Powerful start to the week, only to see the robust buildup disintegrate by Wednesday – a brief resume of how hopes of a crude price surge went awry this week. On paper, it seemed that last week’s tanker attacks and the ensuing jitteriness about shipping prospects via the Hormuz Strait, coupled with the resumption of US-China trade talks ahead of next week’s G20 summit in Japan, would bring Brent back to $65 per barrel. In fact, Tuesday witnessed the largest daily buildup in prices since the first days of January on the news of OPEC fixing its meeting date and a better prospect of a trade deal between the U.S. and China.

End of business on Wednesday, global crude benchmark Brent traded in the $61.8-62 per barrel frame, whilst American benchmark WTI hovered in the $54.1-54.3 per barrel interval.

1. U.S. Extends Iraq’s Gas-Importing Waiver for Further 120 Days

- The US State Department has extended Iraq’s waivers to import natural gas and electricity from Iran for another 120 days, in what might be perceived as a thickly veiled sign of conflict relaxation.

- Wary of protests emerging in the wake of the 2018 Basrah riots, the first waivers was granted for a period of 45 days, followed by two consecutive 90-day exemptions.

- Iraq imports roughly a third of its 14-15 GW electricity demand, primarily by importing gas via cross-border pipelines into the Diyala, Baghdad and Basra provinces that are fed from Iran’s IGAT-6 gas trunkline.

-…

Powerful start to the week, only to see the robust buildup disintegrate by Wednesday – a brief resume of how hopes of a crude price surge went awry this week. On paper, it seemed that last week’s tanker attacks and the ensuing jitteriness about shipping prospects via the Hormuz Strait, coupled with the resumption of US-China trade talks ahead of next week’s G20 summit in Japan, would bring Brent back to $65 per barrel. In fact, Tuesday witnessed the largest daily buildup in prices since the first days of January on the news of OPEC fixing its meeting date and a better prospect of a trade deal between the U.S. and China.

End of business on Wednesday, global crude benchmark Brent traded in the $61.8-62 per barrel frame, whilst American benchmark WTI hovered in the $54.1-54.3 per barrel interval.

1. U.S. Extends Iraq’s Gas-Importing Waiver for Further 120 Days

- The US State Department has extended Iraq’s waivers to import natural gas and electricity from Iran for another 120 days, in what might be perceived as a thickly veiled sign of conflict relaxation.

- Wary of protests emerging in the wake of the 2018 Basrah riots, the first waivers was granted for a period of 45 days, followed by two consecutive 90-day exemptions.

- Iraq imports roughly a third of its 14-15 GW electricity demand, primarily by importing gas via cross-border pipelines into the Diyala, Baghdad and Basra provinces that are fed from Iran’s IGAT-6 gas trunkline.

- Baghdad promises to do better, however with a 50 percent distribution loss rate and a 25 percent electricity bill collection rate it can only do so much.

- The total volume imported by Iraq from its neighbor amounts to some 1.6 BCf per day, equivalent to 7-8 percent of Iran’s aggregate output of 22-23 BCf per day.

2. Japan Revives Largest Indonesian Offshore Project

- Japanese oil and gas company Inpex clinched a deal on the development of Indonesia’s largest hydrocarbon find, the 18.5 TCf and 3.2 Bboe deepwater Masela block.

- Masela will feed the Abadi LNG project, producing 9.5 million tons of LNG per year, to be processed at an onshore site from 2027 onwards.

- Wielding an investment value of $18-20 billion, INPEX will operate the largest investment project in the country’s history.

- Inpex expects to take the final investment decision around 2022-2023, however it seems the FID will be taken without Royal Dutch Shell which heretofore owned 35 percent of the project.

- Shell has been frequently voicing disaccord with the Indonesian government’s insistence on building an onshore processing plant, claiming a FLNG option would be cheaper and quicker to construct.

- With seismic risks jeopardizing the construction of the 180km subsea pipeline, Inpex will have a difficult time replacing Shell with someone this venturesome.

3. Iran Raises Asia Prices, Yet Not As Much As Peers

- Iran’s national oil company NIOC raised its July-loading official selling prices for crude cargoes destined for Asian markets, replicating Saudi Aramco’s hike.

- Iranian Light was hiked 55 cents m-o-m to a 2.2 USD per barrel premium, the biggest since July 2018, whilst Iranian Heavy was increased by 45 cents to 0.6 USD per barrel (the highest in 5 years).

- This brings Iranian Light to its steepest discount to Arab Light, standing at 50 cents per barrel – before the US sanctions Iranian Light was traditionally assessed at a premium to Arab Light.

- OSPs for Iranian Light and Iranian Heavy cargoes bound for NW Europe have been cut by 1.05 and 1.45 USD per barrel, respectively – no relevance implies as last vessels reached it a year ago.

- Similarly, the 55 cent m-o-m increase to a -3.4 USD per barrel discount against Dated for Mediterranean-bound cargoes makes little difference as Asia remains the only remaining market outlet for Iranian crude.

4. Urals Prices Nosedive on Sudden Summer Weakness

- Weak refining margins, aftershocks of an organic chloride contamination story as well as a June supply overhang contributed to the drastic drop in Urals values over the course of the past few days.

- If exactly 1 month ago, Urals traded at a +1 USD per barrel premium against Dated, now it has slid to -2.5/-2.7 USD per barrel territory.

- Organic chloride contamination remains an issue for potential buyers, especially in the Baltic port of Ust-Luga where chloride content still hovers slightly above the Russian standard for crude (i.e. 2-5ppm in total crude) and on the edge of refinability.

- Primorsk loadings are reported to be fully compliant with the Russian GOST standards with regards to organic chloride.

