For those who are confused why the US has spent tens of billions to keep the Ukraine-Russia war going on and on (setting aside of course money-laundering by the Biden crime family) here is your answer: as FreightWaves' Greg Miller reports, the unstated mission of the US military-industrial complex in the lead up and following the Ukraine war, was to unseat and replace Russia as the largest source of European energy, both crude and nat gas, and in the process push US crude exports to record highs, driven by a surge in European exports.

Indeed, as diplomats convene at the United Nations’ COP 28 climate change summit, fossil fuel production and consumption are hitting new highs, and tanker owners are in prime position to profit from rising trade flows.

The Biden administration is a leading proponent of decarbonization, yet the U.S. is pumping out record volumes of hydrocarbons. America is on track to be the world’s largest producer and exporter of natural gas this year, as well as the leading exporter of refined products and liquefied petroleum gas.

Related: The Oil Demand Outlook COP28 Leaders Would Hate

There are also big wins — for energy producers and shipowners, not decarbonization advocates — on the crude oil front.

The U.S. produced 13.2 million barrels per day (b/d) of crude oil in September, according to data released Thursday by the Energy Information Administration. That is the country’s highest monthly production level ever.

And not only is America producing more crude, it is exporting a larger share of the crude it produces, further boosting volumes aboard tankers bound for Europe and Asia.

Seaborne crude exports up 19% vs. 2022

Exports of U.S. crude were banned between 1975 and 2015. For 40 years, U.S. production could only be sold overseas if it was refined first, then exported as petroleum products.

The end of the ban dramatically increased market opportunities for U.S. production, thereby stimulating higher output — creating more business for oil companies and tanker owners.

That upward momentum continues. Seaborne crude exports are tracked by commodity intelligence provider Kpler. In January-November, its data shows that U.S. seaborne crude exports averaged 4 million b/d, an all-time high and up 19% year on year.

Exports in November averaged 4.45 million b/d, the second-highest monthly average on record, just slightly below the peak of 4.46 million bpd in March.

Volumes rise sharply to both Europe and Asia

The Panama Canal is wreaking havoc on many cargo supply chains, but it has virtually no effect on U.S. crude exports.

U.S. crude exports to Asia are loaded on very large crude carriers (VLCCs; tankers that carry 2 million barrels) via ship-to-ship transfers in the U.S. Gulf. VLCCs are too large to transit either the Panama or Suez canals; they use the Cape of Good Hope.

U.S. exports to Europe are shipped aboard Aframaxes (750,000-barrel capacity), Suezmaxes (1 million-barrel capacity) and VLCCs.

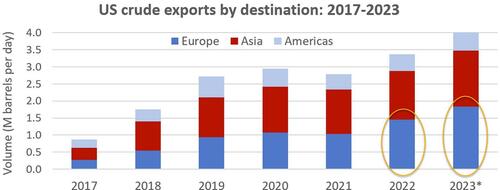

Since the invasion of Ukraine, Europe has hiked its purchases of U.S. crude to help offset banned Russian supply. According to Kpler data, an average of 1.83 million b/d of U.S. crude flowed to Europe in January-November, up 26% from the 2022 full-year average.

Europe’s share of total U.S. crude exports has risen to 46% this year compared to 37% in 2021, the year prior to the invasion, while Asia’s share is 41%, down from 47% in 2021.

“In volumetric terms, the story has been all about Europe this year,” Reid I’Anson, senior commodity analyst at Kpler, told FreightWaves. “Europe continues to grow increasingly reliant on U.S. energy — not just LNG [liquefied natural gas] but across the board.”

Despite the pull of Europe, U.S. crude exports to Asia have also continued to escalate. According to Kpler data, exports to Asia are averaging a record-high 1.65 million b/d year to date, up 15% from last year and up 26% from 2021.

Rising volumes to Asia translate into profitable business for VLCC owners. Brokerage True North Chartering counted 40 spot VLCC cargoes loading in the U.S. Gulf in both October and November, matching the prior monthly high in April.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Russia’s Flagship Crude Oil Falls Below the $60 Price Cap

- The U.S. Wants to Halve Russia’s Oil and Gas Revenues by 2030

- Oil Revenues Send Alberta’s Budget Surplus Soaring

That's the beauty of capitalism ..

Not sure this comment from the contributor is needed in this article:

For those who are confused why the US has spent tens of billions to keep the Ukraine-Russia war going on and on (setting aside of course money-laundering by the Biden crime family) here is your answer: