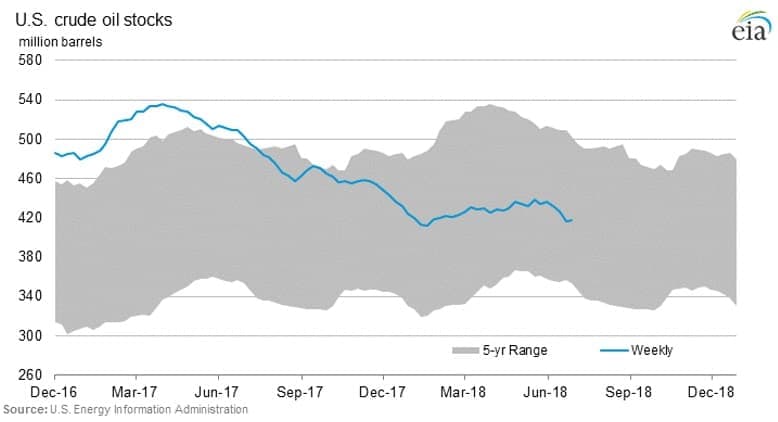

Oil prices fell slightly Friday morning after an EIA report highlighting an unexpected build in crude inventories, with a Saudi supply surge adding further downward pressure on the crude market.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, July 6, 2018

Oil prices dipped on Thursday and in early trading on Friday following a disappointing report from the EIA, which showed an unexpected build in crude inventories. Meanwhile, the U.S.-China trade war began in earnest on Friday, raising concerns about a slowdown in demand. Finally, an increase in oil production from Saudi Arabia dragged down prices.

U.S.-China tariffs begin. U.S. tariffs on $34 billion worth of Chinese goods began on Friday, with retaliatory tariffs from China immediately implemented. China said the U.S. has now initiated the largest trade war in history. The escalation of the trade war is showing no signs of reaching a resolution, and it comes at a time when global trade is slowing down anyway, raising threats to global economic growth. And as China moves to put tariffs on U.S. crude, Chinese refiners are looking elsewhere for oil imports. China is expected to import around 400,000 bpd from the U.S. in July. Meanwhile, the EU is compiling a list of American goods for new tariffs.

Saudi Arabia added 500,000 bpd in June. New reports surfaced recently suggesting that Saudi Arabia ramped up production in June, but the latest from Reuters pegs the figure at 10.5 million barrels per day, or an increase of 500,000 bpd from a month earlier. Saudi Arabia’s all-time record high stands at about 10.7 mb/d, and by all indications, Riyadh is planning to breach that threshold this month. President Trump issued several demands via twitter this week for more production, and the Saudis look set to comply. Related: Do Trump’s Tweets Point To Another Oil Crisis?

$150 oil possible. A dearth of investment in new sources of oil production could lead to a price spike, and investors who demanded capital discipline from oil companies may soon regret that position. “Investors who had egged on management teams to reign in capex and return cash will lament the underinvestment in the industry,” Sanford C. Bernstein & Co. wrote in a note. “Any shortfall in supply will result in a super-spike in prices, potentially much larger than the $150 a barrel spike witnessed in 2008.” Oversupply in the past few years has masked “chronic underinvestment,” Bernstein said. The oil majors have seen their reserves fall by an average of 30 percent since 2000. “If oil demand continues to grow to 2030 and beyond, the strategy of returning cash to shareholders and underinvesting in reserves will only turn out to sow the seeds of the next super-cycle,” the analysts wrote.

Saudi Aramco IPO might not happen. The WSJ reports that preparations for the public offering of Saudi Aramco “have stalled,” raising doubts about whether or not the IPO will ever happen. The Aramco IPO was slated to be the largest public offering in history, and it was a centerpiece of the Saudi crown prince’s plans for economic transformation. Sources told the WSJ that Saudi Arabia is simply not ready for the IPO, and Saudi officials don’t want the scrutiny that comes with a public offering. Listing the company in London or New York would carry legal risks, while a domestic listing would overwhelm the Saudi stock exchange. “Everyone is almost certain it is not going to happen,” a senior Aramco executive told the WSJ.

South Korea halts Iranian oil imports. Under the pressure of U.S. sanctions, South Korea has suspended imports of Iranian oil. It will be the first time in six years that South Korea has zeroed out imports from Iran.

ADVERTISEMENT

Offshore activity picks up. The pace of seismic work contracted out by oil producers doubled in the first quarter of this year, compared to the fourth quarter of 2017. The pickup is a sign that the rise in oil prices is leading to more offshore exploration after several years of a downturn. Upstream companies scanned 40,000 square kilometers in the first quarter, double the size from late 2017.

Mexico’s new president to release energy details in August and September. Mexico’s president-elect, Andres Manuel Lopez Obrador, has fueled a lot of speculation about his plans for the country’s energy sector. One of his top advisers said that details of the administration’s energy plans will be released in September. But Lopez Obrador also said he would announced details on the buildout of domestic refineries in August. Before that, though, his team will audit the oil and gas contracts that were already awarded to international companies. Mexico has awarded 110 blocks over the last three years.

Related: The Saudis Won’t Prevent The Next Oil Shock

Scott Pruitt resigns amid scandal. U.S. EPA Administrator Scott Pruitt finally resigned after months of bad press about his unethical behavior. Pruitt was the subject of at least 13 separate federal investigations. His time at EPA was marked by an extraordinary deregulatory campaign to boost the oil and gas industry. His deputy, Andy Wheeler, will take over and will likely pick up where Pruitt left off.

U.S. judge rules Conoco can depose Citgo. As ConocoPhillips (NYSE: COP) continues to try to enforce a $2 billion arbitration award against Venezuela’s PDVSA, the American oil company wants to ensnare PDVSA’s subsidiary, Citgo. A U.S. district court ruled on Thursday that Conoco can depose Citgo as it proceeds with the legal fight. Conoco alleges that PDVSA transferred oil and refined fuels to Citgo to avoid having assets seized.

Goldman Sachs: Commodities will still rise even in face of trade war. Goldman Sachs maintained its bullish outlook on commodities, arguing in a research note that the trade war will not derail rising prices. The investment bank predicted a 10 percent return on commodities over the next 12 months.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- As Diesel Dies, One Commodity Is Crashing

- Mexico’s New Government Won’t Upend Energy Reforms

- Trump Is Fracturing OPEC

I dont get why WTI was up with a crude build, rig count up, and with the trade war.

Lastly, what happens in Alaska this time of year that knocks off 50-100k bpd? Production would have hit 11m otherwise with the rounding