will fail. Major oil exporters would rather shift all their exports elsewhere than paying the tax.

The US shale oil industry has been since its inception in 2008 sucking the livelihood of most of the oil-producing nations of the world particularly those who overwhelmingly depend on the oil export revenues and also gaining market share at the expense of Russia and Saudi-led OPEC. It is only fair that the shale industry should share the pain with other oil-producing nations who are suffering badly from this state of events.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

oin Our Community