Over the past decade, Argentina has plowed millions of dollars into the country’s giant lithium deposits with little to show for its efforts. To wit, no new mines have come online in the South American nation for nearly a decade. Argentina is the world's fourth-largest lithium producer, and together with Chile and Bolivia, forms part of South America's so-called “lithium triangle”. Argentina has just two mines in operation today, and produces around 34,000 tonnes a year of lithium carbonate equivalent (LCE), according to figures published by Mining.com, putting it in fourth place globally, behind Australia, Chile and China.

However, that is about to change, with four new projects slated to come onstream in the coming weeks and months with Libertarian President Javier Milei pushing hard for sweeping economic reforms.

Built on salt lakes nestled in the Andes mountains, the projects will ramp up annual capacity to 202,000 metric tons of lithium carbonate, according to Bloomberg. According to Mining.com, Argentina’s mining officials say they are expecting a tripling of capacity 260,000 metric tonnes by 2027.

If that happens, it will be a significant addition to an oversupplied market with Bloomberg Intelligence projecting global production to clock in at 1.4 million tons this year. Argentina has the world’s largest lithium pipeline with dozens of projects under consideration.

Related: OPEC’s Oil Production Continues to Rise Despite OPEC+ Pledges

There are growing signs that Argentine credit and equity markets are starting to open up as President Milei--a libertarian--moves to deregulate the country’s tightly controlled economy in his first year in office. Last month, Argentine oil driller Petrolera Aconcagua Energia SA announced plans to join the country’s stock market to raise funds for expansion as Milei’s reforms start to attract capital back to Argentine markets, the Buenos Aires Times reported. Aconcagua has revealed that it’s bidding for aging oil fields being sold by state-run giant YPF SA as the company looks to expand its current production clip of 13,500 boe/d. Milei has proposed to privatize 41 state-owned companies, including national oil firm YPF SA, nuclear power company Nucleoeléctrica Argentina and energy infrastructure player Energía Argentina.

No Lithium Party

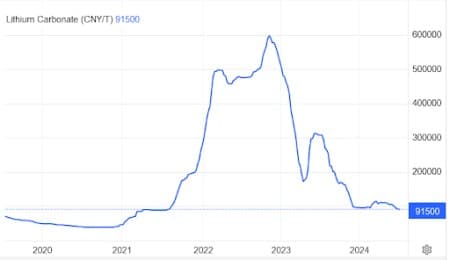

Lithium carbonate prices

Source: Trading Economics

Unfortunately, Argentina’s lithium spring marks a major setback for lithium bulls who were hoping for the ongoing global electrification drive to provide a boon for the battered market. Lithium carbonate prices dipped below CNY 92,000 ($12,650) per tonne in July, its lowest since 2021, as the surplus of raw materials for electric vehicle battery manufacturers continues to depress prices. Over the past few years, lithium producers have rapidly expanded capacity and continued to hunt for new reserves, magnifying expectations of oversupply amid the fallout of battery gluts thanks to government subsidies. Additionally, Chile--the world’s largest lithium producer--has signaled it aims to double output over the next decade. Further, China is facing a tariff storm by hordes of Western nations including by the U.S. and the EU, a headwind that could depress EV imports by the Middle Kingdom by a big margin. The Kiel Institute for the World Economy has forecast that a 20% tariff imposed by the EU, would reduce Chinese EV imports by 25%. Although this would be partly offset by higher production in Europe, European carmakers would struggle to fill the shortfall.

Last month, Turkey imposed 40% tariffs on EV imports from China, joining the U.S. and EU. The additional tariff will be set at a minimum of $7,000 per vehicle, and go into effect from July 7, a presidential decision published in the country's Official Gazette has revealed. Like many of its Western peers, Istanbul is worried about the influx of cheaper Chinese EVs, with the tariff meant to protect its domestic automakers.

The tariff storm that has hit China’s EV sector was probably expected. In China, many of the most popular EVs--including BYD’s Seagull--sell for around $12,000--and some budget models cost less than the average e-bike. The Seagull would likely cost ~$25,000 in the U.S. if BYD was allowed to sell it here; in contrast, Tesla Inc.’s (NASDAQ:TSLA) popular Model 3 starts at $40,630 and goes up to $54,630 depending on the trim and options. To be fair, some of China’s huge competitive advantage in the EV arena can be chalked up to a healthy dose of ‘cheating’ as Biden put it, including abuses of intellectual property and currency manipulations. However, ample government support in the form of incentives and subsidies has probably played an even bigger role. Back in March, U.S. Treasury Secretary Janet Yellen announced that she intends to warn Beijing that its national underwriting for energy and other companies is creating oversupply and distorting global markets when she pays the country an official visit.

"I intend to talk to the Chinese when I visit about overcapacity in some of these industries, and make sure that they understand the undesirable impact that this is having--flooding the market with cheap goods- -on the United States, but also in many of our closest allies, Yellen said in a speech in Norcross, Georgia.

ADVERTISEMENT

That said, some analysts have argued that China is so far ahead in the game that these tariffs will do little to slow down its momentum.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Energy Production Chalks Up Another Record

- Oil Markets Are on Edge as Hurricane Beryl Barrels Towards Jamaica

- U.S. Oil, Gas Drilling Activity Plummets