In December 2017, Novatek launched its much-praised Yamal LNG in the Arctic Circle. Despite difficult permafrost conditions and financial limitations imposed by U.S. sanctions, Yamal LNG was finished on time and on budget. Claims have been made that Yamal LNG will be directed to the Asian market, however, there are several factors that limit its turn to the Asia-Pacific.

Pivot to Asia?

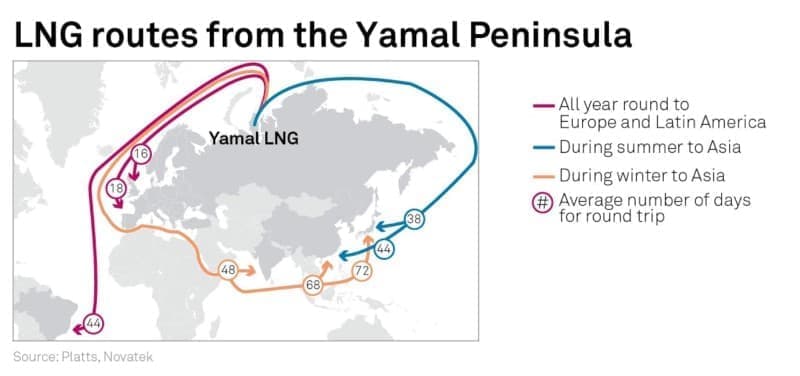

Yamal LNG, co-owned by Russia’s Novatek, France’s Total SA and China’s CNPC and Silk Road Fund, has often been called Russia’s window to the Asia-Pacific. The project’s website praises the plant’s unique location as an opportunity for flexible and competitive logistics which will enable year-round energy supplies to the Asia-Pacific and European markets. In reality, Yamal LNG’s delivery flexibility is constrained by conditions in the Arctic. Between December and April annually, the Northern Sea Route connecting the Yamal Peninsula and the Asia-Pacific, is closed. Shipments can only go westwards to European markets then. During the winter season, deliveries to Asian countries are less profitable, and time-consuming. For example, it takes up to 72 days for a cargo to make a round trip to Japan. That’s 4.5 times longer than for a cargo from Australia (16 days). Moreover, in its efforts to reduce reliance on LNG deliveries transiting the Middle East, Japan would find it less attractive as the cargoes will pass the Strait of Hormuz and the Strait of Malacca – passages hindered by piracy and transportation bottlenecks.

Only from May to November, when the energy demand is usually lower, could vessels go both to Asia-Pacific and European markets. These weather limitations may significantly impact Yamal LNG’s production which will be lower than its capacity.

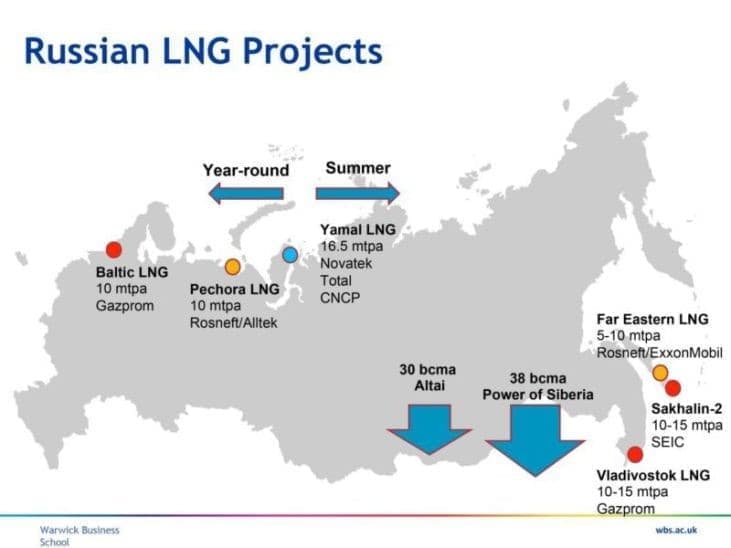

In contrast, Sakhalin-2, Russia’s first LNG project, exports gas to the Asia-Pacific all year-round. In 2016, the plant supplied 6 percent of Asian LNG demand. In particular, supplies to Japan and South Korea have cover to 8.6 percent and 8 percent of national demand respectively.

