Oil markets are moving sideways this week and passively digesting a massive amount of bullish and bearish news. Perhaps it was simply time for a break? Did the world’s oil traders simply need a collective nap after a sleepless month? Maybe. And while we aren’t sure whether oil’s next move will be higher or lower, we do think the non-stop flow of news on US/China, Saudi/Iran and OPEC+ will ensure that the current sideways regime will not last long.

On the trade front, the White House’s newly hawkish stance on Huawei - banning US companies from doing business with the Chinese Telecomm giant- pulls the US and China further apart on a trade deal. The US had labeled Huawei as a security threat dating as far back as 2012 making this a non-surprise move, but the strategic power of Huawei as a bargaining chip in US/China trade relations is still significant. Communications from both sides have maintained a frustrated, non-cooperative tone this week with both governments play hardball and seemingly entrenching further into their own tough positions. In the US the government is preparing another $20b aid package for farmers who have been cut off from Chinese buyers. In China, a song posted on WeChat touting the nation’s ability to withstand the trade war has received more than 100,000 views. Both sides are taking steps to protect themselves from the impact of a slowing economy rather than working together to resolve the dispute. Unfortunately, both sides are also running out of…

Oil markets are moving sideways this week and passively digesting a massive amount of bullish and bearish news. Perhaps it was simply time for a break? Did the world’s oil traders simply need a collective nap after a sleepless month? Maybe. And while we aren’t sure whether oil’s next move will be higher or lower, we do think the non-stop flow of news on US/China, Saudi/Iran and OPEC+ will ensure that the current sideways regime will not last long.

On the trade front, the White House’s newly hawkish stance on Huawei - banning US companies from doing business with the Chinese Telecomm giant- pulls the US and China further apart on a trade deal. The US had labeled Huawei as a security threat dating as far back as 2012 making this a non-surprise move, but the strategic power of Huawei as a bargaining chip in US/China trade relations is still significant. Communications from both sides have maintained a frustrated, non-cooperative tone this week with both governments play hardball and seemingly entrenching further into their own tough positions. In the US the government is preparing another $20b aid package for farmers who have been cut off from Chinese buyers. In China, a song posted on WeChat touting the nation’s ability to withstand the trade war has received more than 100,000 views. Both sides are taking steps to protect themselves from the impact of a slowing economy rather than working together to resolve the dispute. Unfortunately, both sides are also running out of time to fix the issue before it starkly reveals itself in second-quarter economic data. The last round of Trump tariffs came into play on Monday and increased rates on Chinese imports from 10% to 25% on about $200b worth of goods. The global economy simply can’t absorb these policies without hindering GDP growth.

On the other hand, the geopolitical scene is becoming increasingly chaotic and progressively bullish. In Libya, armed gunmen attacked crude oil and drinking water infrastructure in the nation’s capital and Nigeria’s Forcados crude pipeline was shut down as a safety precaution due to a nearby fire. Not to be outdone, key OPEC+ producers met informally in Riyadh this week and confirmed their aim to extend the current supply cut program through the end of 2019. This wasn’t an official extension of the existing deal, but recent oil price weakness overwhelmingly suggests the group will ultimately move to prolong the current bargain. Lastly and perhaps most importantly, the festering Saudi/Iran conflict grew uglier this week following an attack on a Saudi airport which was credited to an Iran-linked group. Iran also heightened tensions by bragging that it had quadrupled its enriched uranium production capacity in response to the Trump administration’s new press to cut off Iranian access to the oil market.

The current tug of war between an extraordinarily bearish US/China trade war and the extraordinarily bullish geopolitical scene is truly a sight to behold for oil markets. Simply put, we can’t remember a market with this much uncertainty and potential upside and downside risk in recent memory. Enjoy the ‘break’ while you can, it won’t last long.

Quick Hits

- Oil prices were basically flat this week with Brent near $72 while WTI traded $63. US/China tensions persist as the key bearish threat to the market while Middle East tensions are putting a floor under prices. On the news wires, there were production/delivery disruptions in Libya and Nigeria and an attack on a Saudi Arabian airport which was credited to an Iran-backed group.

- Merchant traders are taking recent Saudi/Iran hostilities seriously as evidenced by recent strength in Brent spreads. The front 6-month Brent spread is currently backwardated by more than 50-cents per month, implying large inventory draws in the second half of the year.

