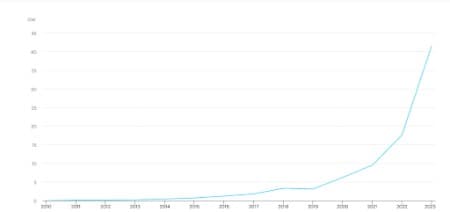

Battery storage was the fastest-growing energy technology in the power sector in 2023, with deployment more than doubling year-on-year, the International Energy Agency (IEA) has revealed.

Strong growth was recorded for utility-scale battery projects, mini-grids, solar home systems and behind-the-meter batteries, adding a total of 42 GW of battery storage capacity globally. However, electric vehicles continue to account for the vast majority of batteries used in the sector, with 14 million new electric cars hitting the records in 2023, good for a 40% growth clip in deployments. In 2023, there were nearly 45 million EVs on the road, and over 85 GW of battery storage in use in the power sector globally.

Another interesting finding: the energy sector now accounts for over 90% of annual lithium-ion battery demand thanks to falling costs and improving performance. That marks a sharp increase from 2016 when it accounted for just 50% of li-ion battery demand, when the total battery market was 10-times smaller. Li-ion battery costs have tumbled 90% from 2010 to a historic low of $139 per kilowatt-hour. Industry analysts consider the $100-per-kilowatt-hour threshold a crucial milestone that will help EVs achieve cost parity with fossil fuel-powered vehicles. According to Bloomberg New Energy Finance (BNEF), last year, global lithium-ion battery demand topped 950 gigawatt-hours, with demand set to grow 53% in the current year thanks to low prices.

Global battery storage capacity additions, 2010-2023

Source: IEA

China remains the world’s largest market for li-ion batteries, accounting for over half of all batteries in use in the energy sector today. Not surprisingly, last year, average battery pack prices were lowest in China, at $126/ per kilowatt-hour, with packs in the U.S. 11% higher while pack costs in Europe were 20% higher. Related: TotalEnergies Mulls Primary New York Listing to Expand U.S. Shareholder Base

The European Union is the next largest battery market followed by the United States, with smaller markets also in the United Kingdom, Korea and Japan. Battery use is also growing rapidly in emerging economies in Africa, where close to 400 million people gain access through decentralized solutions such as solar home systems and mini-grids with batteries.

Despite the rapid growth by the battery sector, the world is not deploying anything close to the required levels to meet its climate goals. Last year, at the COP28 climate summit, the world’s governments set a goal to triple their respective renewable energy capacity.

The IEA estimates that energy storage needs to increase six-times for the world to achieve that goal while maintaining electricity security. To deliver this, battery storage deployment must continue to increase by an average of 25% per year to 2030, a feat that will require action from policy makers and industry.

Battery Costs To Fall Further

The IEA has predicted that further innovation in battery chemistries and manufacturing is set to lower the global average lithium-ion battery costs by a further 40% from 2023 to 2030 and bring sodium?ion batteries to the market. This implies that EVs could start seriously giving the ICE vehicle sector a run for its money before the decade is over.

Other analysts are even more bullish on EVs.

For many years, some electric vehicle critics have argued that EVs will never displace diesel- and gas-powered vehicles from the roads because they will always be more expensive than fossil fuel-powered vehicles. Market experts have repeatedly pointed out that EVs need to achieve cost parity with ICE vehicles if they ever hope to go mainstream. Luckily for EV bulls, there’s growing evidence that this might happen sooner than many expect.

An oversupplied market has led to vicious price wars by Tesla Inc. (NASDAQ:TSLA) and its Chinese rivals, leading to falling EV sticker prices. This is bad news for Tesla and EV investors; however, it’s music in the years of EV enthusiasts who were previously priced out of the market. Indeed, Tesla’s most affordable model is now cheaper than its ICE peer, "The Model 3’s starting price is now $6,500 less than the cheapest BMW 3 Series, which is often seen as the Tesla sedan’s most direct gasoline-powered competitor," Bloomberg has noted.

ADVERTISEMENT

Gartner has even predicted that EVs will be cheaper to produce than ICE vehicles of the same size by 2027 thanks in large part to improvements in manufacturing methods with production costs dropping faster than battery costs.

“New OEM incumbents want to heavily redefine the status quo in automotive. They brought new innovations that simplify production costs such as centralized vehicle architecture or the introduction of gigacastings that help reduce manufacturing cost and assembly time, which legacy automakers had no choice to adopt to survive,”Pedro Pacheco, vice president of research at Gartner, has said.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Global Oil and Gas Discoveries Fell to a Record Low in 2023

- A Strong Global Economy Is Expected to Keep Oil Prices Rangebound

- U.S. Crude Oil And Gasoline Inventories Drop Off