With summer heating up, Donald Trump promising more deregulation if he wins, and record storms causing blackouts leaving multitudes in sweltering darkness, we decided to seek timely guidance about electricity’s future from our favorite electricity guru, the Question Man (QM).

1. Will less regulation and more competition mean better prices for consumers?

QM: Your question implies that deregulation came with effective competition—which it didn’t.

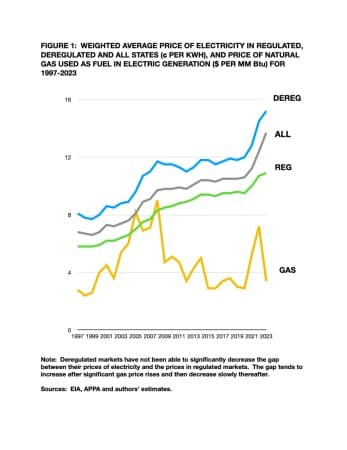

And that the present deregulatory framework brought benefits to consumers— which is not at all clear. And finally you assume these benefits would become more pronounced if there were even less regulation, right? Deregulation and competition policies were supposed to encourage more efficient operations whose benefits would be passed on to consumers in the form of lower prices. So over time, if competition had any impact on electricity prices deregulation should have lowered prices in deregulated states versus expected higher prices in still-regulated states where the benefits of deregulation had not been felt. As you can see from Figure 1, that didn’t happen. The small shifts in relative standing between regulated and unregulated states seem largely due to changes in the cost of natural gas, which sets prices in deregulated states. So, what happened? Is it possible that the unregulated companies were not more inefficient than the regulated companies so adding on competitive incentives could not elicit big savings because none were to be had? Or is it likely that the deregulated companies did find big operating savings but kept them for investors and did not pass them on to consumers? Or is it possible that the new market structure with so many new cost components ate up the efficiency savings through transaction costs or other diseconomies? If there were savings produced by more efficient operations somebody other than the consumer pocketed them. So, why do you think —- contrary to experience— that doing more of what didn’t work well will benefit consumers?

2. Okay, so deregulation only did so much. What have regulators accomplished and what might we expect?

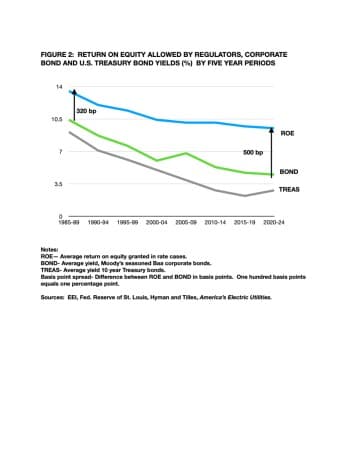

QM: I’m glad you asked. Regulators have accomplished a lot. Over the past three or more decades they have managed to grant utilities rates of return substantially in excess of their cost of capital. It’s easy to do when fuel costs and interest rates are declining. Deflation is great for utilities. Just let the savings accrue to the shareholders. No rate hikes are required. Financial theory says that shareholders deserve a return equal to that earned on bonds (risk-free return) plus an equity risk premium (generally around three percentage points above bond returns). Note from figure 2 how, since 1985 bond yields declined faster than returns granted by regulators and how the gap between bond yield and allowed return on equity grew from 320 to 500 basis points, indicating either that regulators thought the industry was getting riskier (a bigger equity risk premium) or that the regulators just felt generous. (At the beginning of the year, NYU’s cost of capital experts determined electric company cost of equity at 7%. Regulators pegged the number at 9%. That difference adds about 4% to the typical consumer's electric bill.) My question is: will regulators feel as generous when, as a result of rising costs, they have to increase rates rather than just not bothering to lower them? Inflation is a lot less fun than deflation.