- On the US/China front, the recent decision by the US to antagonize Huawei is yet another source of anxiety for market-watchers. We’re focusing on the Shanghai Composite to gauge the market’s attitude towards a potential trade deal and the index continues to move sideways near 2,900- down by about 11% from its YTD high back in April.

- Saudi Arabia and other key OPEC members met informally this week and signaled a desire to continue coordinated output cuts through the rest of 2019. Russia expressed interest in relaxing some of the terms of the existing deal, but we remain confident that recent price weakness will ultimately lead to an extension along the lines of the current agreement. The group also took the unusual step of postponing their usual June meeting until July so that members could watch markets develop and get a better understanding of current fundamentals.

- Bloomberg’s commodity mapping tool still sees Iranian crude being transported. As of Tuesday, the mapping tool observed 39 tankers between the Persian Gulf and Gulf of Oman, 2 tankers near Malaysia and 2 near Hong Kong.

- Hedge funds were net sellers of ICE Brent futures and options last week for the first time since March. Nevertheless, speculators have still increased their net length in the contracts by more than 250% so far in 2019.

- We’re feeling that an underappreciated story in oil right now is the continued strength in the US Dollar. This week the USD Index is back at its YTD high near 98.0 despite continued dovish rhetoric from US Fed members. The USD strength seems to be part of a macro-shift out of emerging markets and into JPY, US Treasuries and yes, Bitcoin.

DOE Wrap Up

- US crude production fell yet again last week declining to 12.1m bpd for a 100k bpd w/w drop. Production has dropped 200k bpd from its all-time high four weeks ago. US crude oil rigs have declined more than 10% in 2019 to 805 which is in an interesting trend opposite the steady climb in prices.

- The relentless climb in US crude oil stocks continued despite decreases in production and net imports. US crude stocks jumped 5.4m bbls last week to 472m and are higher by 11.5m bbls over the last four weeks. Overall crude inventories are higher y/y by 8% over the last four weeks.

- Crude inventories in the Cushing, OK delivery hub increased by 1.8m bbls w/w to 47.8 representing their highest mark since December ’17.

- On the demand side, US refiners processed 16.7m bpd last week for a 250k bpd w/w increase. Unfortunately, refiner demand is still lower y/y by about 50k bpd over the last four week period.

- Crude oil imports increased by 600k bpd w/w to 7.6m bbls. Exports totaled 3.4m bpd for a w/w increase of more than 1m bpd.

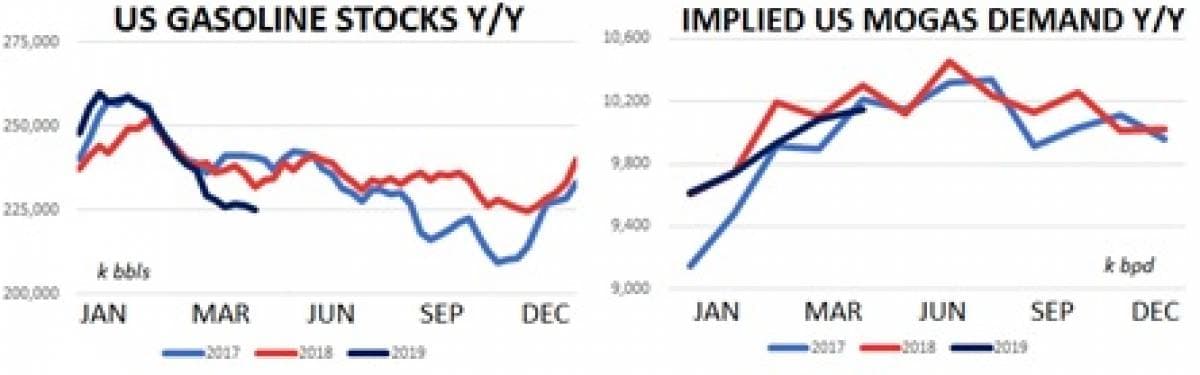

- Gasoline inventories continue to shine as a bullish bright spot in a bearish sea of data. Mogas stocks fell 1m bbls w/w to 225m and are lower y/y by 4% over the last month. The US currently has 23.9 days of gasoline supply on hand which is lower y/y by 0.9 days.

- Domestic gasoline demand + exports printed 9.9m bpd last week and is lower by 160k bpd y/y over the last four weeks. Implied gasoline demand is lower by 1% YTD.

- US distillate stocks increased by about 85k bbls last week to 125.6m and are higher by 8% y/y.