WTI crude hangs above $80 per barrel as geopolitical risks have eased somewhat, but haven't disappeared altogether.

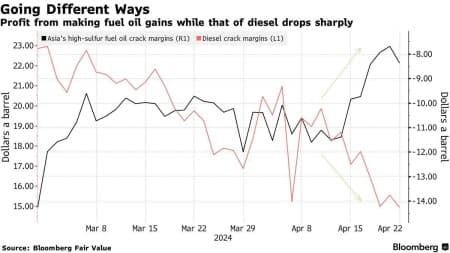

Fuel Oil Is Having Its Sunshine Moment

- Fuel oil has risen to prominence as the most improved oil product of late, boosted by higher demand from Asia’s power generation sector as well as limited supply of heavy crudes required to produce it.

- The US’ snapback of sanctions against Venezuela and Mexico’s sudden cut to exports of heavy sour grades such as Maya have greatly limited the pool of heavier crudes Asia could buy, just as OPEC+ keeps on restricting its production by voluntary cuts.

- The collapse in Asian and European diesel cracks, both down $6-7 per barrel since the beginning of April, came on the heels of higher refinery runs, however fuel oil wasn’t as abundant with ship bunkering and increasing power generation demand from countries like Pakistan or Saudi Arabia kept supply limited.

- With Asian and US fuel oil cracks as low as -$8 per barrel, whilst European cracks remain slightly in the low double digits, prices of heavy sour crudes are poised to balloon over the upcoming weeks including Middle Eastern formula prices.

Market Movers

- Crescent Midstream, a US-based midstream operator backed by Carlyle Group, is reportedly exploring a potential sale after receiving takeover interest, with the Gulf of Mexico-focused firm valued at $1.3 billion including debt.

- US oilfield services giant Baker Hughes (NASDAQ:BKR) landed a deal with Saudi Aramco that would see it delivering equipment to the third phase of the Saudi NOC’s gas network expansion.

- Delayed by several years, UK oil major BP (NYSE:BP) launched the $6 billion Azeri Central East platform it operates offshore Azerbaijan, seeking to boost production by 23,000 b/d by year-end.

Tuesday, April 23, 2024

After a string of politics-heavy weeks when the oil markets were predominantly focused on political risks such as a potential Israel-Iran war, macroeconomics are back in business, with Brent dropping marginally lower to $86 per barrel. The markets have shrugged off the looming threat of Iranian sanctions, believing they wouldn’t have a material impact on physical flows.

Trafigura Bets Big on Copper Boom. Global commodity trader Trafigura believes increasing demand from EVs, power infrastructure, AI and automation will add at least 10 million metric tonnes of additional copper consumption over the next decade, expecting a bull run in the late 2020s.

Equinor Might Feel the Environmentalist Squeeze, Too. A small group of investors led by the UK-based Sarasin & Partners filed a resolution at Norway’s state oil firm Equinor (NYSE:EQNR) to ramp up the ambition of its emissions-cutting, even though the Norwegian state that owns 67% has voted against all previous climate resolutions.

The US Gulf’s Superport Lacks Commercial Backing. The ambitious plan of Enterprise Product Partners (NYSE:EPD) to build the first deepwater port in the US Gulf, capable of loading VLCCs, has been stalled as Chevron and Enbridge both backed out and stagnating US oil supply makes new capacity less desirable.

Namibia’s Giant Discovery Too Big to Handle. Portugal’s national oil company Galp Energia (GALP) is reportedly looking to farm out half of its stake in exploration block PEL 83 offshore Namibia, having only recently discovered a multi-billion-barrel field with its Mopane-1 exploration well.

Jet Fuel Demand Fails to Catch Up with Flights. As newer generations of passenger aircraft become more fuel efficient, the recovery in flight activity will most probably not lead to jet fuel demand surpassing pre-pandemic levels as the IAE forecasts kerosene demand to rise to 7.4 million b/d, still a far cry from 7.9 million b/d in 2019.

Global Traders Cash In On Byzantine Sanctions. Glencore and Trafigura stand to benefit from recent UK sanctions on Russian aluminium as they withdrew some $400 million worth of material from LME warehouses and re-registered it under a new designation, signing storage deals with warehouses to get a share of the rent for as long as it's there.

Saudi Arabia Penetrates Even Deeper into China’s Downstream. Saudi national oil firm Saudi Aramco (TADAWUL:2222) signed a preliminary agreement to buy a 10% stake in one of China’s newest refineries, the 400,000 b/d Hengli Petrochemical.

Back Under Sanctions, Venezuela Flirts with Crypto Again. PDVSA, the national oil firm of Venezuela, is looking to hedge against dollar risks by shifting its crude and fuel oil exports to digital currencies, including the dollar-pegged cryptocurrency known as Tether.

Slowing Down of Electric Transition Puts EU Targets at Risk. The European Court of Auditors, the EU’s auditing service, warned that the bloc’s 2035 ban on fossil cars would hurt its own industry and aggravate dependencies, suggesting a policy rethink amidst slower-than-assumed EV growth.

Gulf of Mexico to Hold Second Offshore Wind Auction. Even though the first Gulf of Mexico offshore wind tender last August saw only one competitive bid, BOEM is pushing ahead with the second lease sale to be held in the fall, offering new acreage in offshore Louisiana and allowing for the production of hydrogen.

Everyone Wants a Piece of UAE Gas. European energy majors TotalEnergies (NYSE:TTE) and Shell (LON:SHEL) are in talks to buy stakes in the next LNG export project of ADNOC, with market rumours suggesting an FID on the project might come as promptly as next month.

California Vows to Finish Exxon Probe Shortly. California’s attorney general promised to conclude a two-year investigation into US oil major ExxonMobil (NYSE:XOM), previously subpoenaed, and the oil industry’s role in global plastic pollution by summer, hinting at a potential lawsuit arising therefrom.

Canada Objects to Mega-Agriculture Merger. Canada’s Competition Bureau flagged major competition concerns around the proposed $34 billion merger between top grain traders Bunge (NYSE:BG) and Glencore-backed Viterra (LON:GLEN), saying it would harm competition for grain markets in Western Canada.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Stabilize as Geopolitical Risk Cools

- American Gasoline Prices Rise for Third Straight Week

- Should We Keep Investing in Oil and Gas? Experts Weigh In