3. How fast can electric sales grow, especially if Donald Trump wins the election?

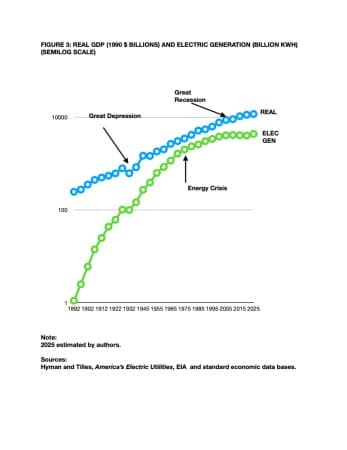

QM: What will Donald Trump do, ban electric vehicles, disconnect heat pumps, replace all LED light bulbs and bring back the horse-drawn carriage? The official projection for electric sales growth, from the EIA, is still less than 1% which sounds way low. Power for AI, if we are to believe the estimates, could add 1% to growth. If it takes 30 years to reach 100% saturation for electric vehicles, that adds another 1%. Forget about electrification of other sectors and I still can see a doubling or tripling of the kilowatt-hour sales growth rate. That means that the electricity market completely reverses its current trajectory of decelerating growth followed by decline. (See Figure 3.) Trump’s policies will constitute a drag on sales growth, but won’t dramatically change it. More likely we’ll still get a lot of electrification in various sectors of the economy while a Republican administration would at the same time aggressively oppose any decarbonization efforts. This would likely mean plans for more new natural gas fired power generation as well as slow-walking closure of existing coal fired power plants, all in the name of avoiding power shortages of course. (I think we just wrote Duke and TVA’s five year plan.) However I do have to wonder: why do industry executives favor a policy of selling a dirty product with limited growth potential instead of a cheaper, clean product that people might want to buy more of?

4. Are electric companies spending enough to meet the uncertain demand?

QM: Are you kidding? If industry executives are forecasting one percent sales growth because they don’t believe in global warming, are backing the presidential candidate who denies the reality of climate change because they don’t want to close down fossil-fired power stations in a timely manner—they are in effect working against a fantastic business opportunity. They are literally on the horns of a dilemma. Why? Because they desperately want the rate base growth and all the EPS acceleration that implies. But they are politically obligated to be skeptical of decarbonization. Said differently, can an industry, which recently appointed a climate change denier as its chief spokesperson, justify spending the money needed to protect its network against climate change and build to meet climate-related demand? Doesn’t that make sense? Well, that’s not my fault. My guess, based on the research you guys published, is that the industry needs to raise capital spending by 50-100%. Now that’s not so terrible for a business that makes money off rate base, but it will require a lot of rate increases and maybe dividend cuts. That means justifying the spending to politicians in states where climate change is still a taboo topic. (See TVA, Duke five five-year plan which was recently embraced by the Texas legislature by the way.) No figure 4 for this question. How can I depict what might happen as convincingly as what happened?

5. Mr QM, it strikes us that all you have done is update analyses that you have presented before. Not much has changed.

ADVERTISEMENT

QM: Well, as the Bible says, there’s nothing new under the sun. You have read “Ecclesiastes”, haven’t you?

By Leonard Hyman and William Tilles for Oilprice.com

More Top Reads From Oilprice.com:

- Nigeria to Spend Nearly $4 Billion on Fuel Subsidies This Year

- Russia’s Oil and Gas Revenues Surged by 73.5% in January-May

- Europe's Shift from Russian Gas to Pricey LNG

The crucial question is how would this global electrification be sourced: by renewables, gas, coal, hydro or nuclear.

Solar and wind energy are incapable on their own of satisfying global demand for electricity because of their intermittent nature. They, therefore, will need huge contributions from natural gas, coal, hydro and nuclear power.

Natural gas in the form of LNG and piped gas will continue to play a crucial and increasing role in generating electricity. That is why its share of global primary energy consumption is going to continue rising almost matching the importance and share of oil.

Coal provides the cheapest electricity in the world providing 35% of global electricity. Therefore, demand for it will continue to rise well into the future albeit at a decelerating rate because of governmental legislations. Moreover, it will continue to be the cornerstone for energy security in countries with sizeable reserves of coal particularly China and India.

Hydropower is already providing almost 16% of global electricity However, its contribution

varies from year to year depending on annual rainfall and the occurrence of droughts.

Nuclear energy is already contributing more than 10% to global electricity and this can only increase with the advancing technology and safety of small modular reactors.

All these energy sources have a role to play in achieving a wider global electrification in coming years.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert