Breaking News:

Gulf Keystone Petroleum Fights Weak Share Price with Buyback Scheme

Gulf Keystone Petroleum initiates a…

Memorial Day Travel Expected to Near Record High

Around 43.8 million Americans are…

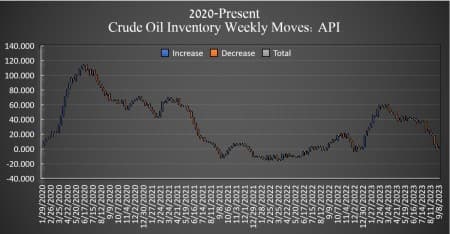

Surprise Crude Build Ends Gains For Oil

The American Petroleum Institute (API) has reported a 1.174-million-barrel build in U.S. crude inventories, compared to the previous week's 5.521-million-barrel draw.

Analysts were expecting an inventory draw of 2 million barrels for the week. The total number of barrels of crude oil gained so far this year is now in the red, according to API data, and there is a net draw in crude inventories since April of more than 47 million barrels.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 300,000 barrels last week, with the SPR inventory still sitting at a near 40-year low of 350.6 million barrels. The amount being funneled into the SPR is a small portion of the hundreds of millions of barrels that were sold off out of the SPR over the last couple of years.

Oil prices were trading up substantially on Tuesday ahead of API data, with Brent trading up 1.61% at $92.10 at 11:51 a.m. ET—a $1 gain week over week, while WTI was trading up 1.99%, at $89.03 per barrel—a gain of more than $1 per barrel from this time last week.

Gasoline inventories were also a build this week, rising by 4.21 million barrels, compared to a 5.09 million barrel draw in the week prior. Gasoline inventories are roughly 5% less than the five-year average for this time of year. Distillate inventories rose by 2.592 million barrels, on top of the 310,000 barrel build in the week prior, and are 14% below the five-year average for this time of year.

Cushing inventories fell by 2.417 million barrels.

By Julianne Geiger for Oilprice.com

ADVERTISEMENT

More Top Reads From Oilprice.com:

- Hedge Fund Partner Blasts Oil Demand Decline Narrative

- Germany Passes Modified Fossil-Fuel Heating Law

- European Parliament Approves Higher Renewable Energy Targets

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

As with so much metal on the US market because of an abundance of Das Auto for sale so too energy product. Borrowing costs continue to soar for everyday Americans but of course for all borrowers meaning everyone. Default risk remains off the charts therefore.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B