First, they said the production curtailments will remain in place until some 35 million barrels of excessive inventories are cleared. Then they said producers only need to wait until Enbridge’s Line 3 is commissioned at the end of 2019, creating a new conduit for ever-increasing Canadian production. This was all in December 2018 when then-Alberta premier Rachel Notley introduced mandatory output constraints for all major producers. In September 2019, the new Alberta Premier Jason Kenney and his government declare that the production quotas will be extended for another year, on the back of Alberta’s lifeline, the Line 3 pipeline, being delayed by legal proceedings in the United States. Is it really worth it?

It is important to remember that the Alberta dilemma – choosing between a market-driven yet very depreciation-prone pricing regime or boosting prices by mandating curtailments that punish the big and spare the small – is not a struggle between politicians and business. Both major political parties present in Alberta supported the production quotas because they brought in additional money for the regional budget. But companies were in it, too. Cenovus Energy, Canada’s fourth-largest producer, was one of the most vocal proponents of such production cuts, whilst the second and third-largest producers in Suncor and Imperial Oil opposed the move and still express reservations to its prolongation.

Cognizant of the reputational risks inherent in clinging onto mandatory…

First, they said the production curtailments will remain in place until some 35 million barrels of excessive inventories are cleared. Then they said producers only need to wait until Enbridge’s Line 3 is commissioned at the end of 2019, creating a new conduit for ever-increasing Canadian production. This was all in December 2018 when then-Alberta premier Rachel Notley introduced mandatory output constraints for all major producers. In September 2019, the new Alberta Premier Jason Kenney and his government declare that the production quotas will be extended for another year, on the back of Alberta’s lifeline, the Line 3 pipeline, being delayed by legal proceedings in the United States. Is it really worth it?

It is important to remember that the Alberta dilemma – choosing between a market-driven yet very depreciation-prone pricing regime or boosting prices by mandating curtailments that punish the big and spare the small – is not a struggle between politicians and business. Both major political parties present in Alberta supported the production quotas because they brought in additional money for the regional budget. But companies were in it, too. Cenovus Energy, Canada’s fourth-largest producer, was one of the most vocal proponents of such production cuts, whilst the second and third-largest producers in Suncor and Imperial Oil opposed the move and still express reservations to its prolongation.

Cognizant of the reputational risks inherent in clinging onto mandatory cuts for too long, the Kenney government is seeking to render Alberta’s curtailments more flexible. It has sought legal advice on how to cancel the previous administration’s decision to buy $2.8 billion worth of oil-by-rail capacity, insisting that it is up to the private companies to make sure their crude is marketed and that the financial burden should not be laid onto the Albertan taxpayer. For this to happen, the Kenney administration has prepared a sweetener – from late 2019 onwards crude supplied away by rail should not be subject to the production curtailments, benefiting greatly those companies (like Cenovus) that already have crude-by-rail loading facilities.

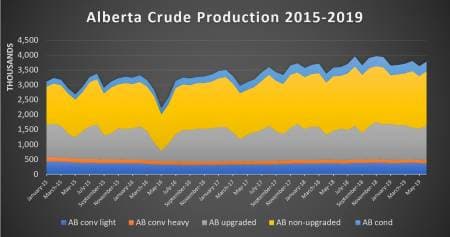

(Click to enlarge)

Source: OilPrice, based on CER data.

Those companies who are missing either reloading facilities or rail tank cars can rectify their situation by buying out the province’s 120kbpd crude-by-rail contracts, Alberta has already received 16 competitive bids to this end. This seems a highly needed move as it frees up some of Canada’s spare production capacity, all the while nudging oil producers to use Alberta’s crude-by-rail opportunities more. The province’s current crude-by-rail takeaway capacity is some 500kbpd, of which only some 300kbpd is used. There is certainly truth in that crude-by-rail usage has been increasing robustly, edging increasingly closer to the all-time high of 406kbpd set in January 2019, yet producers still need to get up to speed if they want to use all the available export routes.

(Click to enlarge)

Source: OilPrice data.

