Green Transition at Risk as Carbon Offset Schemes Falter

Carbon offset schemes used by…

Yerevan and Baku Disagree on Key Provisions of Bilateral Treaty

Azerbaijan and Armenia's foreign ministers…

UK Government May Cut Energy Support For Business In Half To Save Taxpayer Money

Support for businesses to help them cope with swelling energy bills will halve in the spring to avoid taxpayers holding the bag if oil and gas prices surge again, according to The Times.

Chancellor Jeremy Hunt next month will announce a 12-month extension to a scheme that caps energy costs for businesses, similar to a package for households, although the generosity of the aid will be cut to save money.

Under the existing scheme, launched by former prime minister Liz Truss, firms can grab a discount of up to £345 for a megawatt hour of electricity and £91 for a megawatt hour of gas.

Hunt is expected to scale down subsidies to slash the cost of the package by around £20bn. Without the tweaks, the measures could have cost the taxpayer as much as £40bn.

Truss gave her policy a shelf life of six months.

Every sector of the UK economy is currently eligible for government support, but Hunt wants to reshape the policy so it targets the most vulnerable businesses, such as pubs, bars and restaurants.

Leisure and hospitality chiefs have warned a wave of firms could collapse under the weight of sky high energy bills unless the government stumps up more cash.

But, channeling money into the sector is tough due to the poor standard of data energy suppliers keep on business customers.

International energy markets were rocked in 2022 due to capacity constraints and Russia’s illegal invasion of Ukraine.

Related: Gasoline Prices Spike On Refinery Shutdowns

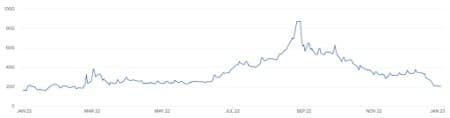

Contracts for future UK gas supplies peaked in the summer at nearly £900. However, they are now trading below pre-Russia-Ukraine war levels.

European energy prices have also fallen sharply recently, driven by countries replacing Russian supplies with liquified natural gas imports and the unusually warm winter curbing demand.

UK gas futures price in 2022

Source: ICE

But analysts are concerned energy prices could surge again 2023 if Britain and Europe experience a cold snap, Russia removes further supplies and China’s economic reopening pumps up oil and gas demand.

Under that scenario, taxpayers could be left with a big bill if the government retains a universal energy bill support package for businesses.

Typical annual household energy costs are currently capped at £2,500, but this will rise to £3,100 from April.

ADVERTISEMENT

Hunt and prime minister Rishi Sunak are trying to curb government spending to rebalance the public finances. Last month’s autumn statement saw the pair cut spending and raise taxes by £55bn.

The tax burden is on course to rise to its highest level since just after the second World War, according to the Office for Budget Responsibility.

The treasury told City A.M. they are “carrying out a review [of the scheme] with the aim of reducing the public finances’ exposure to volatile international energy prices from April 2023.”

“We will announce the outcome of this review in the New Year to ensure businesses have sufficient certainty about future support before the current scheme ends in March 2023.”

By City AM

More Top Reads From Oilprice.com:

- The 10 Most Influential Figures In The History Of Oil

- The Oil Market Crisis Sparked By Russia’s Invasion Is Nearing Its End

- Russian Crude Oil Exports Plummeted At The End Of 2022

City A.M

CityAM.com is the online presence of City A.M., London's first free daily business newspaper. Both platforms cover financial and business news as well as sport and…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B