(Click to enlarge)

Subsidies and tax exemptions

The success of Yamal LNG may be remarkable, but it would not be achieved without government subsidies and tax exemptions. The Yamal-Nenets Autonomous Okrug received substantial privileges that made Yamal commercially profitable even with low fuel prices. Novatek obtained a 12-year tax holiday from the Mineral Extraction Tax (MET) and was exempted from export duties with all Russia’s LNG projects. In addition, the Russian government supported the construction of port facilities. Related: The Impact Of Gazprom’s China-Russia Gas Pipeline

It is less surprising to see that LNG projects that did not receive as much government support have been postponed. Gazprom’s Vladivostok LNG, previously a flagship project of Japan-Russia energy relations, is no longer a priority for the Russian monopoly and has been indefinitely postponed. The development of Rosneft’s Far East LNG, once paralyzed by a power struggle between Gazprom and Rosneft, is now commercially unattractive due to high production costs. The final investment decision has been postponed until 2019 and the decision on construction will be possibly made after 2023 or later. Other Russia’s LNG projects such as Baltic LNG and Pechora LNG are directed to the West only.

(Click to enlarge)

Outlook for expansion

The expansion of Sakhalin-2, namely building a third LNG train, is being discussed as a potential project in the framework of Japan-Russia energy cooperation. However, the source for the gas – the South Kirinskoye field – is currently under U.S. sanctions because of its oil reserves. This makes it difficult for Gazprom to find potential investors in the West and its allies.

After its successful launch, Novatek’s CEO Leonid Mikhelson announced the plan to expand the plant’s capacity and to build Arctic LNG-2, which would produce another 19.8 Mt. The construction of Arctic LNG-2 is planned for 2023 with full capacity to be reached by 2026. Currently, France’s Total SA, China’s CNPC, Japan’s Marubeni Corporation and Saudi Arabia’s Saudi Aramco are showing interest in the project. However, according to the Institute of Energy Economics’ outlook for LNG market, by mid-2020s supply and demand will reach a balance of about 400 Mt. Between 2020 and 2025, Oceania and North America are planning to start operation of their LNG terminals. By 2030, there will be no shortage of LNG supply, as with current projects under plan world LNG supply gets another 370 Mt. In this situation, it will be difficult to find buyers and to attract sufficient investment. Related: Iran Fails To Comply With OPEC Deal

High dependency on China

ADVERTISEMENT

By 2035, the Russian government plans to increase its share of the Asia-Pacific natural gas trade to 33 percent. However, so far Russia’s pivot to Asia has largely been a turn to China. China is now substantially involved in Russian gas projects. Chinese lenders provided support of $12 billion out of an overall $27 billion needed for Yamal LNG. Once Yamal is fully operating in 2019, 4 Mt are planned to be exported to China each year. Earlier, in May 2014, Russia also signed a 30-year gas deal with China. If developed on schedule, by 2030 the Power of Siberia and Altai pipelines together would deliver 68 billion cubic meters per annum (bcma), as opposed to 80 bcma to Europe.

In the attempts to find non-Western capital and to diversify energy supplies from the European markets, Russia will become more and more dependent on China. By 2030, China will be the main importer of natural gas, including LNG, and will replace Japan. China’s rising demand in gas and the lack of new buyers will make Russia more subject to China’s dominating position, whereby Chinese investors can exploit their strong bargaining position over price, routes and supplies.

By Maria Shagina via Global Risk Insights

More Top Reads From Oilprice.com:

- OPEC And Shale Keep Oil Prices Between $60-$75

- Offshore Oil Is Poised For Significant Growth

- How To Avoid Blackouts Using 100% Renewable Energy