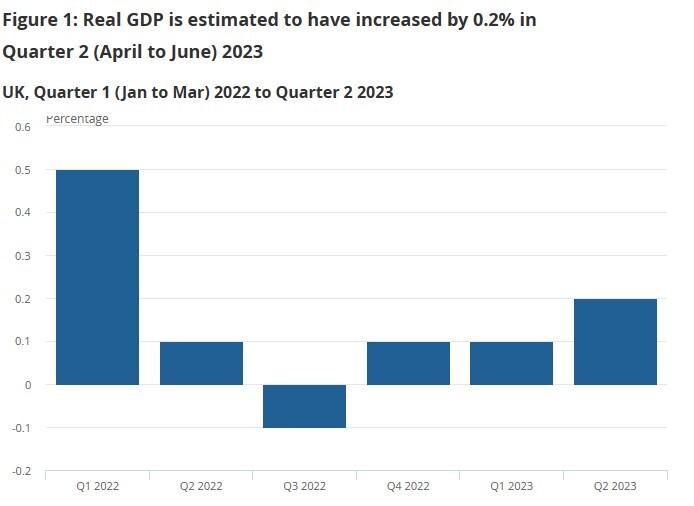

The UK economy grew faster than expected in June, and expanded 0.5 per cent, helping to bring growth in the second quarter to 0.2 per cent – but analysts are divided about what the figures say for the coming months.

Growth in June was given a boost by a strong performance from the production sector, which includes manufacturing, as well as warmer weather attracting punters to pubs and restaurants.

Tombs pointed out that household consumption grew 0.7 per cent in the second quarter despite the impact of soaring inflation.

He argued that going forward households will be able to fuel expansion as cost-of-living pressures ease. Figures out next week are expected to show that wage growth surpassed inflation.

“Looking ahead, we expect households’ real incomes to continue to rise further, as prices continue to rise less quickly than wages,” he argued.

In contrast, Ruth Gregory, deputy chief UK economist at Capital Economics, was less sanguine.

She argued the expansion could mostly be explained by the return to the normal number of working days following the king’s coronation which makes the economy “look stronger than it really is”.

She warned that the full impact of rising interest rates had yet to feed its way through the economy. Some of the most sensitive sectors to interest rates recorded weak performances, such as real estate which saw a third monthly fall in a row.

“We still think that with most of the drag from higher interest rates still to come, GDP will fall in Q3 and a mild recession will begin,” she said.

Making matters worse, Kitty Ussher, chief economist at the Institute of Directors, warned that trends in business investment could be an “early indicator of difficulties ahead”.

While there was a 3.4 per cent increase in business investment in the quarter, this was driven by the imports of US aircraft in April. Elsewhere investment in ICT and machinery declined after the end of the government’s super-deduction allowance, which cut tax rates for business investment.

Davidson suggested the quarter’s strength in business investment is “unlikely to last”.

What about interest rates?

Although analysts are divided about whether the figures signal a positive trend, most are convinced that they are unlikely to attract too much attention in the Bank of England.

At 7.9 per cent, inflation remains well above the Bank’s two per cent target despite a larger than forecast fall in June. The fact that the economy has been able to grow in the second quarter despite the Bank’s aggressive monetary tightening will only strengthen its convictions as it readies for another interest rate hike in September.

ADVERTISEMENT

With further rate hikes priced in, and the full impact of previous hikes yet to be felt, growth is likely to remain subdued for the foreseeable future.

A recent report published by the National Institute for Economic and Social (NIESR) research warned that it will take until the end of 2024 for UK output to surpass its pre-pandemic level, with the think tank highlighting five years of lost economic growth.

NIESR director Jagjit Chadha described the challenges facing Britain, including high inflation, as “the re-emergence of ‘the British disease’.”

By CityAM

More Top Reads From Oilprice.com:

- India Scoops Up Cheapest Russian Oil Since Start Of Ukraine War

- Argentina’s Oil And Gas Industry Will Survive Elections

- Oil, Gas Drilling Still Stalling As Prices Climb

In about half the country house prices are still rising.

Given that the over-heated housing market is the biggest problem after inflation - indeed it is a component of inflation - interest rates still need to be raised.