Fears of another downturn in prices in the lead up to the OPEC meeting are now in the rearview mirror, with oil prices continuing to climb since the announcement.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

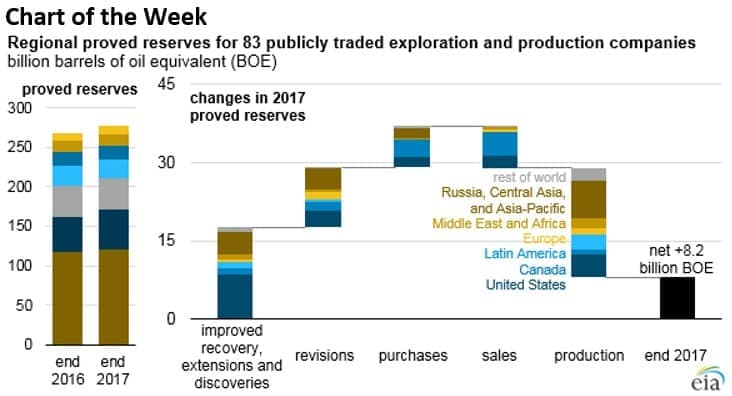

- In 2017, the oil and gas reserves at a selection of 83 publicly-traded companies grew by the most since 2013.

- The companies added a combined 8.2 billion barrels of oil equivalent (boe) to their proved reserves, pushing the total up to 277 billion boe.

- Spending on exploration and development rose by 11 percent compared to 2016 levels, but expenditures were still down 47 percent compared to 2013.

Market Movers

• A federal judge dismissed a lawsuit by the cities of San Francisco and Oakland aimed five oil majors – BP (NYSE: BP), Royal Dutch Shell (NYSE: RDS.A), Exxon Mobil (NYSE: XOM), ConocoPhillips (NYSE: COP) and Chevron (NYSE: CVX) – over their role in fueling climate change. The suit charged that the oil majors should pay damages that the cities need to take on to adapt to climate change. The judge acknowledged the threat of climate change, but ruled that the issue must be solved “by our political branches.”

• Petrobras (NYSE: PBR) began pumping its first oil at the offshore Tartaruga Verde field. The floating production unit could add 150,000 bpd of supply when at full capacity.

• Oasis Petroleum (NYSE: OAS) announced plans to sell non-core assets in the Williston basin for $283 million.

Tuesday June 26, 2018

Oil prices moved up on Tuesday after reports of outages in Canada and ongoing uncertainty in Libya. The market seems to have digested the news of higher OPEC+ production, and is now moving on. The increase from OPEC+ may only reach 600,000 bpd or so, while the outages in a series of countries are accumulating. The fears of another downturn in prices in the lead up to the OPEC meeting are now in the rearview mirror.

Syncrude outage sends WTI soaring. Syncrude Canada suffered an equipment malfunction at one of its oil sands facilities, which could disrupt as much as 360,000 bpd for the month of July. The outage significantly narrowed the WTI-Brent discount, pushing up WTI on expectations of much tighter supplies in North America. Lower flows from Canada could drain inventories at the Cushing hub in Oklahoma, a closely-watched metric that helps determine WTI prices. “With the global market pricing to pull crude out of the U.S., this loss of U.S. supplies will exacerbate the current global deficit, making the increase in OPEC production all the more required,” Goldman Sachs analysts wrote. Related: A Storm Is Brewing In The Southern Gas Corridor

Shell approves North Sea project. Royal Dutch Shell (NYSE: RDS.A) gave the greenlight to a project in the North Sea, the second for Shell in the region in the past six months. The natural gas project was deemed uneconomical six years ago, but Shell has dramatically reduced costs. Shell will produce from two wells in the Fram field in the central North Sea by 2020. The project is not a massive one, but it illustrates how Shell and other companies have boosted the viability of the North Sea.

Permian Highway Pipeline Project could provide outlet for Permian gas. A group of companies including Kinder Morgan Texas Pipeline LLC, a subsidiary of Kinder Morgan (NYSE: KMI), EagleClaw Midstream Ventures LLC and Apache Corp. (NYSE: APA) announced they have signed a letter of intent to develop the Permian Highway Pipeline Project, which would carry natural gas from the Permian to the Gulf Coast. The $2 billion PHP project would move 2 billion cubic feet of natural gas per day (bcf/d) from Waha, Texas to the Texas Coast and to Mexico, and the companies aim to bring it online in late 2020.

ExxonMobil exits talks over Iraq Seawater Project. ExxonMobil (NYSE: XOM) decided to walk away from talks with Iraq over a seawater project crucial to boosting oil production in the country, a sign of tepid interest in Iraq, in part because of the unattractive terms offered. The Common Seawater Supply Project is needed for Iraq to significantly grow oil production, but it has been repeatedly delayed. Exxon’s exit is the latest setback.

ADVERTISEMENT

Libya puts out fires at storage tanks. Two storage tanks at the Ras Lanuf export terminal in Libya were destroyed, but the National Oil Corp. extinguished fires to save other facilities from destruction. Libya had suffered the loss of 450,000 bpd of production because of the port outages, and the NOC said it hopes to resume operations in a “couple of days.” However, forces loyal to military commander Khalifa Haftar in east Libya have handed control of the oil export terminals to the National Oil Corp. based in Benghazi. The NOC in Tripoli denounced the move, arguing that it alone is the rightful authority to control the country’s oil. The dispute creates new uncertainty and could deter international companies from buying Libya’s oil.

Banks flee Iran in sign of disruptions to come. A growing number of foreign banks that helped Iran trade oil are pulling out over fears of U.S. sanctions, including banks that have no U.S. exposure. The banks fear losing access to U.S. dollars. The shrinking availability of finance from international banks could magnify the disruptions in Iranian oil exports, despite assurances from the European Union, China and India that they want to continue buying Iranian oil. Early estimates suggest that Iran’s oil exports have declined to 2.2 million barrels per day (mb/d) in June, down from 2.7 mb/d in May.

Related: A Storm Is Brewing In The Southern Gas Corridor

GE to sell stake in Baker Hughes. Struggling industrial giant GE (NYSE: GE) said on Tuesday that it would spin off its health-care unit and sell its stake in oilfield services company Baker Hughes. The announcement comes a day after the company announced the sale of its distributed power unit for $3.25 billion. GE only bought a major stake in Baker Hughes a year ago, but its need to raise cash and pay off debt is forcing the storied industrial company to shed assets.

Trump to unveil biofuels proposal for 2019. The Trump administration is set to announce next year’s biofuels requirements for oil refiners. Bloomberg reports that the administration will require 19.88 billion gallons of biofuels to be blended into the fuel mix in 2019, including 15 billion gallons of corn ethanol, and the remainder from advanced biofuels. The plan does not include a previously considered proposal that would have added additional requirements to refiners in lieu of the waivers granted to an array of refiners. The Trump administration continues to try to walk a fine line in the battle between refiners and the biofuels industries.

China to drive global gas demand. In a new IEA report, global gas demand is set to rise 1.6 percent annually through 2023, driven largely by soaring Chinese demand. "China, whose market grew by an astonishing 15% in 2017 with a strong coal-to-gas switching program in the residential and industrial sectors, is set to continue to lead the trend with an expected average annual growth rate of 8% for the next five years," the agency said. "Driven by continuous economic growth and strong policy support to curb air pollution, China accounts for 37% of the global increase in gas consumption between 2017 and 2023, more than any other country."

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- This Is Aramco’s Spare Production Capacity

- Goldman Blames Canada For WTI Price Spike

- Oil Prices Spike Despite Saudi Plan For Unprecedented Oil Export Surge