Signs that inflation may be easing in the U.S. have given oil markets a bullish hue this week, but uncertainty over demand remains.

Friday, June 14, 2024

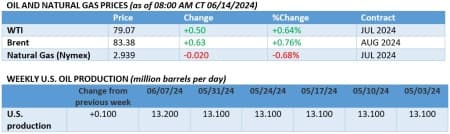

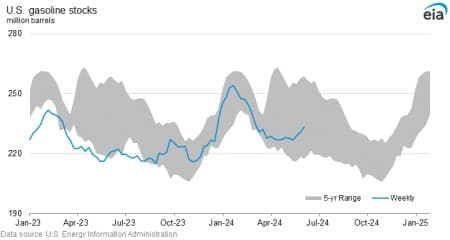

After several weeks of unpredictable see-sawing, oil markets are back to their usual self. The IEA and OPEC are publicly arguing about the future of oil demand, U.S. interest rate cuts are still not happening, and questions remain about the strength of summer gasoline demand. That said, a positive outlook in U.S. inflation data might have helped to tilt the balances slightly in favor of oil bulls, with Brent closing the week around $83 per barrel.

IEA Paints Bleak Picture for Oil Demand. The International Energy Agency predicts a 2029 peak in global oil demand at 105.6 million b/d, predicting a price slump as it believes global supply capacity will hit almost 114 million b/d by the end of this decade.

OPEC Defies Oil Pessimists, Says Demand Grows for Decades. Calling the IEA’s report ‘dangerous commentary’, the OPEC secretary general Haitham al-Ghais stated he doesn’t see a peak in oil demand until at least 2045, saying consumption will grow to a hefty 116 million b/d.

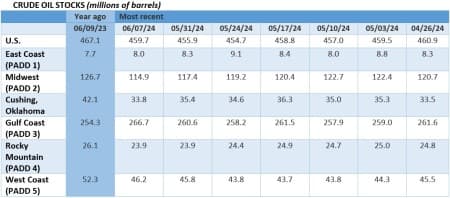

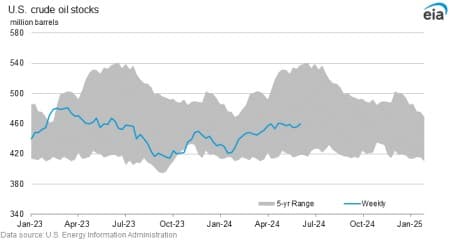

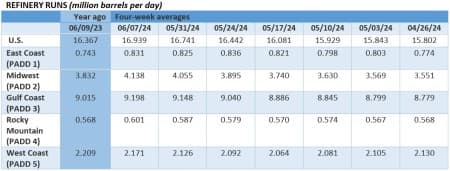

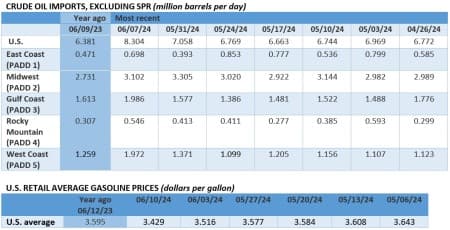

US Crude Imports Rise to 6-Year High. According to the EIA, US crude imports rose to their highest since 2018 last week at 8.304 million b/d, boosted by the first cargoes from Canada’s TMX pipeline reaching PADD 5 refiners and Mexican crude exports rebounding to almost 1 million b/d.

Ukraine Signs US LNG Supply Deal. Ukraine’s largest private energy company DTEK agreed to buy LNG from US energy firm Venture Global, receiving cargoes from Plaquemines LNG starting later this year until end-2026 and also purchasing 2 tmpa from Calcasieu Pass 2 once it starts in 2026.

EU Eyes Russian Gas via Azerbaijan. According to Azerbaijani top officials, the European Union has asked Azerbaijan to facilitate a gas transit deal with Russia as the Ukraine transit agreement for Russian piped gas is set to run out this December, still seeing supplies of around 15 bcm per year.

TMX Running at 80% Pipeline Capacity. Canada’s Trans Mountain Pipeline is alleged to run at approximately 80% capacity with a little bit of spot activity being used, according to the operator’s CEO Mark Maki, adding that 22 tankers are expected to load at Westridge this month.

Saudi Aramco Expands into US LNG. Boosting its gas presence, Saudi Arabia’s national oil company Saudi Aramco (TADAWUL:2222) has signed a 20-year LNG supply deal with US firm NextDecade (NASDAQ:NEXT) for 1.2 mtpa of liquefied gas from the Rio Grande LNG facility.

Senegal Joins Club of Oil Producers. The African Republic of Senegal has officially become an oil and gas producer after Australian oil major Woodside Energy (ASX:WDS) announced first oil at the 100,000 b/d offshore Sangomar project, eyeing exports of medium sour barrels.

ADVERTISEMENT

Europe Slaps Tariffs on Chinese EVs. The European Commission has proposed increasing import duties on Chinese electric vehicles up to 38.1%, up from the 10% tariff already imposed on external carmakers, potentially triggering a trade war between Brussels and Beijing.

Louisiana Air More Toxic Than Ever. According to a Johns Hopkins study, the toxic gas ethylene oxide is detectable in southeastern Louisiana at levels thousand times higher than what’s considered safe, mostly along the ’Cancer Alley’ between Baton Rouge and New Orleans, home to 25% of US petrochemical production.

Copper Smelters Are Shutting Down Globally. According to copper analysts, roughly a fifth of global copper smelting capacity was suspended in May, mostly for seasonal plant maintenance, up from 17.4% in the same month last year, helping to halt the free-fall in copper futures.

API Takes Action Against Biden Emission Mandates. The largest oil trade group in the US, the American Petroleum Institute, filed a federal lawsuit against the Biden administration’s new tailpipe emission rules that force carmakers to scale EV output up to 56% of all car sales by 2030.

Trump Promises Reversal of Arctic Drilling Ban. According to media reports, US presidential candidate Donald Trump vowed to reverse a drilling ban on public lands in Alaska, a year after the Biden administration banned upstream activities in the Arctic National Wildlife Refuge.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Matador Resources to Buy More Permian Assets in $1.9B Deal

- Oil Drops on Inventory Build

- Inflation in China is Finally Beginning to Stabilize

By arguing with the IEA about the future of oil, OPEC+ lowers its status in the global oil market. It should totally ignore the IEA whose Executive Director Fatih Birol craves the limelight.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert