Oil prices are set to post an impressive gain this month as bullish sentiment has been building and demand concerns fading.

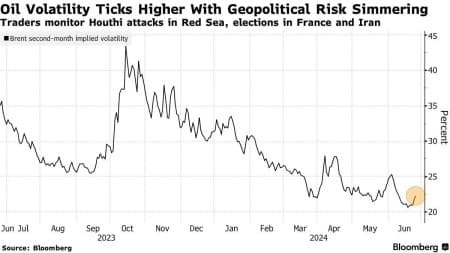

- As Brent futures have moved above $85 per barrel again, geopolitics have started to come to the forefront of market concerns as Houthi militias are intensifying strikes on commercial tankers and Israel-Lebanon tensions fly high.

- Oil prices remain in expansionary mode as Brent remains above the 50-day average of $83.75 per barrel, with expected inventory draws in the summer providing fundamental support for a move higher.

- The product markets are also adding to the bullish drive, with investors increasingly taking long positions in diesel futures and options and ICE gasoil futures seeing the biggest-ever addition in long bets last week.

- US crude inventories in the week ending June 21 are expected to shrink by a couple of million barrels, most probably providing further upside for oil prices, and only underwhelming US inflation data could sour the current bullish sentiment.

Market Movers

- Less than a week after it landed two new Angolan blocks, US oil major Chevron (NYSE:CVX) signed production-sharing contracts with Equatorial Guinea to explore two previously untapped offshore blocks.

- Brazilian state oil company Petrobras (NYSE:PBR), partnering with Ecopetrol (NYSE:EC), began drilling the Uchuva-2 appraisal well that could confirm huge gas deposits in the Tayrona block.

- ADNOC, the national oil company of the United Arab Emirates, has reportedly moved to final-stage negotiations with German chemicals firm Covestro over a proposed $12.5 billion takeover deal.

Tuesday, June 25, 2024

As both Brent and WTI are poised to post a robust 6% month-over-month increase, the oil markets seem to have temporarily shed their demand concerns and are riding the bullish wave. With Israeli President Netanyahu pledging to boost military presence along the country’s border with Lebanon, war risks are becoming a talking point again.

EU Formalizes 14th Russia Sanctions Pack. The European Union has formally adopted a 14th package of sanctions on Russia that bans trans-shipments of Russian LNG off EU ports over a nine-month transition period, also sanctioning 27 tankers and Russia’s shipping firm Sovcomflot.

Landslides Halt Ecuadorian Exports. Petroecuador, the state oil firm of Ecuador, was forced to halt transportation along the 450,000 b/d OCP pipeline amidst rain-induced erosion near its path in Napo province, declaring force majeure on exports of heavy sour Napo crude.

Nigeria Sees Huge Interest in New Blocks. Nigeria’s upstream regulator stated that it will expand the number of oil blocks slated for auctioning in its 2024 licensing round, from 19 to a whopping 36 blocks with the addition of 17 deepwater licenses, citing “tremendous interest”.

US Labour Costs Become Threat to LNG. A shortage of skilled labor has been weighing on LNG developers as strong wage growth in the US Gulf Coast has already led to some delays, with labor costs rising more than 20% since 2021 and contractors often paying skilled workers additional per diems to retain them.

Can Lithium Prices Overcome Their Blues? Spot prices of lithium carbonate in China have dropped to their lowest since August 2021, down 12% on the month at a mere ¥93,100 per metric tonne ($12,825/mt), with producers hoping that prices will start to recover into the fall-winter season.

Japan Restores Power and Gas Subsidies. Seeking to shield consumers from rising energy costs, the Japanese government restored subsidies for retail electricity and city gas in August-October, also extending gasoline subsidies until year-end 2024 as Tokyo keeps the price around ¥175/l ($174/barrel).

UK Renewable Projects Can’t Break into Profits. According to industry consultants Cornwall Insight, only 20% of all renewable projects in the UK that applied for planning permission in 2018-2023 are still viable, with two-thirds of applications already abandoned, as speculative bids abound.

Solitary LNG Carrier Risks A Red Sea Transit. Brushing aside the risk of being targeted by Houthi militants, the Asya Energy LNG carrier became the first vessel to sail through the Red Sea this year as shippers have been avoiding Suez Canal transits for fear of explosion.

ADVERTISEMENT

California Refining Margins Feel the Squeeze. Residents of Richmond, California are set to vote in November on whether to place an additional $1 per barrel tax on refining at Chevron’s (NYSE:CVX) 245,000 b/d refinery for the next 50 years, potentially squeezing margins in PADD5 even further.

Gabon Pre-empts Oil M&A Deals. Gabon’s national oil company GOC pre-empted Carlyle Group’s sale of its oil assets in the country, including the Rabi field, to French upstream firm Maurel & Prom for 1.3 billion, with Swiss-based trading house Gunvor reportedly providing financing for the deal.

Finland Stops Russian LNG Imports. Finland’s main gas importer Gasum will halt purchases and imports of Russian LNG from July 26 in line with the latest round of EU sanctions on Russia that prohibit LNG imports for European terminals that are not connected to the EU gas network.

Trinidad Is Looking for Refinery Buyers. The island nation of Trinidad and Tobago is looking for an operator for its 165,000 b/d Guaracara refinery, mothballed since 2018, with the government claiming it received eight expressions of interest with Indian steel giant Jindal reportedly interested.

Houthi Attacks Intensify in the Summer. Houthi rebels have stepped up their attacks against commercial ships near Yemen this week, claiming a hit on the Greek-owned bulker Trans World Navigator and even attempting to target the Israeli port of Haifa with long-range missiles.

Ex-Pertamina CEO Jailed for Graft. Indonesia has sentenced a former chief executive of the country’s state-controlled energy firm Pertamina to nine years in jail for graft, alleging that a contract she signed with Cheniere (NYSE:LNG) caused state losses of $113.8 million in 2011-2014.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- EU Targets LNG and Dark Fleet in New Sanctions Against Russia

- U.S. to Set New Oil Production Record, But 2025 Looks Bleak

- Aluminum Prices Face Downward Pressure Amid Oversupply Concerns

Oil will continue to lead the global economy well into distant future. No one should believe myths like global energy transition, net-zero emissions and IEA's flawed projection of peak oil demand by 2030 and fads like EVs.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert