Breaking News:

U.S. Oil, Gas Drillers See Continued Slowdown

The total number of active…

U.S. Sees New Egyptian Gas Fields As Key To Its New Middle Eastern Strategy

Besides its important geo-strategic location,…

Surprise Crude Build Caps Oil Price Gains

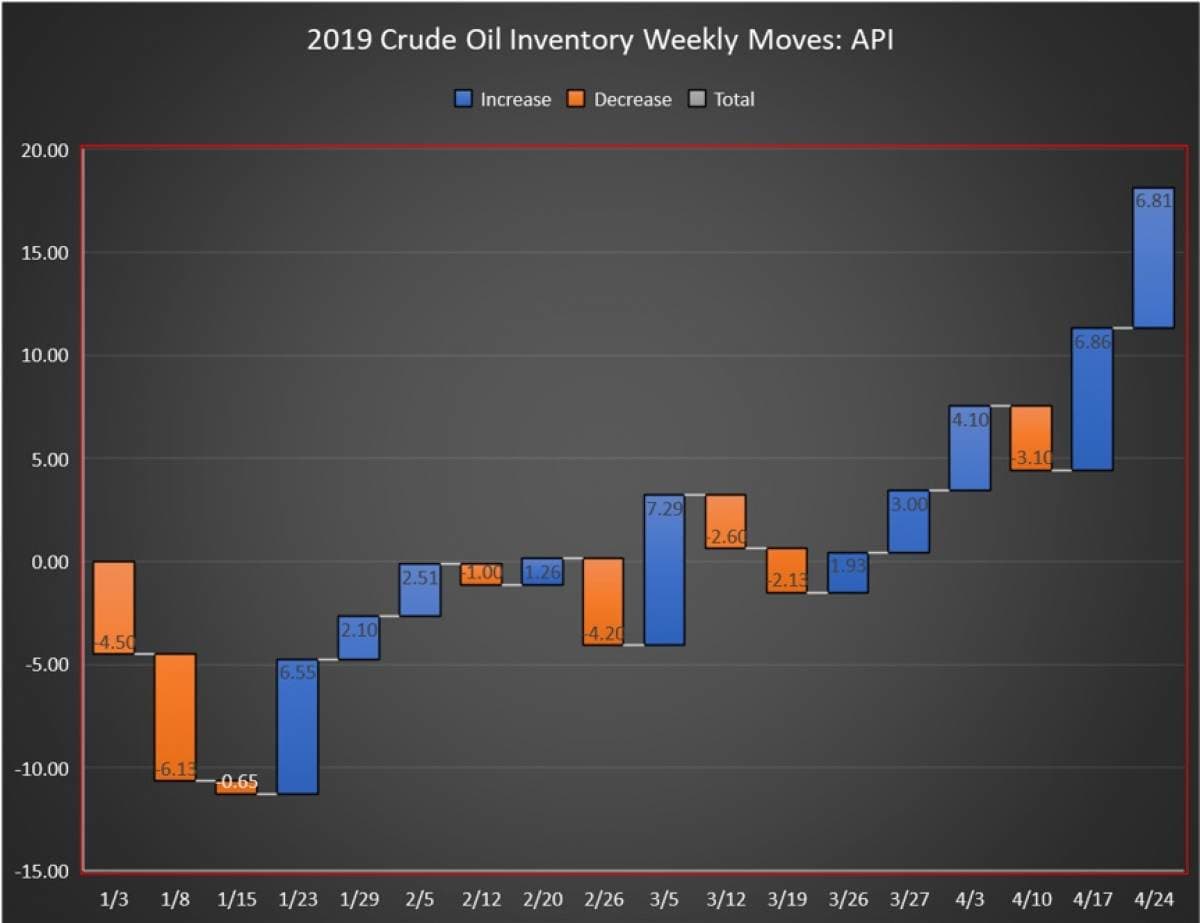

The American Petroleum Institute (API) reported a surprise build in crude oil inventory of 6.81 million barrels for the week ending April 26, coming in over analyst expectations of a 2.093-million-barrel buildup in inventories.

Last week, the API reported a large build in crude oil of 6.86 million barrels. A day later, the EIA confirmed the build with a report of a 5.5-million-barrel drop in inventory.

Including this week’s data, the net build is now 18.11 million barrels for the 18-week reporting period so far this year, using API data.

(Click to enlarge)

Oil prices rose on Tuesday as signs pointed to a continued tightening of global oil supplies as OPEC is giving no indication that it will back off its production quotas.

WTI was trading up on Tuesday before the data release at $64.03, up $0.53 (+0.93%) on the day at 12:29pm, but down week on week by more than $2 per barrel. The Brent benchmark was also trading up on the day at $72.31, $74.21, up $0.77 (+1.08%) at that time. The Brent benchmark was down week on week by nearly $2 per barrel.

The API this week reported a draw in gasoline inventories as well for week ending April 26 in the amount of 1.1 million barrels. Analysts estimated a draw in gasoline inventories of 1.005 million barrels for the week.

Distillates fell by 2.1 million barrels for the week.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending April 19—the latest information available—resumed its all-time high of 12.2 million bpd.

ADVERTISEMENT

The U.S. Energy Information Administration report on crude oil inventories is due to be released on Wednesday at 10:30a.m. EST.

By 4:44pm EST, WTI was trading up at $63.85 and Brent was trading up at $71.96

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Rebound As Saudis Reassure Markets

- 19 Historical Oil Disruptions, And How No.20 Will Shock Markets

- China Set To Miss Shale Gas Production Target By A Mile

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

Build or drop? Come on English majors ???????????????

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B