Despite rail capacity not being used to the maximum possible extent and investors seeing bureaucratic intervention in a rather unfavorable fashion, the government of Alberta has stuck to its course and gradually loosened its grip on the province’s aggregate output. The quotas became effective as of January 01, 2019 when production was capped at 3.56mbpd. With a gradual relaxation of curtailments from month to month, the November 2019 output cap reached 3.8mbpd and will be increased by a further 10 000 barrels per day in December. Hence, one might claim that the production caps have worked – WCS spreads looking healthy, production coming back and industry confidence is growing stronger. All in all, almost one year into the production curtailments, let’s look into those who benefited them the most.

1. The Government of Alberta

The biggest winner in all of this is the government of Alberta. Confronted with WCS Hardisty vs WTI CMA spreads plummeting as low as $50 per barrel, with some Albertan crudes sold at single-digit per barrel prices, it managed to bring the WCS/WTI correlation into a completely workable sphere. It is still quite early to quantify the benefits of the curtailment deal for the province’s coffers, yet one can note that Q1 2019 (the latest available data) revenues were $164 million higher than in the first three months of 2018, even though the Q1 2018 crude prices were more than $3 per barrel higher than those of Q1 2019. Year-on-year Q3 and Q4 2019 revenue data will provide the most illustrative example on why the curtailment idea was so successful.

(Click to enlarge)

Source: Thomson Reuters.

2. Oil Producers in other Canadian provinces

(Click to enlarge)

Source: OilPrice, based on CER data.

Producers that are also active in the Western Canada Sedimentary Basin but are not geographically located in the province of Alberta availed themselves of the provided opportunity fully. Western Canadian spreads bounced back in January-February 2019 to reasonable levels, yet producers in Saskatchewan and British Columbia were not constrained in their output ambitions by their respective provincial governments. Thus, the Saskatchewan grade Midale (32° API, 2.2 percent Sulphur) that traded around $30-35 per barrel in November 2018 at $20-30 per barrel discounts to WTI CMA is now assessed at a comfortable $7-8 per barrel discount. The appreciation of domestic crudes is surely a problem for domestic refiners yet that we will leave aside for the time being.

3. Small Producers

Even though media reports largely focus on large corporations and not small producers, it has to be noted that out of Alberta’s 378 registered producers only 29 were subject to output curtailments (the cutoff line was set in December 2018 at 10kbpd of monthly average production). The others availed themselves of a much-improved pricing improvement, without actually committing to any restrictive measure. 2020 will be even more clement to the minor producers as the province of Alberta seeks to increase the quota threshold to 20kbpd, effectively leaving only 16 producers that would be subject to mandated output curtailments.

Alberta’s best shot in increasing pipeline takeaway capacity is the 370kbpd Enbridge Line 3, which, however, has bogged down recently in court proceedings that have hindered the standard permitting process. Now that the Minnesota Supreme Court has thrown the ball into the court of the state’s Public Utilities Commission, after lengthy disputes with environmentalist and indigenous groups who fear the pipeline would contaminate Minnesota’s soil and waters, it seems likely that Enbridge will be able to commission the Line 3 expansion by H2 2020. Keystone XL and the Trans Mountain Pipeline Expansion also remain on the table, however are very unlikely to see the light of the day before mid-2022.

Concurrently, a remarkable fight is emerging where one would have least expected it – the Canadian Energy Regulator (CER) stopped last week Enbridge’s open season bidding on its 2.85mbpd Mainline crude pipeline system. Willing to alter its current spot-based modus operandi that sees significant month-on-month changes, Enbridge wants to fix 90 percent of Mainline’s throughput capacity by means of long-term contracts and keep only 10 percent for spot supplies. CER, however, claims that Enbridge wields an unhealthy control over Alberta’s pipeline exports (more than 70 percent of the province’s aggregate pipeline exports) and expressed concerns that the transportation company’s open season might lead to an abuse of market power.

(Click to enlarge)

Source: OilPrice data.

Thus, for us to answer the question we started out with – yes, the Alberta production curtailments were worth it, they’ve brought crude stocks lower, brought Canadian pipeline crude prices back to where they belong and shielded small producers from the shocks it triggered (on the other hand, large producers have the wherewithal to weather a year or two of lost earnings). If Enbridge’s Line 3 pipeline expansion proceeds further this year and encounters no further legal obstacle, there is a very high probability that the government of Alberta would call off the production curtailments before the end of 2020. But the larger battle only begins – for Canada to be competitive in the longer term, a more supportive federal government must aid the cause of Canada’s oil producers.