Oil prices plummeted further on Friday, despite a semi-bullish rig count report and the combined efforts of OPEC and its partners.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, December 14, 2018

IEA: OPEC+ puts floor beneath oil.The OPEC+ deal put “a floor” beneath oil prices, according to the IEA’s latest Oil Market Report. The agency said that non-OPEC supply could still outgrow demand next year, expanding by 1.5 mb/d while demand may only soak up 1.4 mb/d of that additional supply. As such, OPEC+ might be forced to maintain the cuts through the end of the year. However, there are plenty of uncertainties, including the extent of losses from Iran and Venezuela, while additional outages could come from Libya or elsewhere. For now, the IEA says the production cut deal will keep prices from falling further, but it is still too early to tell if the agreement will significantly boost prices.

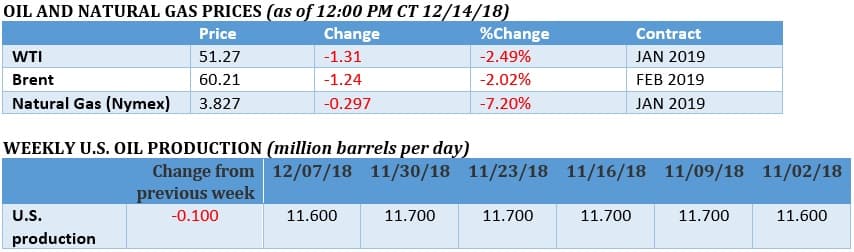

EIA: U.S. to average 12.1 mb/d in 2019. The EIA said in its latest Short-Term Energy Outlook that the U.S. should average 12.1 mb/d in 2019, up sharply from a 10.9 mb/d average this year. Notably, the production estimate is mostly unchanged from previous months, even though oil prices have crashed. The EIA even lowered its expected price for Brent and WTI in 2019 by roughly $10 per barrel, but the agency clearly thinks that the production gains are mostly baked in already.

Signs of demand slowdown in Asia. Refining figures in Asia suggest demand could be slowing down in the region, Bloomberg reports. Asian refining margins are at an eight-month low, which could be a leading indicator of slowing consumption. Related: China Determined To Avoid Another Natural Gas Crisis

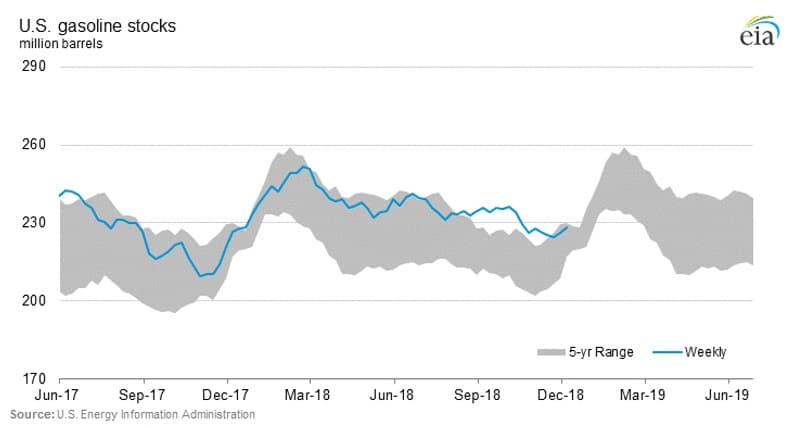

OECD stocks above average. OECD stocks rose above the five-year average in October (the latest month for which data is available) for the first time since March.

Neutral Zone could reopen. Saudi Arabia and Kuwait are nearing a deal to restart idled oil fields in disputed territory along their shared border. The so-called Neutral Zone oil fields have the capacity to produce 500,000 bpd, but have been offline for several years. The U.S. government has leaned on both countries to resolve their differences, with an eye on shrinking supply from Iran. Chevron (NYSE: CVX), which jointly operates one of the fields in Kuwait, said it maintains “readiness for a production restart when that time comes,” according to the Wall Street Journal.

Premier Oil Plc could bid for North Sea assets. Premier Oil plc (LON: PMO) is considering a $2 billion bid for a group of North Sea oil and gas assets from Chevron (NYSE: CVX).

Nigeria files $1.1 billion claim against Shell. Nigeria has filed a $1.1 billion legal claim against Royal Dutch Shell (NYSE: RDS.A) and Eni (NYSE: E) over a highly controversial 2011 oil license, the same license that has also ensnared Eni’s top brass in corruption inquiries in Italy. Nigeria filed a claim in a London court, alleging that the two oil companies, among others, “participated in a fraudulent and corrupt scheme,” according to the FT.

