Via Metal Miner

Nickel prices followed other base metals up throughout April, with a nearly 15% month-over-month rise. By late April, prices hit their highest level since September, although they subsequently began to retrace as upside momentum cooled.

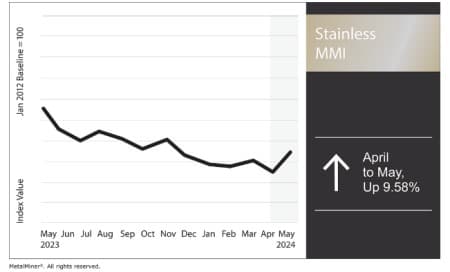

Overall, the Stainless Monthly Metals Index (MMI) rebounded, with a 9.58% jump from April to May.

Outokumpu, Acerinox Post Q1 Results

Outokumpu and Acerinox, the parent company of North American Stainless, recently released their first-quarter results. While both producers noted constrained output in Europe due to strikes, demand appeared relatively stable in North America.

Acerinox stated, “The American market and the high-performance-alloys market remain stable, while that in Europe has not improved even with the reduction in supply.” Despite a 14% year-over-year decline in total melt shop production, markets appeared unfazed by constrained conditions, as “the European market continues to be weak.” However, the U.S. saw flat production demand increase by 8% through February. The company noted that “inventories at distributors remain low compared to the average of recent years.

Stainless Steel Sales Slip at Outokumpu

Meanwhile, Outokumpu saw stainless steel sales fall from the previous year. Nonetheless, the mill noted that “gradual recovery in Europe has continued” despite a 7% quarter-over-quarter drop in deliveries. In the Americas, Outokumpu saw deliveries rise by 15% despite weaker prices. Globally, the producer expects a 5-15% increase in deliveries from Q1 to Q2.

Ultimately, mill results appeared in line with results from major service centers. While down 3.2% from Q1 2023, Ryerson’s quarterly results showed a 17.3% rise in shipments from Q4 2023 to Q1 2024.

Whether the quarterly pickup in stainless steel shipments will continue remains to be seen. Other distributors told MetalMiner that while sales picked up in February, demand began to slow during March. One source noted that demand for 300 and 400 series stainless steel in early Q2 was the slowest witnessed in recent years, with little optimism for a turnaround in the coming months.

Indonesian Boom Continues to Shutter Mines

First Quantum’s operations in Western Australia became the latest casualty of the increasingly oversupplied nickel market. The Canadian miner closed its Ravensthorpe mine in January, intending it to remain idle for at least two years while the company continued to process excess inventories. However, profitability concerns soon forced First Quantum to suspend all production by late May, as the company would have to “process and sell nickel product at a loss.”

Despite the recent bump in nickel prices, the outlook remains sharply bearish. Indeed, LME inventories continue to build, while Indonesian output shows no signals of slowing. Meanwhile, EV sales in the U.S., a market once expected to help drive nickel demand, appear increasingly challenged. Despite considerable subsidies, Q1 EV sales rose by a mere 3.3%, causing the sector to lose market share. Altogether, EV sales accounted for 7.6% of the U.S. market last year, but dwindled to 7.15% during Q1.

How Will Mills Respond to Bearish Nickel Prices?

The glut of supply paints a bearish forecast for the nickel market. Meanwhile, Indonesia continues to produce the material at a discount to nickel produced elsewhere. This has led to calls for a separate “green nickel” price, although it remains unclear whether lower-carbon credentials will attract demand from manufacturers.

However, the current market outlook poses an interesting challenge for stainless producers. In its Q1 earnings report, Outokumpu noted that while stainless steel deliveries saw a 15% seasonal increase, “tight scrap supply and weak stainless steel pricing” dragged its overall earnings. While domestic producers primarily use scrap, the surcharge price remains tied to LME primary nickel prices.

Mills Reconsidering Strategies for Nickel Price Methods

Analysts expect the nickel market to remain decidedly in surplus during the coming years, which could trigger mills like Outokumpu and North American Stainless to rethink their price structure. While mills managed to hold a firm grip on base prices, bearish nickel prices saw the NAS 304 surcharge fall over 52% year-over-year, which cut into overall earnings.

Suppressed nickel prices due to Indonesia’s production boom, combined with a worsening outlook for demand drivers like EVs, make it risky for mills to continue using LME nickel prices to calculate their respective surcharges. This is especially true considering Indonesia plans to aim for an $18,000/mt price cap. While this remains merely speculative, using nickel scrap prices, or even “green nickel” prices (should they come to fruition), could become more advantageous to mills. Nonetheless, it seems worth acknowledging the risk that mills could reevaluate how they calculate stainless steel surcharges.

Source: MetalMiner Insights, Chart & Correlation Analysis Tool

By Nichole Bastin

More Top Reads From Oilprice.com:

- Innovative New Tech is Transforming the Battery Market

- BP’s Azerbaijani Oil Field Could Be a Game-Changer for Baku

- Octopus Energy Overtakes British Gas as the Largest UK Supplier