- A weaker early July schedule will buttress Urals against Dated in the Baltics for a while, whilst there is little probability so far in Urals Med narrowing in to Brent.

5. Mexico Drops USGC K-Factors, Hikes Asian Ones

- PMI Comercio International, the trading arm of Mexican NOC PEMEX, has issued K-factors for July-loading cargoes, hiking Asian differentials on both its Maya and Isthmus streams.

- The Mexican K-factor is PEMEX’s peculiar way of adjusting export prices under conditions when its exports are routinely priced as a weighted average of the leading price indicators of the relevant region.

- Thus, PMI has dropped the Maya K-factor differential for US Gulf Coast for July-loading deliveries $1 per barrel month-on-month, following a six-month high in June 2019.

- For the first time in more than 2 years, the K-Factor for Asia-bound Isthmus cargoes loading in July will be set above zero, hitting a 55 cent month-on-month increase to 0.3 USD per barrel.

- The Asian K-Factor for Maya cargoes was raised by 60 cents m-o-m to an equally rarely seen -4.2 USD per barrel discount.

- Every single month this year so far, Mexico’s production has been lower than equivalent month year-on-year, with May 2019 output dropping to 1.679mbpd and exports to 1.243mbpd.

6. Mexico Cancels Farm-Out Round

- Mexico’s oil and gas regulator, Comisión Nacional de Hidrocarburos (CNH), canceled the long-mooted farming-out auction that would have seen investors taking a stake in 7 producing blocks.

- The blocks – comprising the Artesa, Bacal-Nelash, Bedel-Gasifero, Cinco Presidentes, Giraldas-Sunuapa, Juspi-Teotleco and Lacamango – have been underdeveloped and underfunded by the cash-strapped Mexican NOC, PEMEX.

- The blocks currently produce 33kbpd of oil and PEMEX itself estimates that this would fall to 20kbpd next year unless new sources of financing are found.

- The farm-out cancellation fortifies market fears that the AMLO administration will seal off foreign investors from all (previously planned) future oil and gas investment possibilities.

- Oddly enough, the cancellation takes place against the background of the same CNH’s approval of Shell’s 2.4 billion deepwater exploration program on 4 blocks in the Perdido Folt Belt, acquired in the 2nd licensing round of 2014.

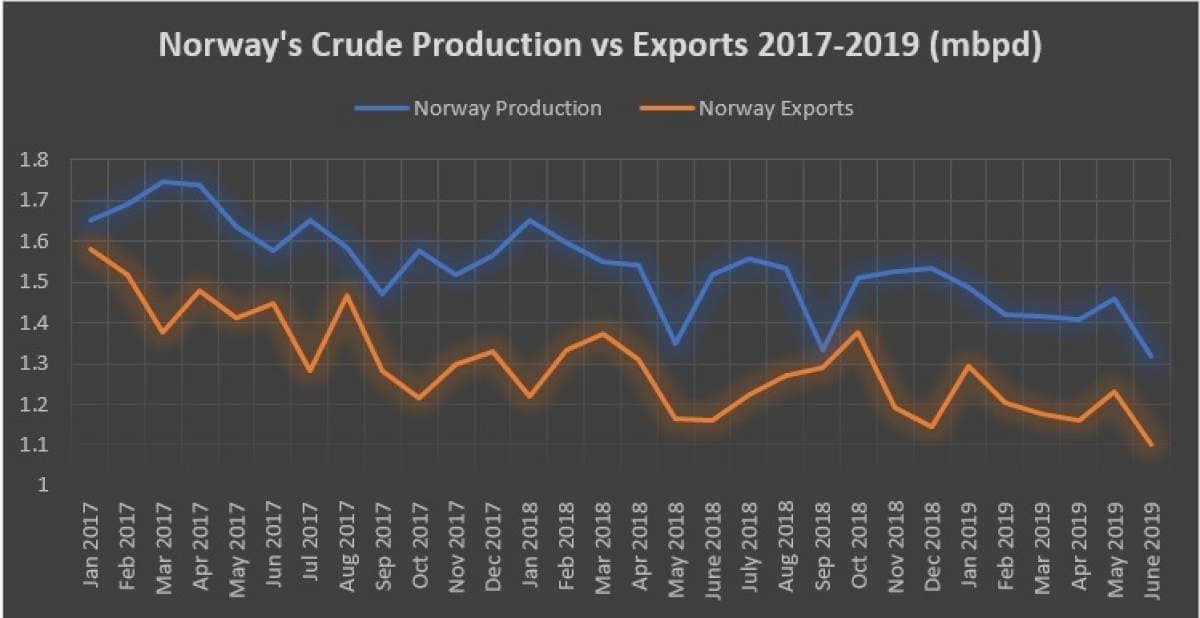

7. As Norway Prepares for Johan Sverdrup, It Struggles to Replace Reserves

- As Norway’s Equinor readies for the commissioning of the 2.1-3 BBboe Johan Sverdrup field, the 5th largest on the Norwegian continental shelf, its upstream results attest of a drilling cold streak.

- First oil is expected in November 2019 (leading up to a Phase One plateau of 440kbpd), with Phase Two, starting in late 2022, expected to bring peak production to 660kbpd, roughly 30 percent of Norway’s output in the mid-2020s.

- Equinor and its partners were indubitably were happy to unearth such a gem, however recent drilling results elicited no enthusiasm at all on the part of Norway’s drillers.

- Equinor’s high-hope wildcat, Korpfjell, spudded in the Barents Sea area next to the Russian border, turned out to be dry.

- If it does find oil, as demonstrated by two recent discoveries next to its Norne field, Equinor generally finds deposits whose recoverable reserves are in single-digit territory.