ADVERTISEMENT

Barclays: Brent at $72 in 2019. Barclays expects Brent to rise to $71 per barrel as early as the first quarter of 2019, which is much more optimistic than a raft of other forecasts that have come out lately. For the full year, Barclays sees Brent averaging $72 and WTI averaging $65. “Brent and WTI prices are poised to rebound in 1H19,” Barclays said in a note. “The inventory situation is far better than the last time cuts started in early 2017, and the cuts have already begun, as shown in December data.”

China stocked up on oil when prices fell. In at least two key regions in China, oil imports jumped by 26 percent in November compared to the average level from the prior ten months, according to Bloomberg. The rise in imports suggests China was stocking up on crude, taking advantage of low prices.

Related: Is Gasoline Demand Really Slipping?

Famed hedge fund manager says U.S. shale makes oil harder to predict. Andy Hall, a well-known hedge fund manager nicknamed “God” for the huge sums he has made on oil trading, said that U.S. shale has made the oil market much harder to predict. The short-cycle nature of shale, which stops and starts much quicker in response to price swings than conventional production, makes it harder to get ahead of the booms and busts. “It used to be, on the supply side of the equation, you could predict with some confidence what future supply was going to be, outside of global political events,” Hall told Bloomberg. Now, “everyone is groping. There are a lot of variables that we don’t have a good handle on.”

U.S. Senate votes to end war in Yemen. The U.S. Senate passed a bill to end American support for the war in Yemen, against the advice of Secretary of Defense Jim Mattis and President Trump. The Senate also censured Saudi crown prince Mohammed bin Salman and blamed him for the murder of slain journalist Jamal Khashoggi. The bill will have no practical effect since the U.S. House of Representatives declined to move companion legislation earlier this week. But the issue is not over and with Democrats taking over control of the House in the New Year, the legislation could be revived.

Saudi Arabia aims to cut oil shipments to United States. In an effort to drain the surplus of oil stocks, Saudi Arabia plans on curtailing shipments specifically to the U.S., according to Bloomberg, a strategy intended to shift market psychology. Because the U.S. is one of the few countries that offers regular and transparent data on oil inventories, cutting down on stocks in the U.S. will transform how investors view the global market. Visible declines in inventories, which the EIA will report week after week, should bolster market confidence. It’s a strategy the Saudis used back in 2017 when it tried to boost prices.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Global Market Turbulence Caps Oil Prices

- One Houston Gas Player Is Changing The LNG Business Forever

- Libya’s NOC Won’t Pay ‘Ransom’ For Biggest Oil Field

With the new OPEC+ cuts, the current robust global oil market fundamentals and the accelerating Chinese crude oil imports, prices could be projected to rise above $80 a barrel in the first quarter of 2019. China’s oil imports have been accelerating beyond 10 million barrels a day (mbd) and could even hit 11 mbd before the end of the year.

As for US oil production, the hype by the US Energy Information Administration (EIA) has reached unprecedented levels. Claims are abound ranging from US oil output averaging 12.1 mbd in 2019 to the US overtaking Russia to become the world’s largest oil producer to the US becoming a net oil exporter. The problem with all these claims is that they are all unsubstantiated and therefore are mere hype.

The EIA has been telling us throughout 2018 that US oil production will average 11.7 mbd but now it is claiming that it will average 10.9 mbd, some 800,000 barrels a day (b/d) less than their original claim.

There are two cardinal figures which determine the level of US oil imports and exports, namely US oil production and US consumption.

In 2018 US consumption was estimated at 20.5 mbd and production is claimed by the EIA to be 11.7 mbd thus necessitating imports of 8.8 mbd. No matter how the EIA tries to manipulate US oil fundamentals, the glaring fact remains, namely the US will never become self-sufficient in oil even for one minute.

The EIA claims that the United States exports 3.2 mbd. But it doesn’t mention that an equivalent amount of heavy and medium crude are imported for use by US refineries that are not equipped to refine the ultra-light tight oil, meaning there are no net exports.

When it comes to US oil production, the EIA figure of 11.7 mbd is overstated by at least 3 mbd made up of 2 mbd of NGLs which come from natural gas wells and include such things as ethane, propane, butane and pentanes and 1 mbd of ethanol. These may not qualify as crude oil. In fact, major exchanges accept neither natural gas plant liquids nor lease condensates or ethanol as satisfactory delivery for crude oil. And if major exchanges don’t accept them as crude oil, then they are not crude oil. Therefore, US oil production couldn’t be bigger than 8.7 mbd compared with 11.41 mbd for Russia and 10.7 mbd for Saudi Arabia.

An MIT study published in December 2017 reached the conclusion that the US vastly overstates oil production forecasts.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London